As the crypto market enters 2025 with uncertainty, developers, investors, and major capital allocators are increasingly focused on identifying “what the next big narrative will be.” Privacy coins have delivered the strongest performance of the year, drawing intense attention from investors. However, analysts are already debating the critical question: “What sector comes next?”

Interviews with leading industry analysts highlight both the reasons behind the rise of privacy coins and the signals that can help identify the next major crypto trend early.

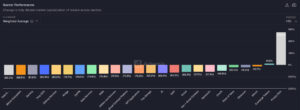

Privacy Coins Become the Strongest Sector of 2025

Throughout 2025, the crypto market experienced turbulent price action, but privacy-focused assets became the clear leaders of the rally. Zcash (ZEC) surged 276.4% year-to-date, making it the top-performing sector. Since early October, its gains have exceeded 700%.

Another strong performer, Dash (DASH), gained nearly 200% in recent months. Even during periods when Bitcoin and Ethereum posted negative returns, privacy coins consistently resisted downside pressure, maintaining their position as one of the strongest segments of the ecosystem. This suggests that privacy-focused assets are not merely part of a short-term speculative trend but reflect a broader macro shift.

Key Drivers Behind the Rise of Privacy Coins

Nic Puckrin explains that the recent surge in global surveillance has significantly fueled the rise of privacy coins. As more countries expand their authority over financial accounts, users are increasingly drawn to assets that offer stronger privacy protections.

Puckrin notes:

“Bitcoin and Ethereum no longer represent cypherpunk ideals. They are easier to track than cash. People are rediscovering the need for real privacy.”

He stresses that in the crypto world, transparency is no longer an advantage—it’s becoming a liability. With AI-supported chain analytics now capable of tracking nearly all activity, users increasingly view privacy as a “fundamental necessity.” After years of speculation-driven hype cycles such as memecoins, investors are shifting back toward projects offering real utility.

What Comes After Privacy Coins?

Analysts say there is no single answer, but several sectors clearly stand out. The expected winners come from two opposite ends of the spectrum:

Short-term hype-driven sectors:

- Memecoins

- Social tokens

Mid- to long-term value-driven sectors:

- Privacy

- RWA (Real-World Asset tokenization)

- DePIN

- AI x Blockchain

- DeFi infrastructure

Youssef summarizes the trend:

“When meme cycles fade, the market returns to real value. That’s why privacy, DeFi, and RWA sectors have started gaining strength.”

The Next Big Narrative According to Analysts

1. RWA – Tokenization of Real-World Assets

RWA is widely considered the strongest contender for the next major crypto narrative. The primary reason is the growing interest from institutional capital. Banks, asset managers, and financial institutions seek to tokenize traditional assets—such as real estate, treasury bills, corporate debt, and fund shares—to enable faster, more transparent, and cheaper transactions.

2. DePIN – Decentralized Physical Infrastructure Networks

DePIN projects merge real-world physical infrastructure with blockchain, creating decentralized service networks. Users deploy devices, contribute to the network, and earn tokens—building a rapidly expanding economic loop.

3. AI x Blockchain Intersection

This is one of the fastest-growing technical sectors. Use cases include:

- Transparent data pipelines for AI model training

- On-chain verification of compute processes

- Trusted API access to AI models

- Blockchain-based solutions for copyright and model ownership

This intersection is becoming increasingly critical as AI adoption accelerates.

4. DeFi 2.0 Infrastructure and Sustainable Yield Models

The next generation of DeFi is focusing on sustainable, risk-aware protocols rather than unsustainable high-yield farming seasons. Key innovations include:

- New DEX models

- Advanced algorithms protecting liquidity providers

- Cross-chain liquidity management

- Institutionally compliant DeFi frameworks

These developments have revived investor interest.

How to Identify the Next Narrative Early

Based on combined expert opinions, a new crypto trend can be identified early by watching three core signals:

1. Real Usage and Demand

The first sign of a new sector emerging is measurable user demand and on-chain activity. Growth in protocol usage, wallet integrations, and application traffic indicates that a narrative is strengthening organically.

2. Ecosystem Growth and Liquidity Flow

Exchange listings, expanding liquidity, partnerships, and ecosystem accessibility show that capital is flowing into the sector. Whale and institutional entries play a decisive role at this stage.

3. Developer Activity and Social Momentum

New narratives typically begin with developers. Spikes in code commits, new product launches, growing volumes in small-cap projects, and expanding developer engagement all signal foundational growth. Parallel increases in social media momentum — especially on X (Twitter) — show that the trend is spreading to the broader community.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.