The crypto market started the new day with strong upward momentum. The total crypto market capitalization (TOTAL) once again approached the critical $3 trillion level, signaling a clear strengthening in overall market recovery. Bitcoin climbed back to $88,000, reflecting improved sentiment across the sector. Meanwhile, several altcoins recorded double-digit gains, drawing significant attention.

Behind this broad rally are not only technical indicators but also diplomatic easing between the U.S. and China, positive developments regarding the Russia–Ukraine front, dovish remarks from Federal Reserve officials, and rising expectations of an interest rate cut at the next Fed meeting.

Crypto Market Cap Approaches $3 Trillion

Over the past 24 hours, the total crypto market cap increased by $52 billion, reaching $2.98 trillion. This recovery indicates renewed confidence from both institutional and retail investors. As long as sentiment remains strong, analysts suggest that TOTAL could target the following regions:

- $3.00 trillion

- $3.05 trillion resistance zone

Experts consider the $3 trillion level a major psychological threshold, essential for confirming a renewed long-term uptrend. However, if global uncertainty increases again, a pullback to $2.93 trillion or even $2.80 trillion in the medium term remains possible.

Bitcoin Approaches the $90,000 Zone

Bitcoin is currently trading at $87,609, holding above the crucial $86,822 support level. As long as BTC maintains this region, upside continuation is likely. For the bullish scenario to strengthen, Bitcoin needs to:

- Break above $89,800

- Retest that level as support

- Establish $91,521 as a solid base

If these conditions are met, analysts believe Bitcoin could initiate a strong move toward the $90,000–$92,000 range.

In a bearish scenario:

- BTC could dip below $85,204

- Lose the critical $85,000 support

- Face increased selling pressure, potentially dropping toward $82,503

Global Factors Supporting the Market

Today’s rally is not solely driven by technical indicators; macro and geopolitical developments are also playing a major role:

Improved U.S.–China Relations: Recent signs of diplomatic softening between the U.S. and China point to a new phase of cooperation. Reduced tensions between the two powers have significantly boosted global risk appetite.

Positive Signals From the Russia–Ukraine Front: Occasional easing of tensions has reduced pressure on energy and commodity markets, indirectly improving sentiment in crypto as well.

Dovish Comments From Fed Officials: Federal Reserve members have recently noted that inflation is cooling as expected. This softer tone in monetary policy is creating a favorable environment for crypto assets.

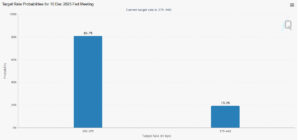

Rate Cut Expectations Strengthen Ahead of Fed Meeting

Markets are increasingly pricing in the possibility of an interest rate cut at the upcoming Fed meeting. Rate cuts typically boost demand for risk assets by encouraging:

- Higher liquidity

- Increased capital inflows

- Stronger speculative appetite

The crypto market is responding quickly to these expectations.

Overall Assessment

Today’s crypto market rally is being driven by both technical momentum and supportive global developments. The total market cap nearing $3 trillion indicates a meaningful strengthening in bullish sentiment. Bitcoin’s approach toward the $90,000 region, the recovery seen in altcoins, and improving macroeconomic conditions suggest that the market may continue building positive momentum in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.