Metaplanet has announced that it has drawn a new $130 million loan through its Bitcoin-backed credit facility. This brings the company’s total usage from the credit line which has a maximum limit of $500 million to over $230 million. The firm stated that its 30,823 BTC holdings more than sufficiently meet the collateral requirements of the facility.

The newly secured funds will be allocated across three strategic areas:

- New Bitcoin purchases

- Expanding Bitcoin-based revenue and yield operations

- Share repurchases when market conditions are favorable

Metaplanet Deepens Its BTC-Backed Financing Strategy

The move by the publicly listed Japanese firm is seen as an expanded version of one of the largest corporate Bitcoin-collateralized financing models to date. The company positions Bitcoin not merely as a reserve asset but as the core strategic asset of its long-term vision.

For this reason, Metaplanet prefers to generate liquidity by borrowing against its BTC rather than selling it — enabling the company to maintain its aggressively Bitcoin-focused balance sheet strategy. However, current market conditions are challenging. Over the weekend, Bitcoin fell to the $80,000 range, well below Metaplanet’s estimated cost basis of $108,000, creating significant unrealized losses on its holdings.

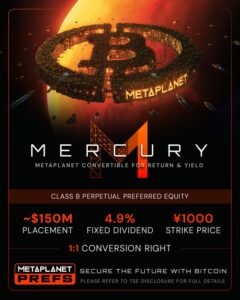

The “Mercury” Capital Program and the Impact of BTC Declines

The new loan coincides with Metaplanet’s recently announced “Mercury” capital initiative, which targets raising $150 million through the issuance of preferred shares to further increase the company’s Bitcoin reserves. However, the sharp drop in BTC price has complicated this plan:

- Lower BTC prices make raising capital more difficult

- Share issuance increases dilution pressure

- Investor sentiment becomes more fragile

Metaplanet’s stock fell 7.75% on Friday but recovered 2.24% today. Analysts note that if Bitcoin remains at lower levels, a successful capital raise could help reduce the company’s average cost basis.

What Does This Mean for Bitcoin-Focused Companies?

Metaplanet’s decision highlights a growing trend among crypto-aligned corporations: relying on Bitcoin-backed loans instead of selling BTC.

This strategy:

- Preserves long-term bullish expectations

- Generates liquidity without reducing BTC exposure

- Provides financial advantages, especially in low-interest environments

Experts believe this model could be adopted by more global companies in the coming years.

What Comes Next?

All eyes are now on how Metaplanet will navigate the ongoing Bitcoin downturn. The company’s highly leveraged BTC strategy raises key questions:

- Will this become a bold example of innovative treasury management?

- Or will it lead to a stress test of the limits of Bitcoin-collateralized financing?

Metaplanet’s approach will be closely watched by the market as a potential indicator of how corporate Bitcoin strategies evolve in the future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.