Bitcoin is heading toward an unusually weak November, breaking from its historically strong seasonal pattern. Analysts suggest the market is approaching a decisive point — either demand starts recovering soon or the asset enters a longer consolidation phase.

Seasonal Trends Fail to Hold This Quarter

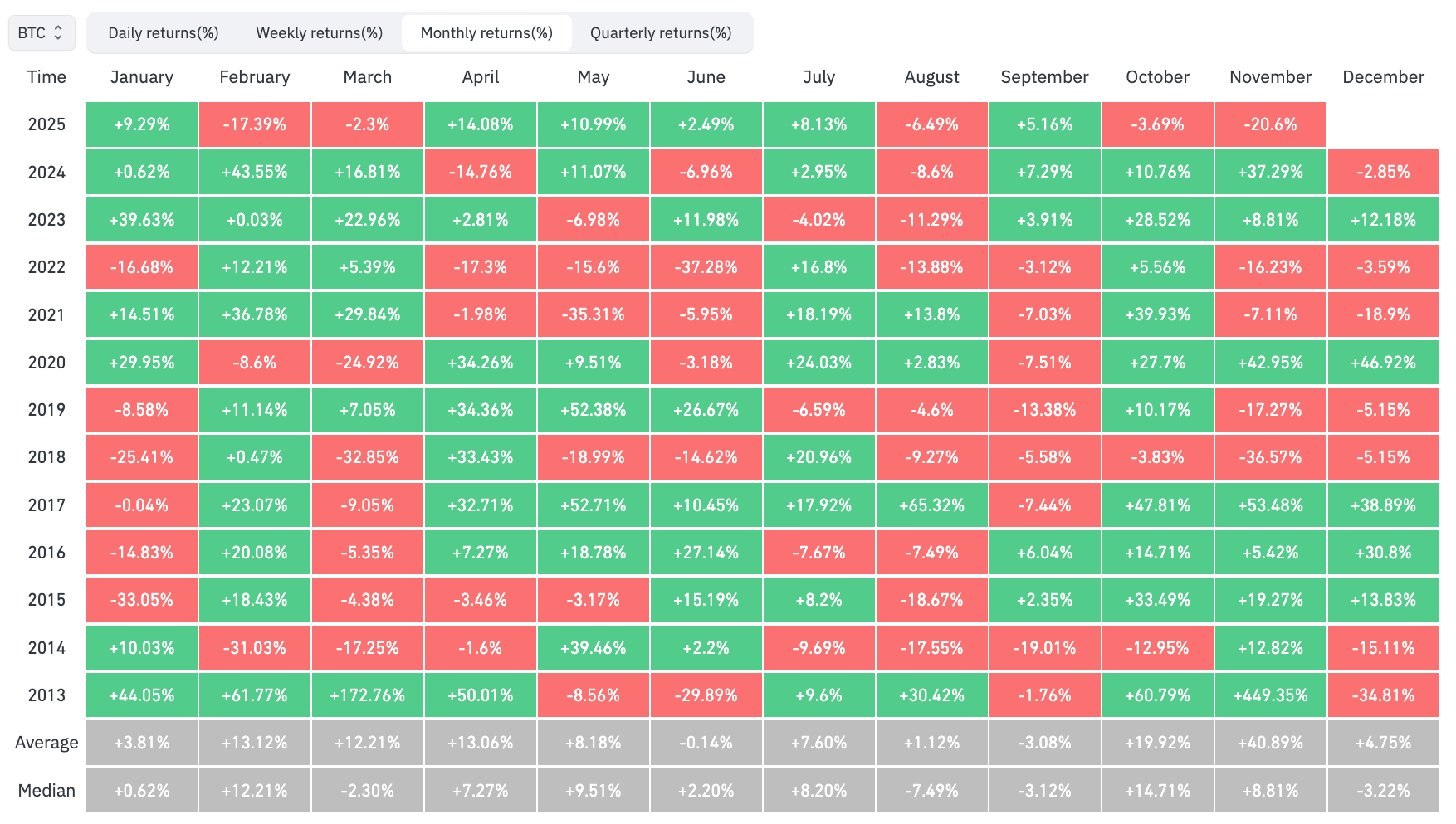

Historically, November has been Bitcoin’s most impressive month, delivering average returns above 40% according to CoinGlass data. This year, however, the market is departing from its traditional playbook. October, which normally posts close to 20% average gains, ended with a 3.69% decline instead, raising doubts about whether seasonality still provides reliable guidance.

Bitfinex analysts highlight that the current quarter has defied historical trends almost entirely. Bitcoin’s price has fallen more than 20% from the start of November, signaling a clear break from its typical performance pattern.

At the time of writing, Bitcoin was trading around $87,300.

Short-Term Holders Are Adding Pressure

According to Bitfinex, a major factor behind the recent downside move is the excessive buying activity that took place between $106,000 and $118,000. Many of the investors who entered the market at these levels are now selling at a loss, creating additional downward pressure.

The analysts also point out that Bitcoin has slipped below the short-term holders’ cost basis for only the third time since early 2024. CoinGlass estimates that short-term holders — those who have held BTC for less than 155 days — have an average realized price of approximately $86,787.

Whale Demand Shows Signs of Recovery

Despite the overall weakness, certain metrics indicate that accumulation may be picking up again among larger investors. Data shared by Santiment shows that the number of wallets holding at least 100 BTC has increased by 0.47% since November 11, suggesting that whale interest is once more gaining momentum.

What to Expect in December?

Even if seasonal patterns have been unreliable this year, historical data still portrays December as a relatively calmer month for Bitcoin, with average returns of about 4.75% since 2013.

From this point forward, the market appears to be narrowing toward two possible scenarios: a resurgence in demand that stabilizes prices or an extended accumulation phase that could deepen before a broader recovery. Either way, the coming weeks are likely to be pivotal for market sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.