Bitcoin price fluctuated below $88,000 as investors focused on the potential impact of this week’s $14 billion BTC options expiry. The market is searching for direction amid rising macroeconomic pressures, and key levels are coming into focus. With Bitcoin struggling to hold the $88,000 line, market sentiment remains weak. The past 30-day performance has been poor, keeping traders cautious.

Bitcoin Options Expiry Adds Pressure

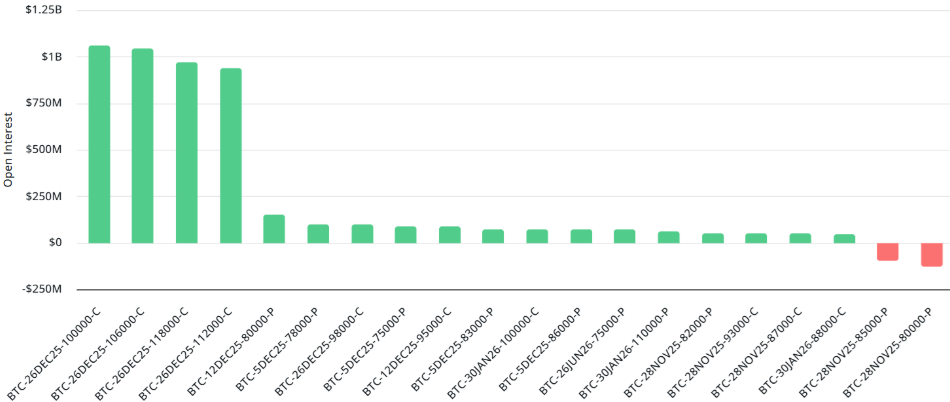

Bitcoin failed to surpass the $89,200 resistance in the first half of the week, dropping back to around $87,500. This movement indicates that traders are reassessing their risks ahead of the major upcoming options expiry. The options market currently holds a total of $14 billion in open positions, with a significant portion consisting of call contracts placed above $91,000, betting on higher prices.

The 23% decline over the past 30 days has put these positions at a disadvantage. However, the put side aligns better with current market conditions, presenting a clearer picture. Protection positions opened at $84,500 and below have become more meaningful as the expiry date approaches. Overall, this setup suggests neutral to mildly bearish scenarios are currently stronger.

In line with last week’s volatility, traders are acting more cautiously, and the short-term directional search is becoming clearer.

Macro Data Dampens Risk Appetite

Recent macroeconomic data has made it challenging for crypto investors. ADP reported weakness in private sector employment, followed by a drop in consumer confidence to 88.7, significantly reducing risk appetite. These developments have dampened expectations for a short-term Bitcoin recovery. At the same time, investors see a weaker data trend as increasing the likelihood of a more accommodative policy from the Federal Reserve.

Gold prices rose over 1%, and the Russell 2000 index recovered, signaling a potential easing effect. In addition, U.S. President Donald Trump signed the “Genesis Mission” executive order, boosting optimism for technology investments. Following this, crypto investors have increased year-end call option positions above $100,000.

Key Levels and Possible Bitcoin Scenarios

The upcoming options expiry presents five potential closing scenarios, clarifying levels traders should watch:

• $85,000–$87,000: put positions strongly advantageous

• $87,001–$88,000: sellers still hold the edge

• $88,001–$89,000: call and put positions balanced

• $89,001–$90,000: call positions gain slight advantage

• $90,001–$92,000: buyers hold nearly $3.8 billion advantage

This five-tier structure suggests the market could experience significant swings after the options expiry. If Bitcoin maintains support around the $88,000 line, a neutral-to-suppressed sentiment may persist. However, stronger global stimulus expectations could trigger price movements in the options market, potentially giving Bitcoin a new direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.