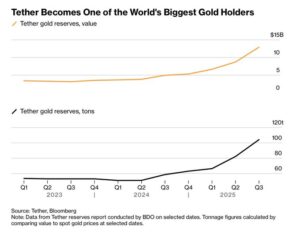

Tether, the largest stablecoin issuer in the crypto industry, has shocked the traditional financial world by becoming a major force in the global gold market. According to a new analysis published by Jefferies, the company has become the largest individual holder of gold in the world, excluding central banks. This development suggests that Tether’s influence on gold’s recent surge to all-time highs may be far greater than previously assumed.

Jefferies: “Tether Drove the Gold Rally”

Gold prices have recently reached historic highs, with analysts largely attributing the rise to a weaker U.S. dollar, macroeconomic uncertainty, or market momentum. But according to Jefferies, there is another major factor that completes the picture: Tether’s aggressive gold purchases. Since 2020, Tether has been issuing its XAUt token, backed by physical gold stored in Switzerland. During the same period, the company has invested over $300 million in mining and precious metal firms. CEO Paolo Ardoino has repeatedly described gold as “natural bitcoin,” emphasizing that the company is diversifying its reserves.

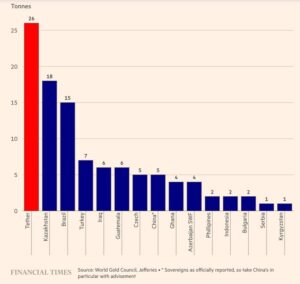

According to Jefferies, the 116 tons of physical gold reported in Tether’s end-September reserve disclosure places the company on par with mid-sized central banks globally. This amount is comparable to the gold reserves of countries such as South Korea, Hungary, and Greece.

Tether Accounts for 2% of Global Gold Demand

The report highlights that Tether alone accounts for about 2% of global gold demand—equivalent to 12% of quarterly central bank gold purchases. Based on discussions with the company, Jefferies states that Tether plans to purchase around 100 more tons of gold in 2025. Strong demand for stablecoins and Tether’s projected $15 billion profit for this year provide the company with substantial financial capacity to continue these purchases.

Regulatory Obstacles: Conflict with the U.S. Genius Act

Tether’s aggressive gold strategy directly conflicts with the Genius Act, a regulatory initiative recently introduced in the United States. The act prohibits stablecoin issuers from using gold as a reserve asset. As a result, Tether’s massive gold holdings cannot be used to back its upcoming compliant stablecoin, USAT, expected to launch by the end of the year.

Overall Assessment

Tether’s gold accumulation strategy is opening the door to major debates across both the crypto and traditional financial sectors. Becoming the largest non-central-bank holder of gold highlights how significantly the stablecoin industry is influencing global financial dynamics. If Tether continues its aggressive gold-buying trend next year, analysts believe it could reshape the balance of institutional demand in the global gold market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.