ARK Invest, one of the most closely followed firms in the digital asset space, has shared a new market outlook suggesting that liquidity conditions are improving and preparing the ground for a potential year-end rally. Led by Cathie Wood, the company highlights that both liquidity dynamics and monetary policy are shifting into a market-friendly position, particularly for risk assets such as cryptocurrencies.

Liquidity Rebounds From Lows

In a brief analysis published on X, ARK Invest emphasized that liquidity is beginning to return, noting that this trend could act as the foundation for a broader market rebound. According to the firm, substantial capital inflows are expected to enter U.S. financial markets over the coming weeks.

The analysis points out that total liquidity in the U.S. markets reached a cycle low of 5.5 trillion dollars on October 30. Roughly 621 billion dollars had been withdrawn during the six-week government shutdown. With government operations resuming, around 70 billion dollars has already flowed back into the system. ARK Invest estimates that an additional 300 billion dollars may enter the market within the next five to six weeks, creating a favorable backdrop for risk-on sentiment.

Monetary Policy Turning Supportive

Another major theme in ARK Invest’s outlook is the potential shift in Federal Reserve policy. The firm notes that a rate cut is increasingly likely at the December meeting, with several key Fed officials—including New York Fed President John Williams, Christopher Waller, and Mary Daly—expressing openness to lowering rates. Markets are currently pricing in a 90 percent probability of a near-term cut.

Such a shift would mark a significant transition away from the strict tightening cycle the Fed has maintained over the past years, offering further support for equities and crypto assets.

QT Set to End, Bitcoin Forecast Still Bullish

The analysis also underscores the approaching end of the Fed’s quantitative tightening (QT) program on December 1. ARK Invest argues that the termination of QT will signal a renewed expansion in liquidity, reinforcing the trend already underway.

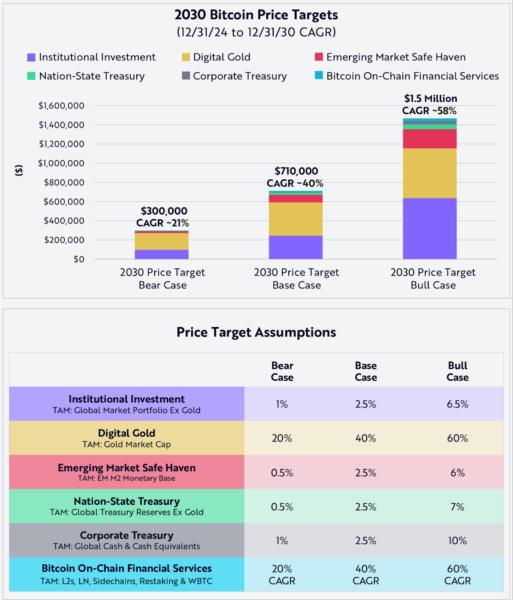

Earlier this year, the firm laid out its long-term projections for Bitcoin, estimating a target of 1.5 million dollars in its bullish 2030 scenario and 300,000 dollars in its bearish case.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.