After a week of sharp losses, Bitcoin has once again attracted strong buying interest, rebounding above $91,000 as expectations for a Federal Reserve rate cut in December continue to rise. Gaining 4.5% in the past 24 hours, BTC was trading at $91,755 as of Wednesday. Last week, Bitcoin had dropped to around $81,000 before recovering and climbing to $89,000 earlier today. This swift reversal signals that the market structure is beginning to stabilize after the intense selling pressure.

Analysts: “Rate Cut Expectations Are Boosting Bitcoin”

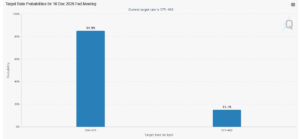

The CME Group’s FedWatch tool shows an 84.7% probability that the Federal Reserve will cut interest rates in December. Although Fed Chair Jerome Powell previously stated that a December rate cut is not guaranteed, market participants are increasingly pricing in this possibility based on recent macroeconomic data.

Jeffrey Ding, Chief Analyst at HashKey Group, emphasized that Bitcoin’s rebound should not be attributed to a single catalyst, describing the recovery instead as a “natural market rebalancing after a sharp pullback”:

“The market structure is healthy, liquidity is improving, and the long-term macro outlook remains positive. So BTC’s recovery isn’t tied to one factor — it’s the result of an overall improvement.”

Major Cryptocurrencies Rise Alongside Bitcoin

Other large-cap cryptocurrencies also turned upward with Bitcoin:

- Ethereum (ETH): up 2.8% to $3,038

- XRP: up 1.6% to $2.22

- BNB: up 3.9% to $897.9

- Solana (SOL): up 2.9% to $143.26

This broad recovery suggests that investor confidence, which had weakened in recent weeks, is beginning to return across the crypto market.

Risk Appetite Strengthens: U.S. Stocks Log Four-Day Rally

Ahead of the Thanksgiving holiday, U.S. stock markets recorded their strongest four-day rally since May. According to Yahoo Finance:

- Dow Jones: +0.67%

- Nasdaq: +0.82%

- S&P 500: +0.69%

This supportive macro backdrop is one of the key factors aligning with the crypto market’s renewed strength.

Overall Assessment

Bitcoin’s move above $91,000 represents a powerful rebound driven by both technical indicators and improving macroeconomic sentiment. A potential rate cut from the Fed in December could trigger a new wave of risk appetite across crypto markets. If market conditions remain favorable, Bitcoin’s upward momentum may continue, with altcoins also expected to benefit from the renewed bullish sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.