Bitcoin is on track to close November with a decline of nearly 17%, marking its weakest performance for the month since 2019. Despite the downturn, several analysts argue that the recent sell-off may lay the groundwork for a healthier market structure heading into 2026. For long-term investors, this period could represent a constructive reset rather than a sign of deeper trouble ahead.

Capitulation as a Setup for Opportunity

Nick Ruck, Research Director at LVRG, believes the market’s recent washout offers a strategic opportunity. According to Ruck, the sustained downside pressure has effectively removed excessive leverage and flushed out weaker, unsustainable projects. This cleansing effect, he notes, can create a more favorable environment for investors looking to build long-term exposure.

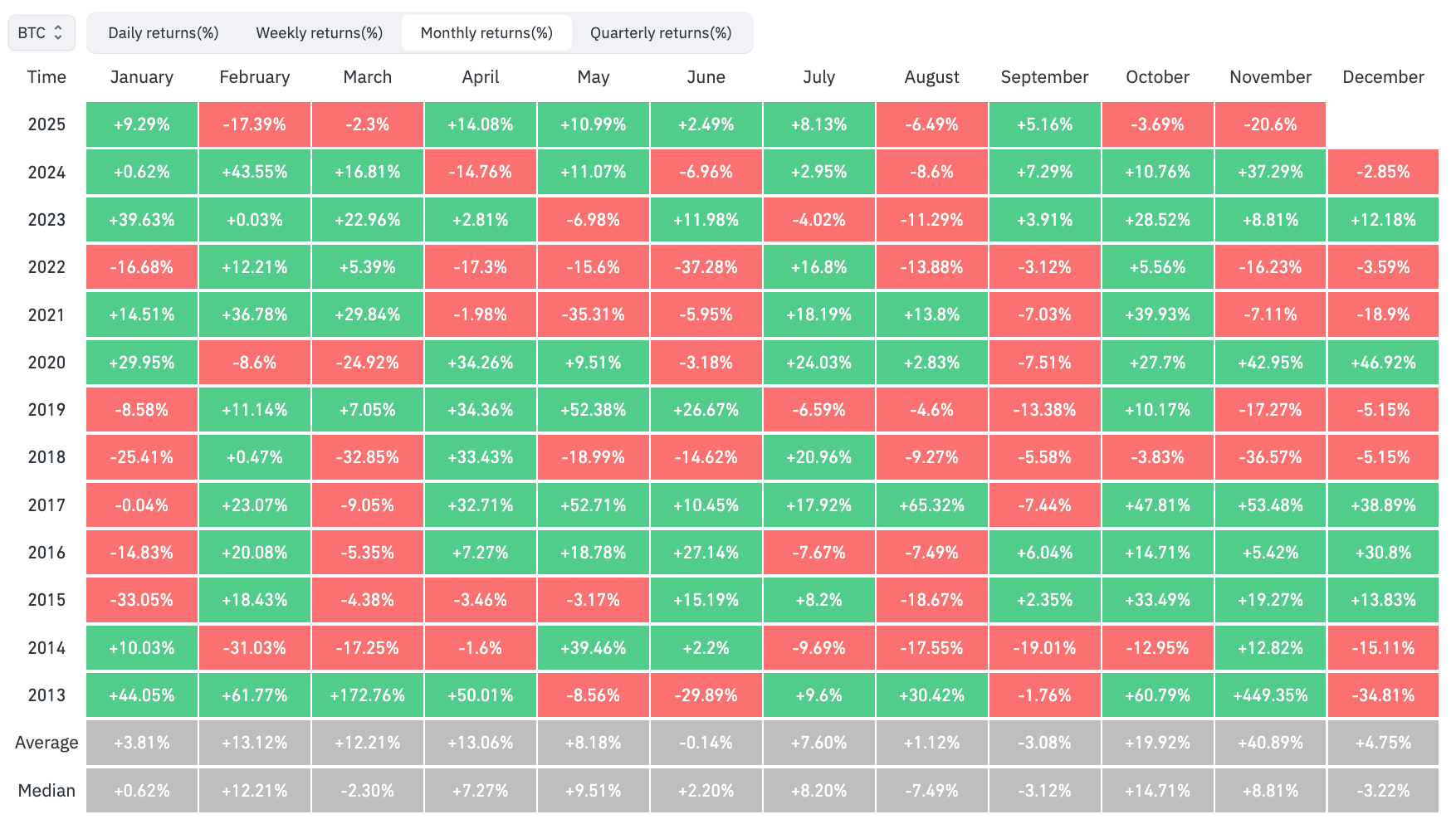

Throughout November, Bitcoin has fallen approximately 16.9%, trading around the 91,500-dollar level. Data from CoinGlass shows that this decline is approaching the 17.3% drop seen in November 2019. Bitcoin’s worst November on record occurred in 2018, when the cryptocurrency shed roughly 36.5% of its value.

Have Bitcoin’s Historical Patterns Shifted?

Crypto educator Sumit Kapoor highlights that November typically delivers strong returns for Bitcoin. However, subdued price action and lower trading activity during the Thanksgiving period contributed to the weakest November since 2018. Kapoor adds that historically, red Novembers are often followed by similarly negative performances in December.

On the other hand, Justin d’Anethan, Head of Research at Arctic Digital, points to a structural shift in market dynamics. He notes that the approval of spot Bitcoin ETFs in the United States earlier in 2024 pulled forward the traditional four-year cycle. With institutional players now a dominant part of the market, d’Anethan argues that the familiar rhythm of past cycles may no longer apply, suggesting that “this time could indeed be different.”

Key Levels Ahead of the Monthly Close

Technical analysts are watching a few crucial price levels as the month draws to a close. Many emphasize that a close above 93,000 dollars would be a constructive signal. Analyst CrediBull Crypto identifies 93,401 dollars and 102,437 dollars as the primary resistance zones for this timeframe. Holding above 93,000 dollars would be considered positive, while a move beyond 102,000 dollars would signal a significantly stronger market structure. However, analysts also caution that reaching the upper threshold may not happen until the following month.

At the time of writing, Bitcoin is trading around 91,600 dollars, struggling to break above resistance near 92,000 dollars.

*This content does not constitute investment advice.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.