The biggest problem in DeFi remains the same: liquidity. Even with Uniswap V3 and the proliferation of Layer 2s, most projects are still stuck in the loop of “let’s offer sky-high APRs, print tokens, and watch everyone dump after a month.” The result? Temporary liquidity, endless inflation, and users terrified of impermanent loss.

iZUMi Finance (IZI) breaks this vicious cycle at its root. As the first multi-chain protocol to truly deliver Liquidity as a Service (LaaS), it ensures every token enjoys continuous, efficient, and long-lasting on-chain liquidity. In Japanese, “iZUMi” means “spring” or “fountain” — just like a spring that flows for centuries, liquidity here is uninterrupted and abundant.

What is iZUMi Finance (IZI)?

iZUMi is a decentralized finance platform that provides “liquidity as a service.” The protocol makes on-chain liquidity programmable, targeted, and long-term for token holders, projects, and market makers. Its goal is permanent, sustainable liquidity instead of one-time pumps.

In concrete terms: if a project needs liquidity around 1000 ETH, iZUMi offers tools that keep that liquidity in the right price range, with the right incentives, and with low inflation (i.e., without excessive token supply).

iZUMi’s 3 Main Weapons

- LiquidBox — Programmable Liquidity Mining Uniswap V3-style AMMs allow concentrated liquidity in specific price ranges, but projects usually distribute incentives blindly — leading to short-term inflation and dumps. LiquidBox changes that:

- The project sets rewards for a specific price range (e.g., ETH between $1,500–$2,500).

- Only LPs providing liquidity in that range earn extra rewards.

- Auto-rebase and structured incentive mechanisms eliminate the “Pool-2 disaster”: high APR → excessive token emission → rapid sell-off. Result: Projects emit far fewer tokens, liquidity stays longer; LPs can mine with reduced impermanent loss risk. LiquidBox currently runs on Ethereum, Arbitrum, and Polygon and is used by projects like WOO, BitDAO, and DeHorizon.

- iZiSwap — Discretized-Liquidity-AMM (DL-AMM) Launched on BNB Chain, iZiSwap is a next-generation DEX that evolves Uniswap V3:

- Liquidity can be placed on individual price ticks instead of ranges.

- True non-custodial limit orders become possible — you can place limit orders on a DEX without a centralized order book.

- iZiSwap claims significantly higher capital efficiency than classic x*y=k AMMs (up to 5000× according to documentation). This means far less slippage and more effective trading with the same liquidity. Goal: Bring a CEX-like experience to DEXes while staying fully on-chain and non-custodial.

- iUSD & Bond Farming — Convertible Bonds in DeFi iZUMi brought the traditional finance concept of “convertible bonds” to DeFi:

- iUSD: An over-collateralized USD-backed instrument issued by iZUMi. It offers institutional investors a fixed-yield, principal-protected option.

- Bond Farming: Investors buy iUSD for stable returns; at maturity they have the option to convert their iUSD into iZi tokens. Revenue is first used to pay bondholders, with the remainder going to professional market makers. This structure attracts both risk-averse institutions seeking stable income and market makers chasing higher yields.

Future: Shared Liquidity Box and Multi-Chain Super Loop

iZUMi’s boldest vision: Keep liquidity on one chain while extending its effects across all chains.

- Deposit ETH on Ethereum → provide slETH liquidity on zkSync, Linea, Scroll, etc.

- Principal always stays safe on Ethereum; even if a new chain gets rugged, you’re unaffected.

- Farm on 5–10 different chains with the same liquidity and multiply your APR.

- sl-Tokens are 1:1 redeemable and continuously monitored by Box Keepers. This eliminates bridge risk and pushes capital efficiency to the maximum.

iZUMi Finance (IZI) Tokenomics

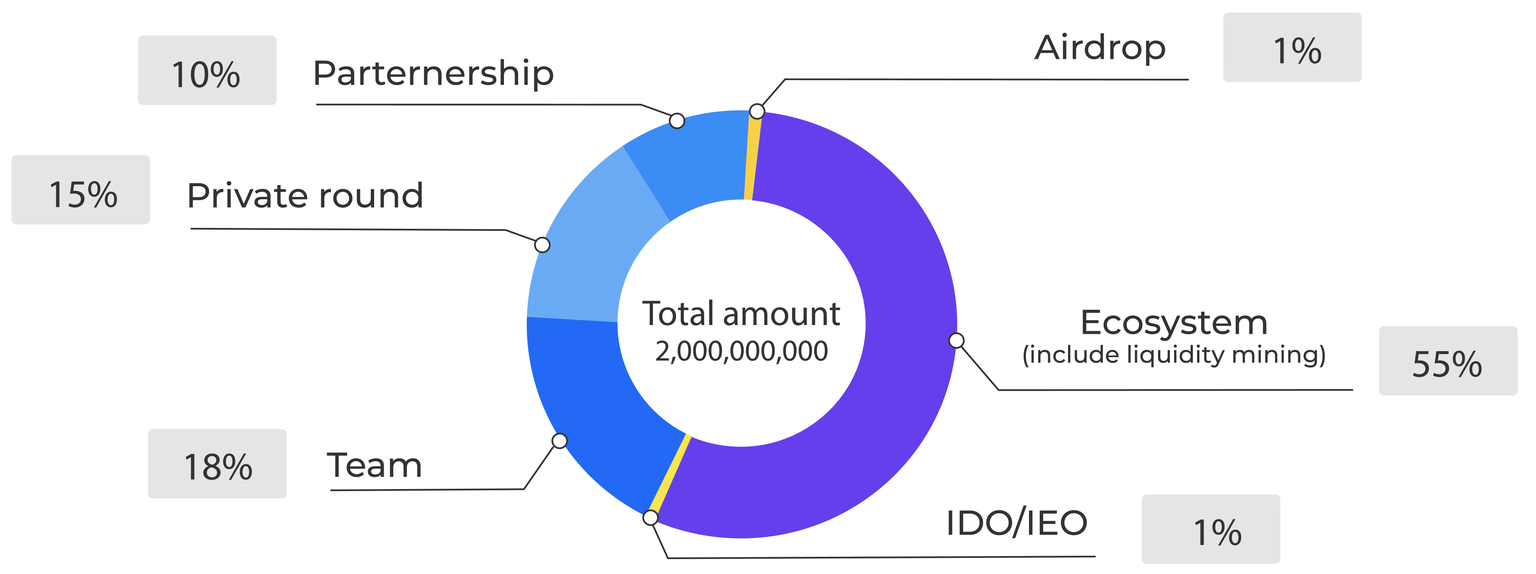

Total supply: 2,000,000,000 IZI

- Ecosystem: 55% (gradual release over 4 years)

- Team: 18% (6-month cliff + 18-month linear)

- Private: 15%

- Partnership: 10%

- IDO/IEO + Airdrop: 2%

Governance is handled via veiZi (vote-escrow iZi), which is transferable as an NFT.

Security and Audits

Fully audited by CertiK and Blocksec. Additionally reviewed by internal security teams of investors such as Bybit, Huobi, and Cobo. All contracts are open-source on GitHub.

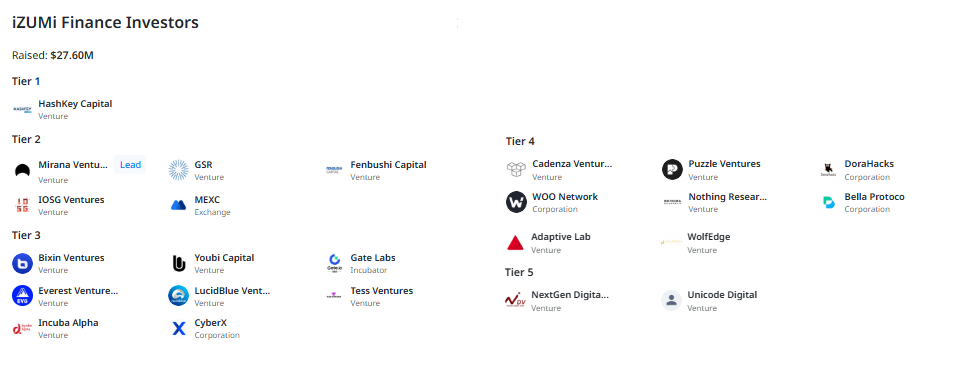

Investors — $27.6M Raised in Total

iZUMi Finance attracted strong institutional backing from the earliest stages. The support from well-known DeFi funds demonstrates confidence in both the technical infrastructure and the long-term vision. Investors are listed below by tier:

Tier 1 HashKey Capital

Tier 2 Mirana Ventures GSR Fenbushi Capital IOSG Ventures MEXC

Tier 3 Bixin Ventures Youbi Capital Gate Labs Everest Ventures Group LucidBlue Ventures

Tier 4 & 5 Cadenza, Puzzle Ventures, DoraHacks, WOO Network, Bella Protocol, and many more.

IZI Team

Behind iZUMi Finance’s success is a lean, highly effective team with deep DeFi expertise, strong technical skills, and visionary marketing. Leadership is shared by two co-founders:

- Lemon Lin – Co-Founder & CMO

- Jimmy Yin – Co-Founder & Technical Lead

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.