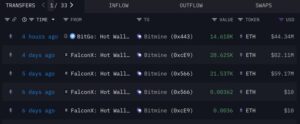

As volatility continues across the crypto market, BitMine Immersion Technologies one of the world’s largest institutional Ethereum investors has continued expanding its portfolio. According to Arkham Intelligence data, the company purchased a total of 14,618 ETH on Thursday, adding approximately $44.34 million to its reserves. This move stands out as a significant acquisition made during a period of market weakness.

Transaction Appears to Originate From BitGo

On-chain analytics platform Lookonchain reported that the transfer was sent from BitGo to the “0xbd0…E75B8” address, which matches BitMine’s known wallet. Although the company has not officially confirmed the purchase, the transaction aligns with BitMine’s long-running aggressive accumulation strategy. Following last week’s massive $200 million ETH investment, this additional purchase reinforces the company’s confidence in Ethereum’s long-term outlook.

BitMine’s Ethereum Reserves Reach Massive Levels

The company currently holds 3,629,701 ETH, worth around $10.9 billion, making it one of the largest Ethereum treasuries in the world. This amount represents roughly 3% of the total ETH supply.

BitMine has previously stated its ambition to reach 5% of the total supply, emphasizing Ethereum’s continued critical role in institutional financial infrastructure. As a result, the company’s consistent purchases are viewed as part of a long-term strategic positioning.

Tom Lee: “Ethereum Could Hit $7,000–$9,000 in 2026”

BitMine Chairman Tom Lee has frequently noted Ethereum’s strong potential despite recent market downturns. In a recent podcast appearance, Lee said ETH may establish a bottom around $2,500 in the short term but could rise to the $7,000–$9,000 range by late January 2026.

Lee cites several key factors supporting this bullish outlook:

- Growing integration of Ethereum within financial market structures

- Increased institutional use of ETH in financial products

- The possibility that the U.S. may adopt Ethereum as a “neutral chain” for future blockchain initiatives

Lee also told CNBC that the Federal Reserve may adopt a more accommodative policy toward the end of the year, which could benefit risk assets. He maintains his expectation that Bitcoin could surpass $100,000 or attempt a new all-time high.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.