The latest data from the U.S. labor market has become a new macro signal pressuring the crypto market’s fragile recovery that has been ongoing for weeks. After setting new highs in early 2025, Bitcoin has struggled to maintain momentum throughout the final weeks of November, and the rise in U.S. unemployment has created a cautious atmosphere among investors.

A Noticeable Cooling in the U.S. Labor Market

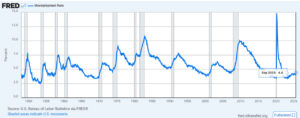

The U.S. unemployment rate has climbed from the post-pandemic lows of around 3% to above 4%, reaching its highest level in recent years. Growth in nonfarm payrolls has also slowed significantly compared to the post-pandemic boom. Data from the BLS and FRED shows that job openings are declining, finding employment is becoming harder, and quit rates have fallen. These indicators point to a softening labor market rather than a collapse.

These developments affect pricing not only in equities, bonds, and FX markets but also in crypto assets, because macro data directly influences investor risk appetite and overall liquidity conditions. The U.S. Employment Situation Report is one of the most critical macro indicators for global investors. Strong employment supports consumer spending and corporate profitability, while weak employment raises concerns about economic slowdown. Due to ETF flows and growing institutional participation, the crypto market is now directly influenced by these data points.

Why Do Labor Market Data Matter for Crypto?

Labor data shape crypto pricing through two main channels:

1. Risk-Off Channel: Rising unemployment and weak wage growth can push investors away from risk assets. In such periods, Bitcoin—and especially altcoins—tend to come under pressure.

2. Liquidity Channel: On the flip side, weaker labor data increase the likelihood of Federal Reserve rate cuts. Lower interest rates mean more liquidity and a weaker dollar—conditions that usually support Bitcoin.

Therefore, labor market data exert a dual effect: they can both pressure and support crypto, depending on which channel dominates.

How Does Bitcoin React When Labor Data Are Released?

Based on recent years:

- Payrolls better than expected → BTC rises ~0.7% on average

- Payrolls worse than expected → BTC falls ~0.7% on average

These reactions typically occur within the first minutes after the headline data release. For example, after the surprisingly weak jobs report in September 2025, BTC dropped below $90,000 and later slid to the $80,000 range due to tightening liquidity.

(At the time of writing, BTC is trading around $90,500.)

Key Labor Indicators Crypto Investors Should Watch

Analysts highlight the following as essential indicators for understanding labor market strength and anticipating crypto market reactions:

- Nonfarm payrolls & unemployment rate

- Wage growth and hours worked

- JOLTS data: job openings, quits, hires

- Weekly jobless claims

Together, these provide insight into both the strength of the U.S. economy and the Federal Reserve’s policy trajectory.

Does Weak Labor Data = Bitcoin Downtrend?

There is no simple answer because weak labor data generate two opposing forces:

- Short term: Risk-off sentiment strengthens → BTC faces downward pressure

- Mid term: Higher probability of rate cuts → BTC gains support

For Bitcoin, the key factor is which effect becomes dominant and how the Federal Reserve responds. Weak labor data do not necessarily mean Bitcoin must fall — but they almost always increase volatility.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.