The first days of December brought renewed volatility to the crypto market. After briefly climbing above $92,000, Bitcoin reversed sharply at the start of the week, slipping below $86,000 and trading near $85,800. The market’s cautious tone reflects growing anticipation of upcoming policy decisions from both the Bank of Japan (BoJ) and the U.S. Federal Reserve (Fed). With the Fed expected to formally conclude its quantitative tightening (QT) program, investors are closely evaluating how global monetary shifts might shape crypto performance. So, what’s driving this latest pullback?

Bank of Japan Signals Possible Policy Shift

One of the key developments weighing on risk assets is the rising expectation that the Bank of Japan may soon abandon its long-standing ultra-loose monetary framework. Attention is squarely on the BoJ’s December 19 meeting. According to reporting from Japan’s domestic media, Japanese government bond yields have surged to their highest levels since 2008.

Two-year yields have reached 1 percent, five-year yields stand around 1.35 percent, and ten-year yields have climbed to nearly 1.845 percent. The Japanese yen has also strengthened, moving past 155.4 against the U.S. dollar. Analysts increasingly expect a series of rate hikes, potentially three separate 25-basis-point increases by March. Market pricing suggests a 76 percent probability of a rate hike at the upcoming meeting, underscoring how seriously investors are taking this shift.

Fed Rate Cut Expected but Largely Priced In

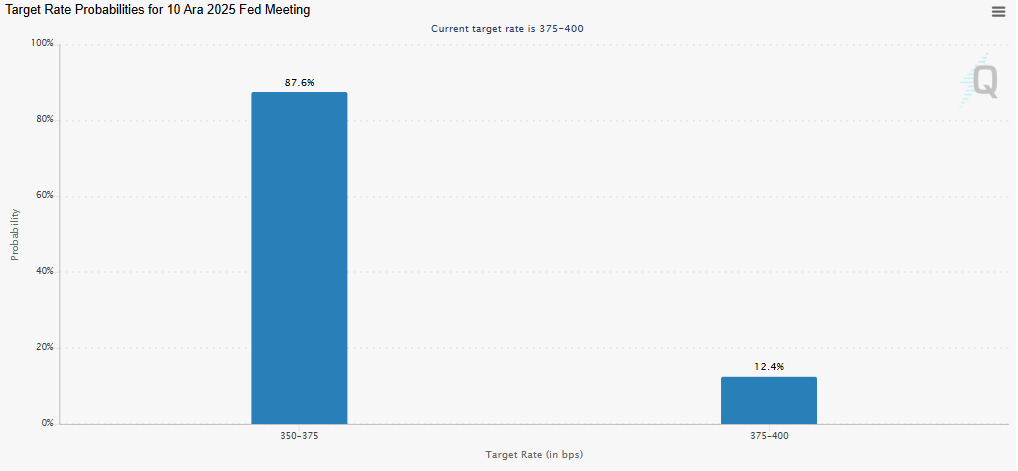

While Japan considers tightening, the U.S. Federal Reserve faces a different debate. Markets currently assign an 87 percent likelihood of a 25-basis-point rate cut at the Fed’s December 10 meeting, based on CME FedWatch data. However, most market strategists believe this move has been anticipated for weeks and is already reflected in asset prices.

Inside the Fed, policymakers remain divided. Some officials argue that inflation—though moderating—requires rates to stay elevated for longer, while others highlight weakening labor market conditions as a reason to begin cutting sooner.

President Trump Hints at Next Fed Chair

Adding to the uncertainty, U.S. President Donald Trump recently stated that he has already chosen the next Federal Reserve Chair and plans to reveal the decision soon. The announcement has prompted renewed speculation about the future direction of U.S. monetary policy.

Click here to get the latest news from Coin Engineer!