The cryptocurrency market has entered another sharp downward cycle amid increasing selling pressure, rapid liquidations, and a series of negative developments. Bitcoin falling below $86,500 on Sunday night triggered a chain reaction of sell-offs that affected the entire market. Macro pressures, the Yearn Finance hack, and mass liquidations of leveraged positions further weakened market sentiment.

Sharp Market Decline: Billions in Value Vanish

Around 19:00 UTC on Sunday, Bitcoin was trading near $91,300, but within just three hours it plunged sharply to the $87,000 range. This movement erased the five-day recovery and pushed Bitcoin back into the weak zone last seen in mid-November. Over the past 24 hours, Bitcoin fell 4.8% to as low as $86,310. Major altcoins also recorded significant losses:

- Ether: Down 5.36% to $2,827

- XRP: Down 6.39% to $2.05

- Solana: Down 6.41% to $126

In the last four hours, the total crypto market cap dropped 4.5%, wiping out more than $144 billion.

What Triggered the Pressure: Macro Concerns and the Yearn Finance Hack

Two major developments were behind Bitcoin’s decline:

- Macroeconomic pressures and interest rate expectations

- A major hack targeting DeFi giant Yearn Finance

The draining of Yearn Finance’s yETH pool and the attacker sending 1,000 ETH to Tornado Cash sparked widespread panic across DeFi. The incident came less than a week after the hack involving Upbit, further increasing distrust in the market.

Jeff Mei, COO of BTSE, commented:

“Yearn is a major DeFi aggregator that manages fund flows between Aave, Compound, and Curve. Such an attack can trigger chain-reaction withdrawals and accelerate sell-offs.”

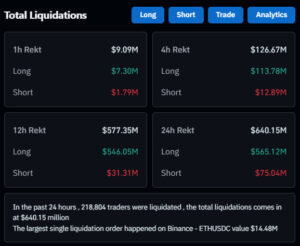

Leverage Wiped Out: $200 Million Liquidated in One Hour

The drop didn’t just hit the spot market — leveraged positions were destroyed as well. According to Coinglass, as Bitcoin fell from $91,000 to $86,000 within an hour, approximately $560 million in long positions were automatically liquidated.

These liquidations:

- Closed borrowed positions of bullish traders

- Created chain-reaction selling that accelerated downward momentum

- Added further pressure on the price

Analysts described the event as “a classic example of a leverage spiral.”

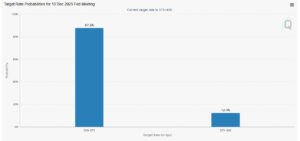

Rate Cut Expectations Are No Longer Enough to Support the Market

According to the CME FedWatch Tool, the probability of a 25 bps rate cut in December has risen to 87.6%. However, analysts note that the market has been pricing in this expectation for months, limiting its impact.

BTC Markets analyst Rachael Lucas stated:

“The December rate cut is no longer new information. The market priced this in during the September–October rally. Bitcoin is behaving like a high-beta risk asset and needs real liquidity inflows.”

According to Lucas, risk appetite continues to be constrained by:

- Stubborn inflation

- Trade tariffs

- $3.5 billion in outflows from Bitcoin ETFs in November

- Billions of dollars in long-position liquidations

Possible Scenarios: $120,000 or $75,000?

Analysts highlight two main scenarios for Bitcoin:

1. Bullish Scenario

- A December rate cut could push BTC 10–15% higher toward the $95,000–$100,000 range

- If Powell adopts a more dovish stance, $110,000–$120,000 may be possible

2. Bearish Scenario

- Losing the $87,000 support would open the door to $80,400

- If this level breaks, liquidity could target $75,000

Conclusion

Bitcoin falling below $86,500 has further weakened an already fragile crypto market structure. Macro pressures, security concerns in DeFi, the Yearn Finance hack, ETF outflows, and leveraged position risks continue to contribute to strong short-term downward pressure. While an expected December rate cut or dovish Fed commentary may offer temporary relief, current conditions suggest that investors should remain cautious — especially regarding leveraged trades and risk management.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.