With the term of U.S. Federal Reserve (Fed) Chair Jerome Powell set to expire in May 2026, the question of “Who will be the next Fed Chair?” has become one of the hottest topics in Washington. The crypto market, in particular, is closely following developments regarding who will take this seat, as one of the candidates, Kevin Hassett, stands out with his crypto-friendly background.

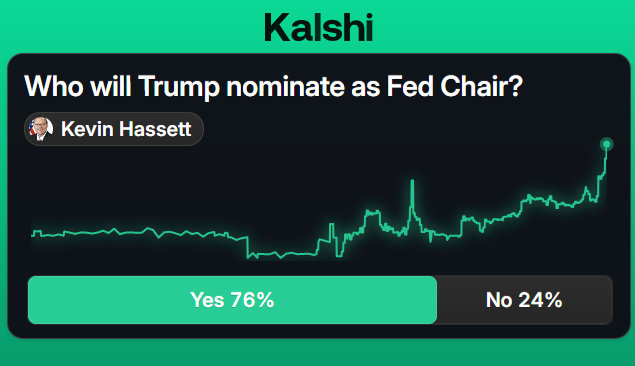

Prediction Markets: Hassett Far Ahead

In recent days, there has been significant activity on global prediction platforms Polymarket and Kalshi. According to the data:

- Hassett: 76%

- Kevin Warsh: 14%

- Christopher Waller: 10%

Hassett’s rise is especially notable. Hassett, who served as Director of the National Economic Council during the Trump administration, has long been considered a favorite. The main reason he is viewed as “crypto-friendly” in the crypto world is his role on Coinbase’s advisory council and the fact that he is known to hold a substantial stake in the exchange.

The assessment from Caitlin Long, CEO of Wyoming-based Custodia Bank, resonated within the crypto community:

“If Hassett really becomes Fed Chair, the influence of anti-crypto figures within the institution will be significantly reduced. We would see major changes at the Fed.”

A New Era in Crypto Policy?

Hassett’s rise brings back the possibility of a softening in the Fed’s approach to crypto assets. However, past examples show the importance of managing expectations. As remembered, Gary Gensler raised optimism when he arrived at the SEC with blockchain expertise, yet he maintained strict regulatory policies throughout his tenure.

If Hassett is chosen, there is no definitive picture that the Fed will fully open the door to crypto. However, compared to the current Fed structure, a more “experimental” stance and a more open approach to bank-crypto integration appear more likely.

Supervision Debates Continue Inside the Fed

While the new chair discussions continue, significant disagreements regarding supervisory and oversight mechanisms are emerging within the Fed. The institution’s recently announced “risk-focused supervision” approach has been viewed as too lenient by some internal figures. For this reason, it is clear that the new chair will take over a Fed already in the midst of a shift.

When Will the Announcement Come?

U.S. Treasury Secretary Scott Bessent recently stated, “It is highly likely that Trump will announce the new Fed Chair before Christmas,” increasing expectations even further.

All eyes are now on Washington. Hassett’s rising probability is being followed with great interest, especially by crypto investors and industry participants. In the coming weeks, we may witness critical developments that will directly shape the future of U.S. monetary policy and its relationship with crypto.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.