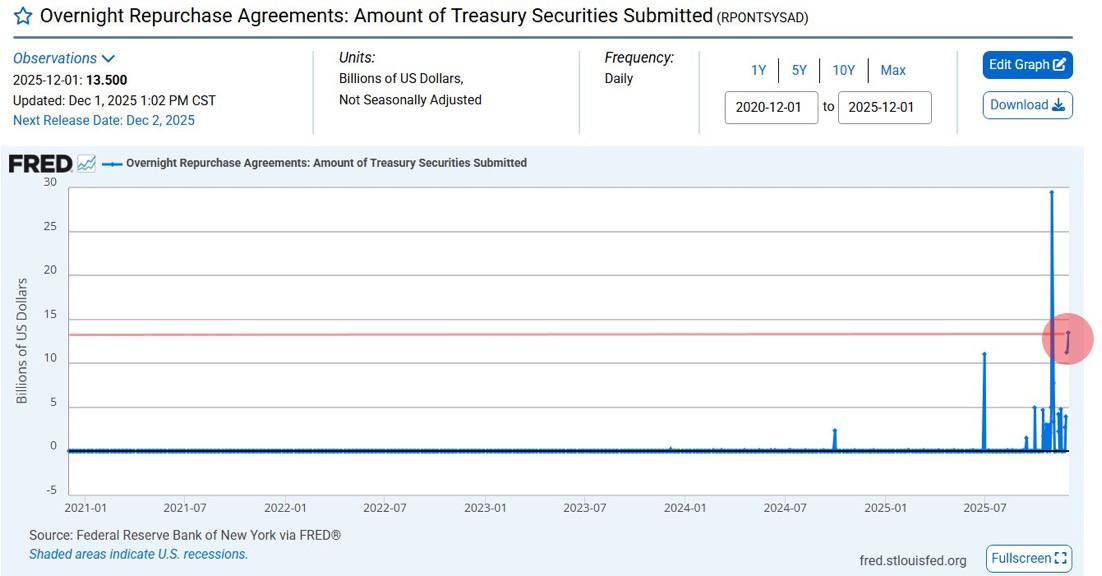

At the start of December, the Federal Reserve (Fed) conducted a sizable overnight repo operation, supplying the banking system with 13.5 billion dollars in fresh liquidity. According to New York Fed data and independent market reports, this was the second-largest injection seen since the Covid era. Such a move is widely interpreted as a sign of renewed funding pressures within parts of the financial system, prompting the Fed to stabilize short-term conditions.

What Are Overnight Repos and Why Do They Matter?

Overnight repurchase agreements are one of the Fed’s primary tools for supplying immediate, short-term cash to banks. The mechanism is straightforward: the Fed purchases securities such as U.S. Treasuries from financial institutions and simultaneously agrees to sell them back the following day. In practice, this provides banks with the liquidity they need to manage sudden cash shortfalls without resorting to asset sales.

A notable rise in repo demand typically signals tightening liquidity or stress within the funding markets. From a macro perspective, these injections can ease financial conditions, support credit channels, and exert downward pressure on short-term rates. Historically, improved liquidity has also contributed to stronger risk appetite, often resulting in upward movement across various asset classes.

Implications for the Crypto Market

Liquidity shifts often appear in digital asset markets before they are fully priced into traditional markets. Bitcoin tends to respond first as system liquidity expands, followed by large-cap altcoins such as Ethereum and XRP as Bitcoin dominance softens. A sideways-trending Bitcoin paired with declining dominance has frequently preceded altcoin rotations in previous cycles. Although liquidity injections do not guarantee upward momentum, they have historically reduced the likelihood of sustained downside moves.

QT Ends and Market Expectations Shift Toward the FOMC Meeting

The Fed’s termination of quantitative tightening marks another significant milestone. With asset runoff now halted, financial conditions are no longer being actively tightened through balance sheet reduction. This development reinforces market sentiment that monetary policy is moving toward a more accommodative stance.

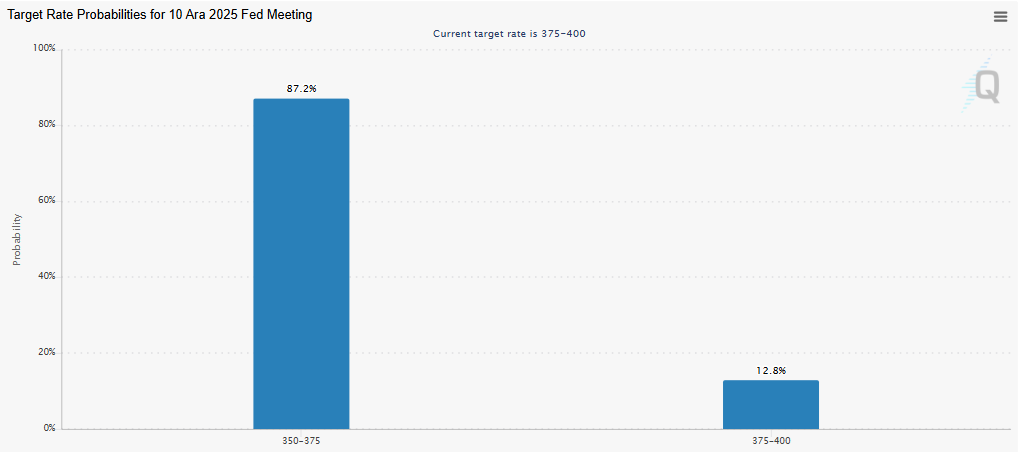

The next focal point for investors is the December 10 FOMC meeting. Current projections indicate an 87.2 percent probability of a 25-basis-point rate cut, while the chance of leaving rates unchanged stands at 12.8 percent. These expectations reveal a market increasingly confident that the Fed is approaching a pivot toward easing.

In the coming days, the continuation of repo operations and the outcome of the FOMC meeting will shape the direction of financial markets. The recent liquidity injection suggests that year-end trading conditions may become more volatile yet potentially more supportive for risk assets.

This article is for informational purposes only and does not constitute investment advice.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.