Bitcoin dropped to $84,000 on Monday after failing to surpass $92,000 on Sunday. This sharp decline was driven by stress in the Japan bond market, stablecoin concerns, and declining investor risk appetite. BTC investors are taking a cautious stance amid rising market uncertainty. Discover the reasons behind Bitcoin’s recent drop and market impact.

Stablecoin and Regulatory Concerns in Bitcoin Decline

One of the key factors in the Bitcoin drop was concern over USD-backed stablecoins. Tether (USDT) and similar digital assets raised questions about reserve transparency and reliability, reducing investor risk appetite. According to Reuters, the People’s Bank of China (PBOC) reiterated its strict stance on digital assets, stating that stablecoins are being used for “money laundering, fraud, and unauthorized cross-border fund transfers” and vowed to increase enforcement against such illegal activities.

Strategy (MSTR US) CEO Phong Le stated that the company would only sell its Bitcoin if the market NAV (mNAV) remained low and all other financing options were exhausted. Despite weekend concerns, Strategy raised $1.44 billion in cash on Monday to support dividend payments and meet debt obligations. This illustrates how strategic digital asset reserve companies adjust their BTC holdings in volatile markets.

Japan Bond Market and Global Economic Stress

Some analysts linked Bitcoin’s decline to rising yields on Japan’s 20-year government bonds. Higher yields generally reduce investor appetite for purchasing bonds at current prices. However, 30-day correlation data shows that a direct link is difficult to establish.

Stress in the Japan bond market also reflects deteriorating global economic expectations. Cloud AI companies issuing GPU-backed debt instruments create potential default risk, shaking investor confidence. Nvidia and CoreWeave’s financing strategies have contributed to market uncertainty, making Bitcoin investors cautious.

Liquidity, Order Book, and Investor Behavior

Liquidity constraints and shallow order books contributed to Bitcoin’s decline. Despite over 400,000 BTC accumulated around $84,000–$90,000, strong buying pressure was absent, and short-term investors remain underwater compared to their average entry of $104,600.

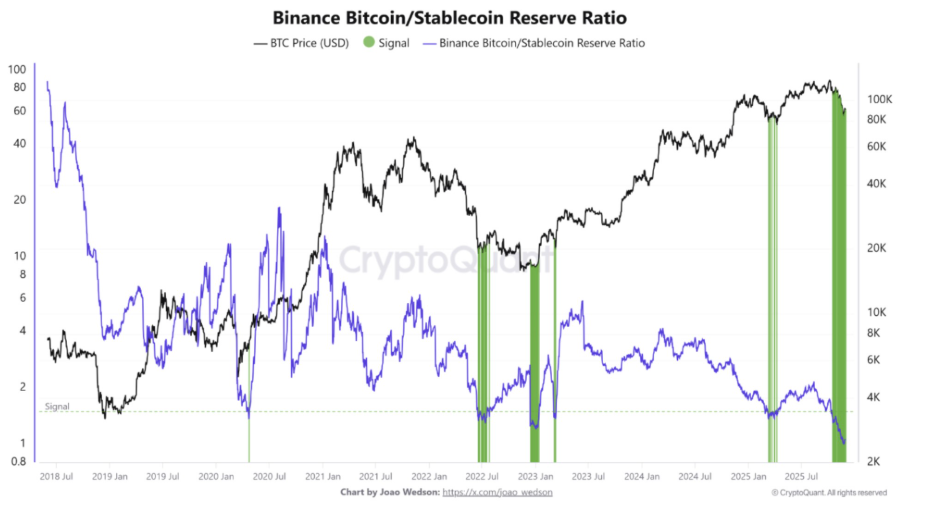

CryptoQuant data shows Binance’s “Bitcoin/Stablecoin Reserve Ratio” at its lowest since 2018. This indicates that buying power is waiting on the sidelines while spot demand remains weak.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.