Despite ongoing volatility in the crypto market, spot ETF flows continue to clearly reflect institutional investor behavior. Regardless of price swings and macro uncertainty, ETF data shows which assets major institutions trust the most. As of December 2, the latest figures reveal strong and consistent inflows into Bitcoin, Solana, and XRP spot ETFs. This indicates that institutional investors are maintaining — and in some cases increasing — long-term strategic positions, independent of short-term market movements.

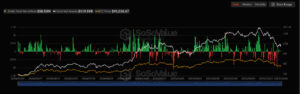

Bitcoin Spot ETFs Record Fifth Consecutive Day of Inflows

Bitcoin ETFs saw $58.5 million in net inflows on December 2, underscoring persistent institutional demand. This marks the fifth consecutive day of positive flows into Bitcoin-focused products, highlighting continued strategic interest from large investors. Despite occasional price pressure, institutions are clearly maintaining a long-term outlook and using market dips as buying opportunities.

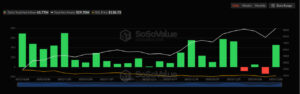

Outflows in Ethereum Spot ETFs

Ethereum showed a contrasting trend. ETH ETFs recorded $9.91 million in net outflows on December 2. This signals a more cautious stance among investors in the short term, with risk reduction favored during periods of heightened uncertainty. Analysts note that ongoing price pressure on Ethereum — driven by both macro conditions and weakening sentiment has prompted many institutional investors to take profits.

Strong Inflows Into Solana ETFs

Solana ETFs posted $45.77 million in net inflows, demonstrating continued institutional demand for the asset. The substantial inflow suggests growing interest in the Solana ecosystem not only from retail traders, but also from major institutions. Despite price volatility, the persistence of positive flows indicates that institutional investors remain confident in Solana’s long-term growth potential and are not viewing short-term volatility as a strategic threat.

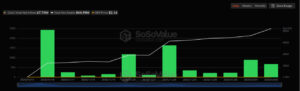

Significant Increase in XRP ETF Flows

One of the most notable data points was the $67.74 million inflow into XRP ETFs. This strong investor demand reflects rising confidence in the Ripple ecosystem. Recent legal optimism and growing institutional interest are among the primary drivers of increased capital flows.

A market analyst commented:

“ETF data clearly shows institutional preferences. Strong inflows into Bitcoin, Solana, and XRP suggest ongoing risk appetite for these assets, while Ethereum’s outflows reflect a more cautious short-term stance.”

Conclusion

The December 2 figures show a divergence in behavior across the spot ETF market.

- Bitcoin and Solana recorded strong inflows

- XRP saw a standout $67.74 million inflow

- Ethereum experienced notable outflows, indicating risk reduction

Overall, the data shows that institutional interest in crypto remains intact, with BTC, SOL, and XRP standing out as preferred major assets in the current market environment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.