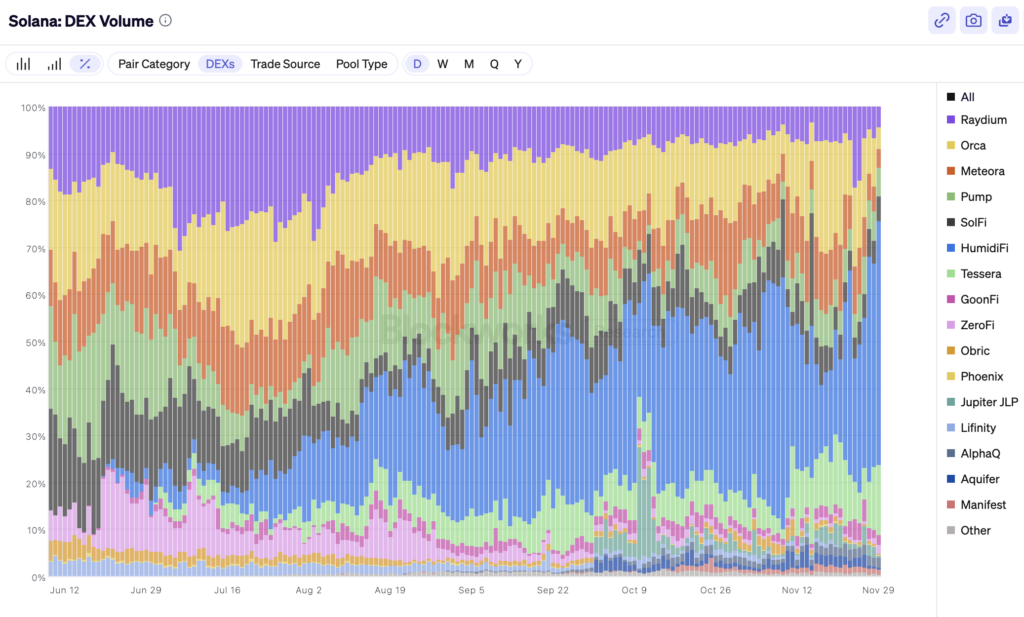

HumidiFi is the largest decentralized exchange (DEX) on the Solana network. With daily trading volumes exceeding $1 billion, it accounts for roughly 35% of all spot DEX activity on Solana. Unlike traditional automated market makers (AMMs), HumidiFi uses a proprietary AMM (prop AMM) model. This approach combines on-chain execution with institutional-grade market-making logic, providing tighter spreads, deeper liquidity, and superior trading performance.

HumidiFi is designed to evolve alongside Solana, leveraging every technical upgrade to create one of the most efficient, high-performance, and transparent market ecosystems: true internet capital markets.

HumidiFi’s Core Concept and Problem Solving

Traditional AMMs form the backbone of DeFi but are designed for simplicity, not performance. Static liquidity curves struggle to adapt in real time, creating several issues:

-

Prices cannot respond instantly to market changes.

-

Capital is inefficiently distributed, away from active trading zones.

-

Wide spreads and poor price discovery harm user experience.

-

Lack of user segmentation puts retail traders at a disadvantage versus arbitrage or bot activity.

-

Liquidity is fragmented across pools and platforms.

-

LPs face impermanent loss and reduced returns due to inefficient capital usage.

-

High slippage and poor execution reduce retail trader satisfaction.

HumidiFi solves these problems with an active liquidity (prop AMM) approach:

-

Predictive quoting: Real-time market data and risk metrics generate accurate price quotes.

-

Dynamic inventory management: Exposure is continuously balanced, maximizing capital efficiency.

-

On-chain settlement, off-chain intelligence: Computation is off-chain while custody and settlement remain fully on Solana.

-

Retail-first design: Retail users receive better spreads and lower congestion than bots or arbitrageurs.

HumidiFi delivers low slippage, fast execution, and institutional-level liquidity, bringing Solana DEX performance closer to CEX standards.

Team and Partners

HumidiFi is supported by the Zero Position Foundation, a memberless organization without central owners. Core engineering contributions are provided by Butterfly Research (DBA Temporal), which specializes in protocol engineering, validator optimization, and liquidity infrastructure on Solana.

Additional support comes from independent engineering teams, liquidity providers, and product advisors, enhancing HumidiFi’s performance, resilience, and long-term sustainability.

Project Architecture and Features

HumidiFi is optimized for Solana’s high throughput and parallel execution:

-

Proprietary Quoting Engine: Core liquidity and pricing logic is private and not open-sourced.

-

Off-Chain Oracle & Predictive Model: HFT-powered oracle continuously updates market data.

-

Optimized Solana Integration: Millisecond-level transaction confirmation, low network congestion.

-

Universal Liquidity Layer: New pools are independent but share oracle and execution frameworks.

Integrations: Jupiter, DFlow, Titan, OKX Router, and other Solana infrastructure.

Roadmap

HumidiFi aims to go beyond being a DEX on Solana and establish a universal liquidity layer. Planned milestones include platform AMM services for institutional partners, issuer pools, and cross-chain expansion.

-

May 2025: HumidiFi protocol launch on Solana.

-

Oct/Nov 2025: Reaching top DEX volume in the Solana ecosystem.

-

Nov/Dec 2025: $WET Token Launch via Jupiter DTF platform.

-

Near Future: Full governance rollout and additional DeFi product launches.

Governance

$WET serves as HumidiFi’s governance token. Token holders can stake or lock $WET to vote on protocol upgrades, fee structures, and development decisions, ensuring decentralization and community influence.

Token Details

-

Total Supply: 1,000,000,000 WET

-

Max Supply: 1,000,000,000 WET

-

Circulating Supply: 230,000,000 WET

$WET Token Use

-

Staking for trading fee rebates and tier-based benefits.

-

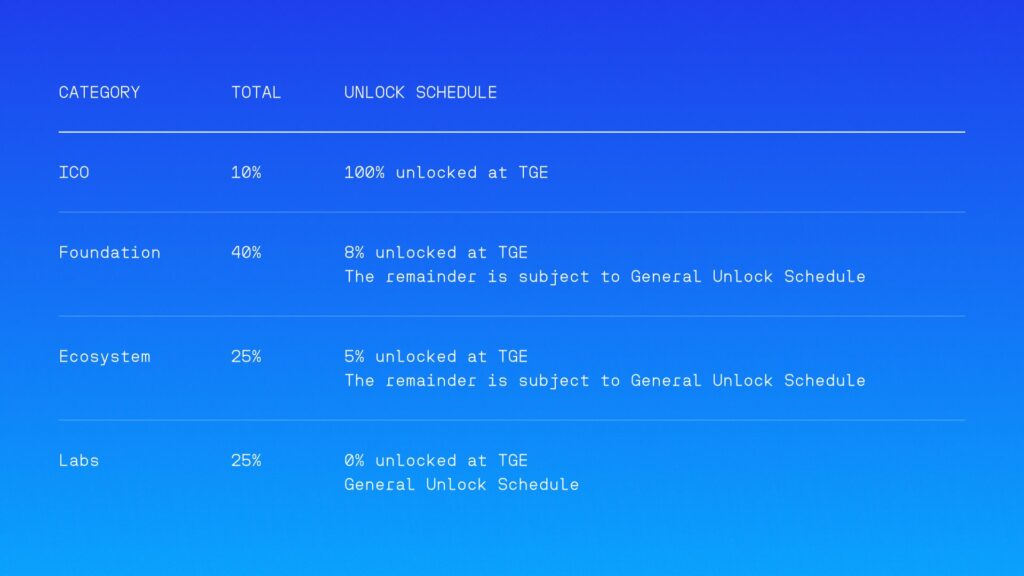

TGE (Token Generation Event) on December 5, 2025, via Jupiter DTF.

-

Max supply: 1 billion WET (SPL standard).

-

Distribution: Wetlist (6%), Jupiter stakers (2%), public pre-sale (2%).

$WET is a utility token, not an investment.

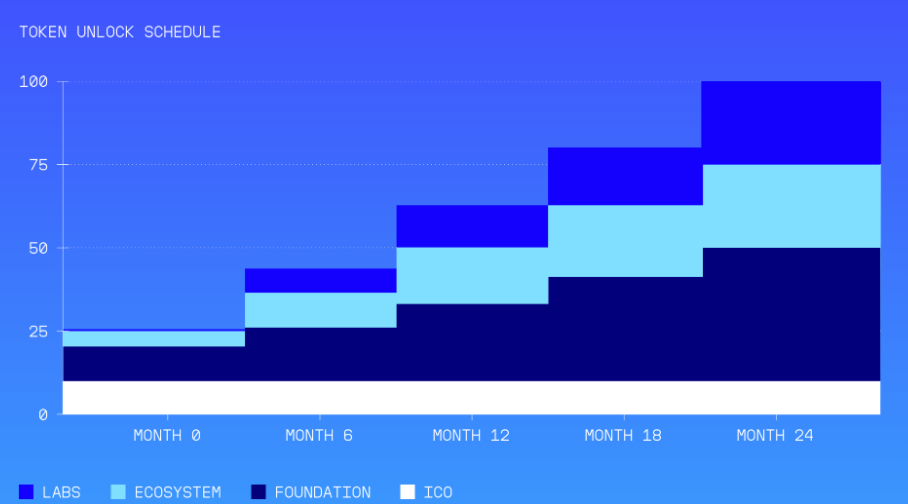

Token Allocation

-

Foundation: 40%

-

Ecosystem: 25%

-

Labs: 25%

-

ICO / Public Sale: 10%

Token Ecosystem & Features

-

Active liquidity DEX (prop AMM)

-

Predictive quoting and dynamic inventory management

-

CEX-level, on-chain transparent execution

-

Retail-focused design

-

Parallel execution for low latency and minimal slippage

HumidiFi represents DeFi 2.0 on Solana, creating adaptive, efficient liquidity for true internet capital markets.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.