A major options expiry worth more than $4 billion in Bitcoin and Ethereum options is drawing attention across the crypto market. Traders are navigating short-term uncertainty while building new medium-term strategies. Fresh derivatives data shows shifting volatility conditions and a clear change in positioning behavior.

Bitcoin and Ethereum Options Brace for a $4B Expiry

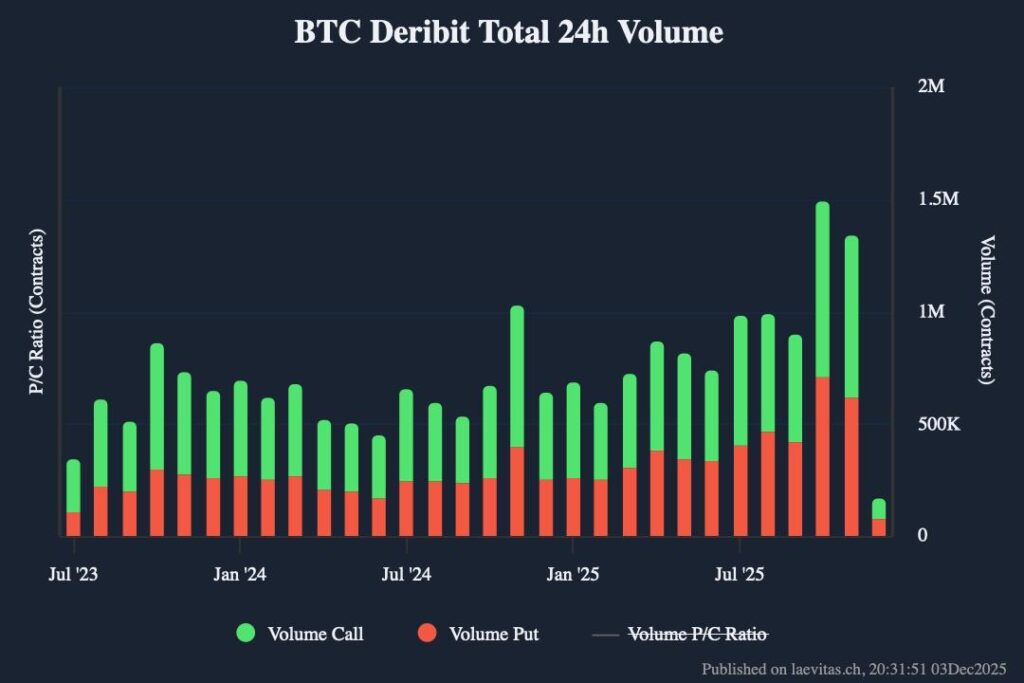

Bitcoin Ethereum options are back in focus this week as Deribit data confirms that more than $4 billion in contracts will expire today. Bitcoin accounts for roughly $3.4 billion of the total, while Ethereum contributes about $668 million. BTC’s put-to-call ratio near 0.91 reflects a cautious stance, with the max-pain level sitting at $91,000. This threshold remains slightly below the current spot price, signaling balanced but defensive positioning.

Ethereum displays a more optimistic tone. Its PCR has slipped to 0.78, indicating stronger demand for call options. With max-pain at $3,050 and ETH trading above that level, sentiment leans bullish for Ethereum. During this period of cooled volatility, option strategies are becoming more defined and data-driven across both assets.

Institutional Flows Shift Toward Mid-2026 Option Maturities

Derivatives activity has climbed notably in recent weeks, particularly among institutional desks. Many large traders are allocating into mid-2026 Bitcoin Ethereum options, positioning around expectations for rate cuts, ETF inflows, and an improvement in broader liquidity conditions. This trend suggests that medium-term risk appetite remains intact despite choppy spot movements.

Open interest across major options platforms continues to expand, reinforcing professional interest in long-dated exposure. Meanwhile, ETH’s relatively more attractive implied volatility is encouraging new strategic build-ups. These developments highlight an ongoing search for direction in the options market as broader macro trends evolve.

Strategy Rotation Highlights Yield and Risk Preservation

Investor behavior has been shifting toward more conservative and sustainable approaches. High-leverage short-term trades are giving way to measured strategies centered on yield, hedging, and portfolio resilience. Current dynamics can be summarized as follows:

-

increased use of hedging strategies amid low volatility

-

rising institutional demand for medium-term call exposure

-

stronger bullish pricing on Ethereum compared to Bitcoin

-

growing interest in long-dated options detached from spot noise

These structural changes offer more stability in a period marked by unpredictable price swings. With the market entering a maturing phase, professional flows increasingly shape the derivatives landscape. Some brief volatility may follow today’s expiry, yet markets typically recalibrate quickly as new positions emerge.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.