During a period of rising volatility in the crypto market, spot ETF data from December 4 clearly revealed institutional investor behavior. Increasing macro uncertainty, fluctuating Fed rate expectations, and tightening liquidity conditions have made ETF flows more directional. In this environment, Bitcoin and Ethereum ETFs saw significant outflows, while XRP and Solana recorded modest but positive inflows suggesting that institutions are reshaping risk exposure within the market.

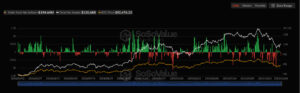

Major Outflows in Bitcoin ETFs

As of December 4, spot Bitcoin ETFs recorded a net outflow of $194.64 million. The most striking detail of the day was that none of the 12 Bitcoin ETFs saw net inflows. This reflects a notable decline in short-term risk appetite among institutional players.

Analysts point to rising volatility, uncertainty ahead of the upcoming Fed rate decision, and a shift toward capital preservation as drivers of the outflows. Additionally, Bitcoin’s struggle to find direction in recent days has prompted large funds to adopt a more cautious, wait-and-see strategy.

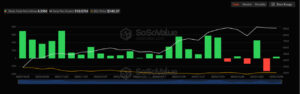

Ethereum ETFs Continue to See Outflows, Except BlackRock’s ETHA

Spot Ethereum ETFs recorded a net outflow of $41.57 million on December 4. However, the exception was BlackRock’s ETHA, which saw a net inflow—indicating that institutional demand for ETH has not disappeared entirely.

According to experts, the outflow trend reflects price pressure, shrinking liquidity, and investor caution ahead of key macro data. Yet, the selective maintenance of ETH exposure by major institutions suggests that long-term sentiment toward Ethereum remains strong.

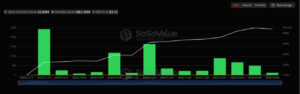

Net Inflows for XRP ETFs

Spot XRP ETFs recorded $12.84 million in net inflows during the day. This positive movement indicates sustained institutional confidence in the Ripple ecosystem and growing optimism regarding the ongoing U.S. regulatory process. Analysts note that these inflows reflect investor conviction in medium- to long-term use cases for XRP.

Solana ETFs Show Positive Flows

Spot Solana ETFs closed the day with $4.59 million in net inflows. Solana’s expanding developer ecosystem, high transaction throughput, and rising institutional adoption are seen as key drivers behind the positive flows. Solana’s growing role in DeFi, NFTs, and high-performance applications has helped sustain interest from institutional investors.

Analysts commented:

“Recent data shows institutions are reshaping risk allocation. While caution continues in Bitcoin and Ethereum, positive flows into XRP and Solana signal a more selective and targeted demand.”

Conclusion

The December 4 ETF data reveals a divergent institutional demand landscape in the crypto market. While Bitcoin and Ethereum are seeing short-term risk reduction, XRP and Solana continue to positively diverge, driven by ecosystem growth and regulatory expectations. Overall, the data suggests that as the year enters its final quarter, institutional strategies are becoming increasingly selective and cautious.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.