Markets have once again turned their focus to the Federal Reserve (Fed). Statements made by White House economic adviser Kevin Hassett have strengthened expectations that the Fed may implement an interest rate cut at next week’s meeting. According to economists and investors, this potential decision could have rapid effects on global markets, particularly on currencies.

Hassett’s Statements Spark New Expectations in the Markets

In an interview with Fox News, Kevin Hassett stated that the likelihood of the Fed cutting rates has increased. Hassett noted that recent statements by Fed governors and regional presidents show momentum shifting toward a rate cut. Emphasizing that a 25 basis point cut is on the table, Hassett suggested that policymakers may aim for a much lower interest rate in the near future.

These comments, especially coming from Hassett who is mentioned as a possible candidate for Fed chair have reinforced market expectations. The fact that next week’s meeting is the final meeting of 2025 has further heightened uncertainty in the markets.

Probability According to Economists and FedWatch Data

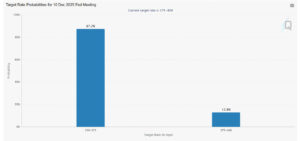

Expectations of a rate cut are based not only on commentary but also on concrete survey data. According to a Reuters poll, 82% of economists expect a 25 basis point cut next week. FedWatch data shows this probability at 87.2%.

Senior officials such as John Williams, Michelle Bowman, Christopher Waller, and Stephen Miran have also signaled toward easing, supporting this expectation. However, at least five FOMC members opposing a cut, along with Fed Chair Jerome Powell’s warnings that inflation could accelerate again, have significantly increased the level of uncertainty ahead of the meeting. The fact that inflation remains above 2%, and a 43-day government shutdown disrupted data flow, are among the factors reinforcing uncertainty around the direction of the decision.

Impact on Global Markets: Relief Expected in Asian Currencies

A rate cut in December would not only affect U.S. borrowing costs. According to strategists, a rapid relief effect could occur particularly in Asian currencies. Currencies such as the rupee, won, rupiah, and peso have been under pressure for weeks. If the Fed opts for easing, these currencies could re-establish balance. Some analysts point to expectations of a stronger yuan, suggesting that taking long positions in Asian currencies may once again become attractive.

Kevin Hassett stated:

“Recent statements show that the Fed now has a clearer inclination toward cutting rates. I believe a 25 basis point move could set the tone for the period ahead.”

Assessment

Next week’s FOMC decision will shape not only short-term interest rate policy but also the overall economic outlook for 2026. Expectations strengthened by Hassett’s comments have shifted the markets’ attention entirely toward the Fed. A possible rate cut could create significant movement in both domestic markets and global currencies. Therefore, the meeting is considered one of the most critical decision points of the year.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.