As uncertainty continues in the cryptocurrency markets, analysts at investment giant JPMorgan have evaluated the critical factor that will determine Bitcoin’s short-term price direction. A new analysis reveals that there is a factor far more influential than miners’ selling pressure. This assessment carries important signals for investors closely following the market.

Critical Factor for Bitcoin: Strategy’s Financial Resilience

In a report published by the JPMorgan team, it is stated that Bitcoin has recently faced two major pressures. Led by managing director Nikolaos Panigirtzoglou, analysts emphasize that beyond the decline in the network hash rate and mining difficulty, uncertainties surrounding Strategy are significantly more impactful. Accordingly, the real factor that will determine Bitcoin’s short-term price movements is how financially resilient Strategy is, as the world’s largest institutional holder of Bitcoin.

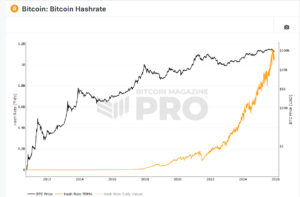

Decline in Hash Rate and Miners’ Condition

According to analysts, the decline in Bitcoin’s network hash rate is due to some miners reducing operations as a result of China reiterating its ban on private mining activities and high energy costs. Although production costs have fallen, the fact that the price remains below these costs has led high-cost miners to create selling pressure. JPMorgan estimates the current production cost at around $90,000.

Despite this, analysts say that miner selling is not the main factor determining Bitcoin’s direction. Instead, the decisive element is whether Strategy can meet its financial obligations without selling its large Bitcoin holdings.

What Does Strategy’s Financial Strength Indicate?

The metric showing the ratio of Strategy’s debt, dividends, and capital structure to its Bitcoin holdings currently stands at 1.13. According to analysts, this ratio indicates that the company is not under selling pressure. Additionally, the company’s recently announced $1.44 billion cash reserve is strong enough to comfortably cover dividends and interest payments for the next two years. This significantly reduces the risk of Bitcoin sales.

Although Strategy’s accumulation pace has slowed, its total holdings have surpassed 650,000 Bitcoin, showing that the firm remains one of the largest institutional Bitcoin holders in the sector.

Index Decision Could Be a Key Market Catalyst

The index decision that MSCI will announce on January 15 is seen as an important turning point for the markets. According to JPMorgan, a possible removal from the index is largely priced in. Conversely, Strategy remaining in the indexes could trigger strong recovery momentum for both the company’s stock and the price of Bitcoin.

The JPMorgan report states:

“The main factor determining Bitcoin’s short-term price direction is not miner behavior, but the financial resilience of large institutional investors. Strategy’s ability to meet its obligations without selling is critical for the market.”

Assessment

JPMorgan’s analysis reveals that the short-term outlook for Bitcoin largely depends on Strategy’s financial structure. While miner selling pressure is significant, it is not the main driver. With index decisions approaching and macroeconomic conditions at play, Bitcoin’s price direction may become clearer in the coming period. In the long-term view, analysts believe Bitcoin carries strong appreciation potential similar to gold.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.