Volatility has risen again in the cryptocurrency markets, and Bitcoin experienced an unexpected sharp pullback. The selling pressure that quickly took effect pushed the price back below the $89,000 level. This decline triggered a chain of liquidations in highly leveraged market positions, creating a strong impact across the market.

Bitcoin Below $90,000: Liquidations Increase

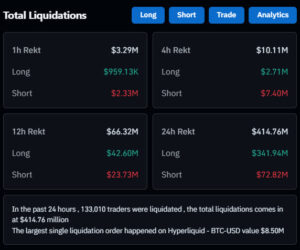

Within the last hour, Bitcoin lost nearly 2% in value, dropping to $88,964. This movement triggered a rapid wave of liquidations not only in spot markets but also in leveraged trades. The total liquidation amount in the last 24 hours rose to $414.76 million. Bitcoin alone caused $170.9 million worth of liquidations, further increasing pressure on the market.

Market Overview: Volatility in Ethereum and Altcoins

The decline initiated by Bitcoin spread to the rest of the market. Ethereum dropped to $3,072, losing more than 2% in the last hour. Although major altcoins such as Solana, XRP, BNB, and Dogecoin show positive 24-hour performance, short-term volatility has visibly increased.

According to liquidation data, Bitcoin and Ethereum lead the sell-off. In the last 24 hours, Ethereum saw $101.8 million, while Solana recorded $22 million in liquidations. Millions of dollars in liquidations even in smaller-cap assets indicate that selling pressure has spread across the market. A similar picture is seen in traditional markets, with the Nasdaq index down 0.02%.

Analyst Joao Wedson’s Assessment

Crypto analyst Joao Wedson commented on the current situation after Bitcoin’s decline. According to Wedson, Bitcoin losing the $89,800 level is a clear confirmation of the weakness the market has been signaling for a while. He added that staying below key on-chain support could lead to a prolonged sideways price movement. Wedson stated that he opened a short position near the recent local high, emphasizing that strategic discipline is more important than the outcome of any single trade.

The critical levels pointed out by Wedson are extremely important for the market. According to him, if Bitcoin breaks below $86,500, losing the $80,500 support becomes highly likely. This could pave the way for forming a new local bottom.

Macro Data: PCE Report and Market Reaction

This sharp pullback in Bitcoin occurred after the release of the U.S. Personal Consumption Expenditures (PCE) data. According to the latest report, annual PCE inflation came in at 2.8%, while the monthly figure was 0.2%. Core PCE remained steady at 2.8% annually and 0.2% monthly. These indicators show that inflation pressures continue but are under control.

Wedson stated:

“Bitcoin losing key support levels clearly highlights the weakness in the market. As long as it stays below critical levels, downward pressure may continue.”

Assessment

Bitcoin’s sudden drop once again highlights how fragile highly leveraged positions are in the market. Rapidly increasing liquidations disrupted balance and demonstrated how quickly volatility can spike. Rising liquidations indicate that investors with high-risk positions should act more cautiously and that the market remains open to sharp price movements in the short term. The critical support levels identified by analysts will play a major role in determining Bitcoin’s direction and shaping overall market sentiment going forward.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.