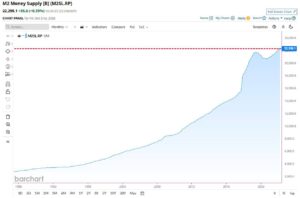

The fact that U.S. M2 money supply has reached an all-time high of $22.3 trillion marks an important turning point for both traditional finance and the cryptocurrency markets. The rapid expansion of the money supply creates uncertainty in the economic outlook and raises the question of how alternative assets like Bitcoin will be affected. So, what does this record-breaking M2 money supply mean for the crypto world?

What Is M2 Money Supply and What Does Its Increase Mean?

M2 money supply is a broad monetary measure that includes cash in circulation, demand deposits, savings accounts, and short-term deposits. An increase in M2 means the amount of money circulating in the economy is rising. This generally points to two primary outcomes:

- The implementation of expansionary monetary policies to support the economy, i.e., central banks injecting more liquidity into the market,

- The risk of rising inflationary pressure, since rapid growth in money supply can push prices upward.

A rapid increase in M2, especially during periods of high inflation, heightens concerns about the decreasing purchasing power of money. In such cases, individuals and institutions become more willing to move into alternative assets with value-preserving potential. Because of this, Bitcoin — with its limited supply — is closely linked to money supply data and is closely followed in the crypto space.

What Does It Mean for Bitcoin?

One of Bitcoin’s core narratives is that its limited supply makes it a hedge against inflation. With a maximum supply of 21 million, Bitcoin cannot be arbitrarily expanded by central banks like traditional currencies. This characteristic makes Bitcoin an attractive alternative during periods of monetary expansion. Therefore, record-high M2 levels reinforce Bitcoin’s perception as a “digital store of value.”

Historically, increases in M2 have supported Bitcoin demand in the medium and long term. When inflation threatens purchasing power, investors tend to migrate toward assets with limited supply. Bitcoin’s scarcity makes it especially appealing to institutional investors during periods of aggressive liquidity expansion. As a result, Bitcoin can strengthen its position as both an inflation hedge and a long-term store of value.

Impacts on the Crypto Market as a Whole

The impact of money supply expansion is not limited to Bitcoin. Increased liquidity can influence behavior and capital flows across the entire digital asset ecosystem. Broader effects on the crypto market can be summarized as follows:

- Liquidity Expansion Can Support the Entire Crypto Market: New money entering the economy typically increases investors’ risk appetite. This can drive demand not only toward Bitcoin but also toward mid- and small-cap altcoins. During high-liquidity periods, investors tend to adopt more aggressive strategies, leading to higher trading volumes and price volatility in the altcoin market.

- Inflation Concerns Can Boost Stablecoin Demand: During inflationary environments, individuals and institutions often seek stability before shifting to more volatile assets. As a result, dollar-backed stablecoins, especially those with global utility, may become more attractive. Increased demand for stablecoins directly influences crypto trading activity and DeFi infrastructure.

- DeFi and Crypto Derivatives Activity May Rise: Higher liquidity can drive increased participation in decentralized finance ecosystems, including lending, liquidity pools, yield strategies, and derivatives platforms. During these periods, users may deposit more collateral, borrow more, and trade more. This supports the growth of DeFi protocols.

Why Is M2 Growth an Important Indicator?

A rising M2 typically signals a shift toward looser monetary policy by central banks. During this process:

- The purchasing power of money may decline,

- Expectations of interest rate cuts may increase,

- Risk appetite may strengthen.

These three dynamics often create a positive environment for crypto assets. Analysts explain:

“Rising M2 money supply increases the importance of scarce assets like Bitcoin. Historically, Bitcoin tends to perform better in the medium term when liquidity expands.”

Assessment

The record-high $22.3 trillion M2 money supply indicates that global liquidity is expanding rapidly. While this raises inflation concerns, it also makes Bitcoin’s scarcity-based value proposition more attractive. Higher liquidity and rising risk appetite in the crypto market could support positive price movements in the medium term. For investors, the key question is whether this growth in money supply is sustainable and how central banks will respond.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.