The U.S. Federal Reserve’s (Fed) monetary policy has continued to be the main directional force for global markets over the past two years. The fight against inflation, interest rate hikes, balance sheet reduction (QT), and tight financial conditions have left markets longing for liquidity for a long time. However, in recent days, some assessments coming from figures close to the Fed suggest that this picture may be changing.

In particular, the latest remarks from Mark Cabana, a former New York Fed repo expert who is now working at Bank of America, have once again brought the possibility of a new wave of liquidity to the agenda. However, one critical point must be clearly underlined: These assessments are not an official decision for now, but merely Cabana’s projections based on market dynamics.

What Does Mark Cabana’s Liquidity Scenario Suggest?

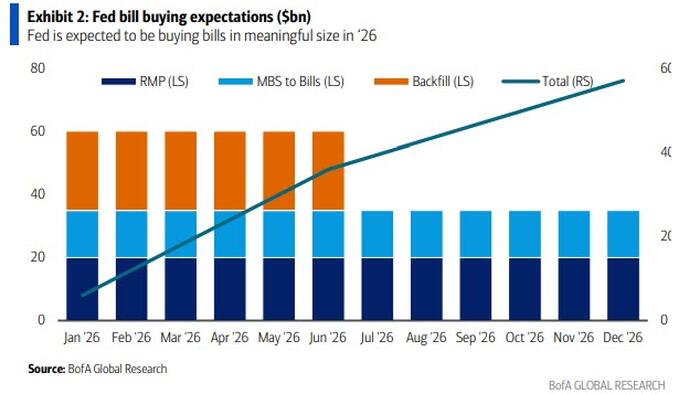

According to Mark Cabana, Fed Chair Jerome Powell could put on the table a move to launch approximately $45 billion per month in Treasury bill (T-bill) purchases following this week’s FOMC meeting. It is stated that:

-

$20 billion of this amount could be used to meet reserve needs in line with growing public liabilities,

-

$25 billion could be allocated to replenish reserves that have been drained in the repo market.

According to Cabana, this process may not technically be labeled as “QE” (quantitative easing). However, since it would imply balance sheet expansion, it could effectively function as a mechanism that injects new liquidity into the market.

The Claim That “QT Is Over, the Liquidity Tap May Be Reopened”

One of Cabana’s most striking comments is his assessment that the quantitative tightening (QT) process may have effectively come to an end. According to him:

-

At the December meeting, the Fed may not only implement a 25-basis-point rate cut,

-

But may also quietly reopen the liquidity channel.

If this scenario materializes, starting from January:

-

Monthly T-bill purchases of $40–45 billion,

-

And term repo operations

could begin supplying additional reserves to the market.

Even if it is not officially called “QE,” such a step—implying balance sheet expansion—could serve as a strong short-term support factor for equities, crypto assets, and other risky instruments.

What Would Be the Market Impact If This Scenario Occurs?

Such liquidity expansion could technically be reflected in the market through several channels:

-

Treasury bill purchases reduce the use of the RRP (Reverse Repo Facility),

-

A drawdown in the RRP increases net system liquidity,

-

Rising liquidity strengthens appetite for risk assets.

However, with Cabana’s own warning, such temporary liquidity support mechanisms could also lay the groundwork for greater valuation pressures in the long term.

What Do Institutions Expect from the Fed?

Bank of America’s View

According to Bank of America, even if the Fed continues to use cautious language, markets may begin to price in more aggressive rate cut expectations for January. The bank forecasts:

-

A 25-basis-point cut in December,

-

But also tighter forward guidance,

-

And the possibility of several dissenting votes in the decision process.

Morgan Stanley’s Assessment

Morgan Stanley, taking into account recent Fed statements and market pricing, states that a 25-basis-point rate cut at the December meeting has now become a strong probability. According to the bank, the gap between market expectations and the Fed’s communication is narrowing.

A Striking Message from Hassett

Kevin Hassett, one of the White House’s economic advisers, also argues in his assessment of the Fed that the time has come to begin rate cuts in a cautious manner. This view is interpreted as a message in line with the shift signals expected by the markets.

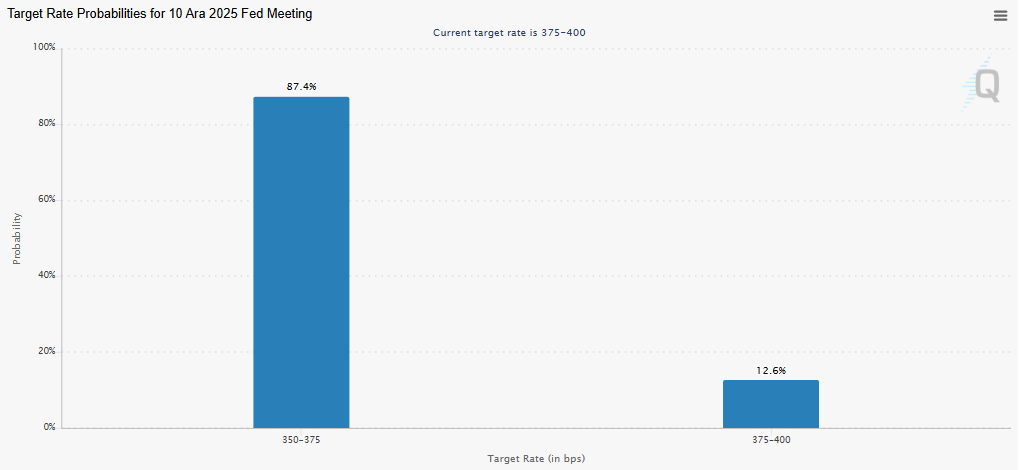

What Do CME FedWatch Data Say?

Data from the CME FedWatch Tool, one of the most closely followed indicators in the futures market, show that investor expectations are shaping as follows:

-

Probability of a 25-basis-point rate cut: 87.4%

-

Probability of rates being left unchanged: 12.6%

These figures indicate that a rate cut at the December meeting has almost become the “base case” for the markets.

*This content does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.