The long-debated four-year Bitcoin market cycle is once again under scrutiny. Changpeng Zhao (CZ), the founder of Binance, recently suggested that the traditional rise-and-fall pattern of Bitcoin may be losing its relevance. Speaking at the Bitcoin MENA conference in Dubai, CZ stated that the crypto market could be entering a prolonged “supercycle,” potentially extending through 2026. According to his outlook, this phase could represent a sustained growth period unlike anything seen in previous cycles.

The End of the Traditional Four-Year Cycle?

For years, Bitcoin’s price movements have been closely associated with its halving events, forming a predictable four-year rhythm. However, CZ believes that this framework may no longer accurately reflect today’s market dynamics. He emphasized that crypto is no longer driven solely by supply shocks and retail speculation. Instead, global politics, monetary policy decisions, and institutional behavior are now playing a dominant role. These evolving factors could support a longer and structurally different expansion phase.

U.S. Politics, Federal Reserve Policy, and Institutional Demand

CZ attributes the potential supercycle to three major forces: regulatory and political developments in the United States, a possible shift toward monetary easing by the Federal Reserve, and the accelerating involvement of institutional investors. If interest rates decline and liquidity conditions improve, risk assets—including cryptocurrencies—could experience stronger capital inflows. At the same time, growing participation from large financial institutions may bring deeper liquidity and reinforce long-term market stability.

Bitcoin’s Immediate Market Response

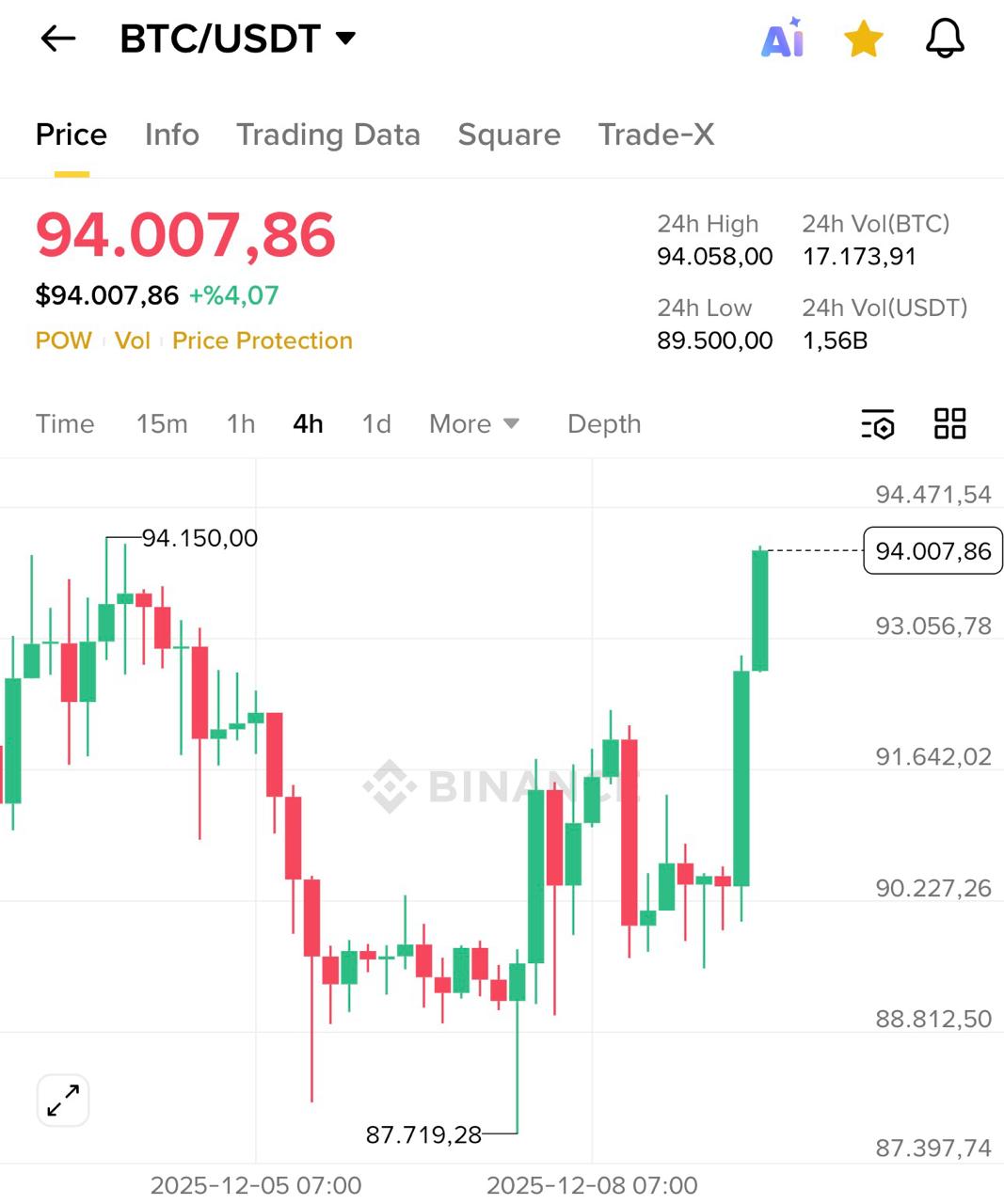

Following CZ’s remarks at the conference, the market reacted swiftly. Bitcoin experienced strong buying pressure in a short time frame, climbing toward the 94,000-dollar range. This surge reflected a clear shift in investor sentiment, with renewed optimism spreading rapidly across the market. The price action demonstrated how influential high-profile statements can be in shaping short-term momentum and broader psychological trends within the crypto ecosystem.

What Should Investors Take from This Outlook?

The supercycle narrative highlighted by CZ suggests that the crypto market may be moving beyond short-term speculative cycles into a deeper structural growth phase. However, this does not imply that volatility will disappear. On the contrary, sharp corrections and rapid price swings are still likely within a broader upward trend. If such a prolonged cycle materializes, it could reshape long-term investment strategies and redefine how market participants approach risk in the digital asset space.

*This content does not constitute investment advice.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for the kind of news.