Hyperliquid has rapidly emerged as one of the most closely watched projects in the crypto market, drawing attention not only for its technical architecture but also for the growing level of institutional interest surrounding the ecosystem. Recent developments tied to a proposed HYPE-focused exchange-traded fund (ETF) have further intensified market discussions, positioning Hyperliquid at the center of conversations around the future of decentralized derivatives.

As decentralized finance continues to mature, platforms capable of meeting institutional standards for performance, transparency, and reliability are gaining strategic importance. Hyperliquid appears to be aligning itself precisely with this shift.

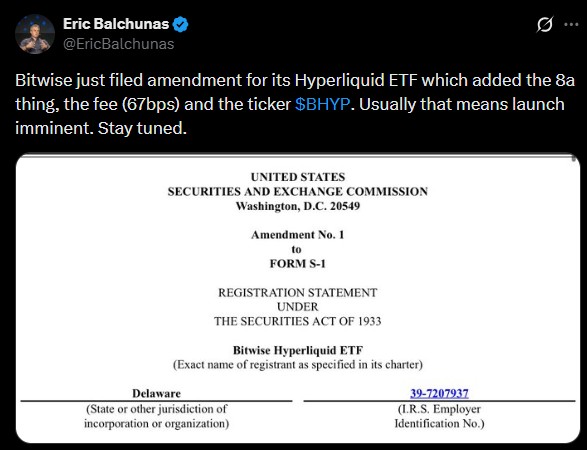

Bitwise Advances HYPE ETF Filing

Asset management firm Bitwise has taken a notable step forward in its Hyperliquid-related ETF initiative. The latest amendment to the filing includes the addition of an 8-A registration, the disclosure of a 67 basis point annual management fee, and confirmation that the product will trade under the ticker symbol $BHYP.

Within traditional financial markets, such procedural updates are commonly interpreted as signals that a fund is approaching its final pre-launch phase. While an official approval date has not yet been announced, the structure and completeness of the filing suggest that the process is moving into its later stages.

This development underscores a broader trend: institutional investors are expanding their exposure beyond spot crypto products and increasingly exploring infrastructure-level and derivatives-focused opportunities within the DeFi landscape.

What Is Hyperliquid?

Hyperliquid is a purpose-built Layer-1 blockchain designed specifically for on-chain perpetual futures and spot trading. Unlike many decentralized exchanges that rely on automated market makers, Hyperliquid operates with a fully on-chain order book, delivering a trading experience closer to that of centralized platforms.

At the core of the system is HyperCore, a high-performance matching engine capable of processing approximately 200,000 orders per second. This engine is paired with HyperBFT, a proprietary consensus mechanism that enables single-block finality, allowing for fast and deterministic transaction settlement.

All trades on Hyperliquid are executed on-chain, ensuring transparency and verifiability. The platform uses USDC as collateral and supports spot trading alongside more than 100 perpetual contracts, covering a wide range of digital assets.

A New Model for Decentralized Derivatives

Hyperliquid also introduces specialized instruments known as hyperps, which are designed to reduce susceptibility to price manipulation through a more resilient pricing framework. This approach aims to preserve market integrity while maintaining deep liquidity and low latency.

Taken together, Hyperliquid represents a next-generation attempt to merge centralized exchange performance with decentralized infrastructure. The progress of the HYPE ETF narrative suggests that this vision is increasingly resonating beyond native crypto users and into the realm of traditional finance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.