When institutional Bitcoin accumulation is discussed, few names carry as much weight as Michael Saylor and Strategy. Over several years, the company has executed one of the most aggressive corporate Bitcoin accumulation strategies in history. As Strategy’s holdings continue to grow, market observers increasingly view its position as extremely difficult for any other public company to replicate.

Bitcoin entrepreneur Anthony Pompliano has emphasized that while it may be theoretically possible for another firm to reach similar levels, the practical barriers are substantial.

How Large Is Strategy’s Bitcoin Position?

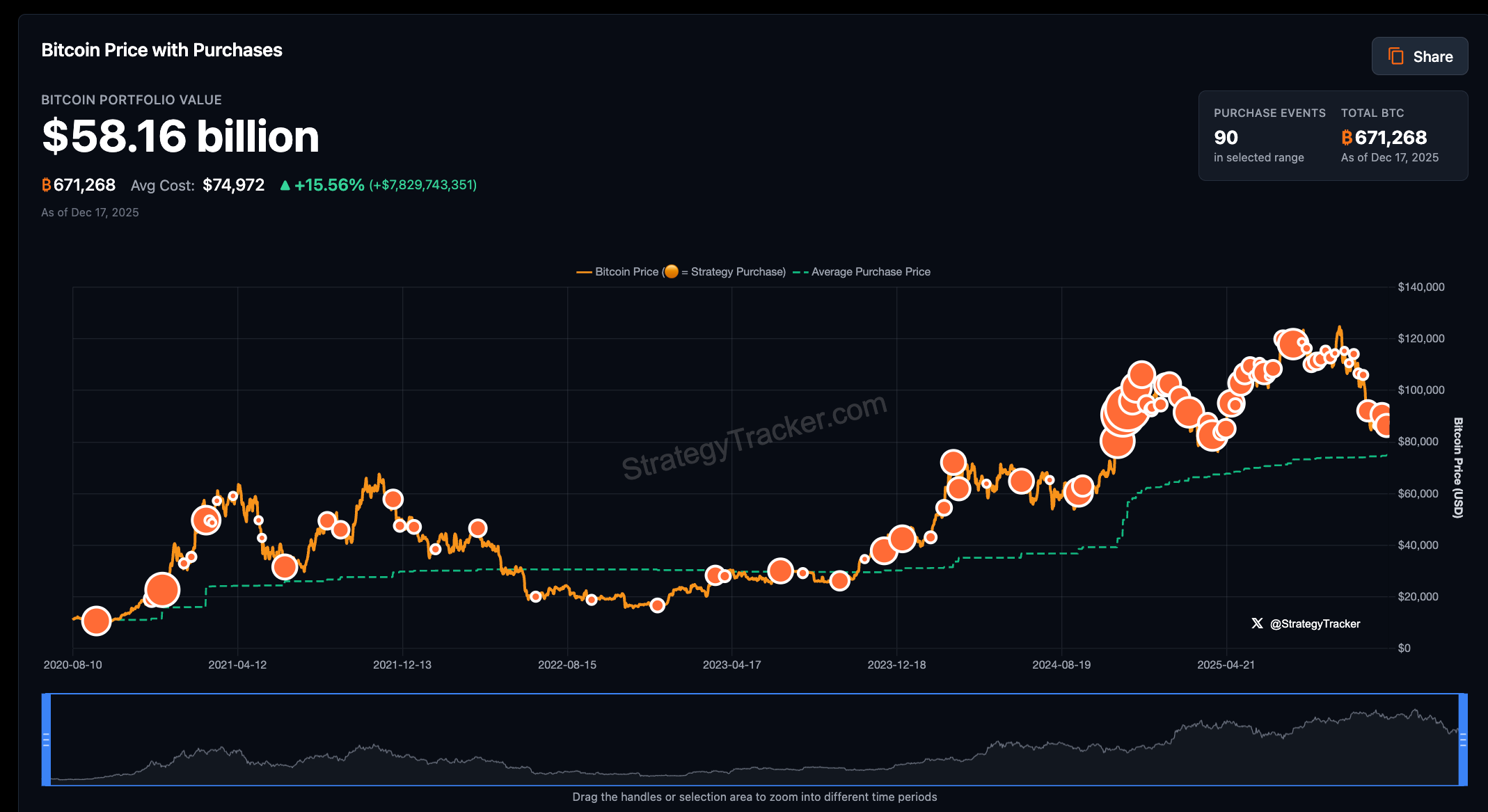

Strategy currently holds 671,268 BTC, representing approximately 3.2% of Bitcoin’s fixed 21 million supply. At current market prices, this position is valued at roughly $58.6 billion, placing the company among the largest Bitcoin holders globally.

The accumulation strategy remains active. Most recently, Strategy purchased 10,645 BTC for $980.3 million, paying an average price of $92,098 per Bitcoin. These continued acquisitions reinforce the company’s long-term conviction rather than signaling any shift toward profit-taking.

Pompliano has described this scale as both significant and, in theory, reachable. However, he also stresses that replicating it would require financial resources far beyond what most public companies can realistically access.

Early Bitcoin Purchases Changed the Equation

One of Strategy’s key advantages lies in timing. In 2020, the company made its first major Bitcoin investment, allocating approximately $500 million when Bitcoin was trading between $9,000 and $10,000. That single purchase alone is now valued at more than $4.8 billion.

According to Pompliano, any company attempting to match Strategy today would need either hundreds of billions of dollars in capital or an exceptionally profitable business capable of generating massive free cash flow on a sustained basis.

Market Impact Concerns and Long-Term Commitment

As Strategy’s Bitcoin share has grown, concerns have emerged regarding potential market influence. Critics worry that such a concentrated position could affect price dynamics under certain conditions.

However, these concerns have been tempered by statements from company leadership. Strategy CEO Phong Lee has publicly stated that the firm does not expect to sell any Bitcoin before at least 2065. Meanwhile, Michael Saylor has repeatedly reinforced the company’s long-term accumulation mindset.

Additionally, Strategy conducts large purchases through over-the-counter (OTC) desks, reducing direct impact on spot market prices.

Overall, Strategy’s Bitcoin strategy is widely viewed as a long-term institutional bet on digital scarcity. As time passes, matching this position appears not only expensive, but increasingly impractical for most public companies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.