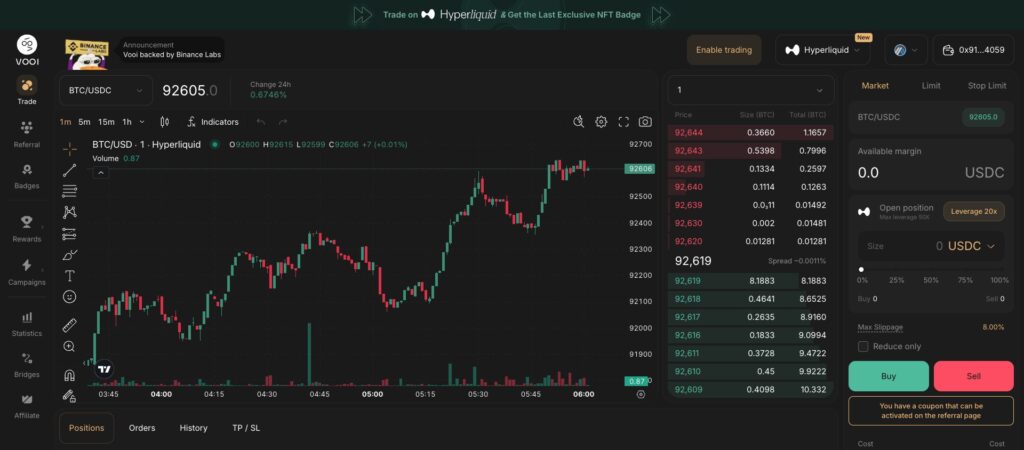

VOOI is a perpetual DEX aggregator designed to make leveraged trading in DeFi more accessible, cross-chain, and user-friendly. Supporting both EVM and non-EVM networks, VOOI unifies trading across multiple perpetual DEXs into a single interface. This removes the need for users to manage complex gas fees, bridges, or network switching. The platform is built around chain abstraction and account abstraction, allowing users to trade across all supported networks using a single unified balance.

Team and Founders

The is developed by a team with deep expertise in DeFi infrastructure and blockchain systems.

-

Will K (CEO): Responsible for vision, strategy, and long-term growth

-

Aleksei Svetlovskii (CPO): Leads product development and user experience

Founded in 2023, the team has rapidly scaled the platform and reached meaningful on-chain trading volumes in a short period.

Project Vision and Problem Statement

Leveraged trading in DeFi remains complex for most users. Fragmented liquidity, multiple networks, gas costs, and bridging requirements significantly reduce usability. VOOI addresses this by aggregating multiple perpetual DEXs into a single execution layer.

Users are not locked into one chain or one DEX. Instead, VOOI routes trades to the venue offering the best price, liquidity, and execution quality. This architecture delivers operational efficiency, particularly for active and professional traders.

How Works?

VOOI operates purely as an aggregator and does not provide its own liquidity.

-

The user connects to the VOOI interface

-

The desired asset and position type are selected

-

VOOI scans integrated perpetual DEXs for optimal execution

-

The trade is executed on the selected DEX via the user’s wallet

-

Assets and private keys always remain under user control

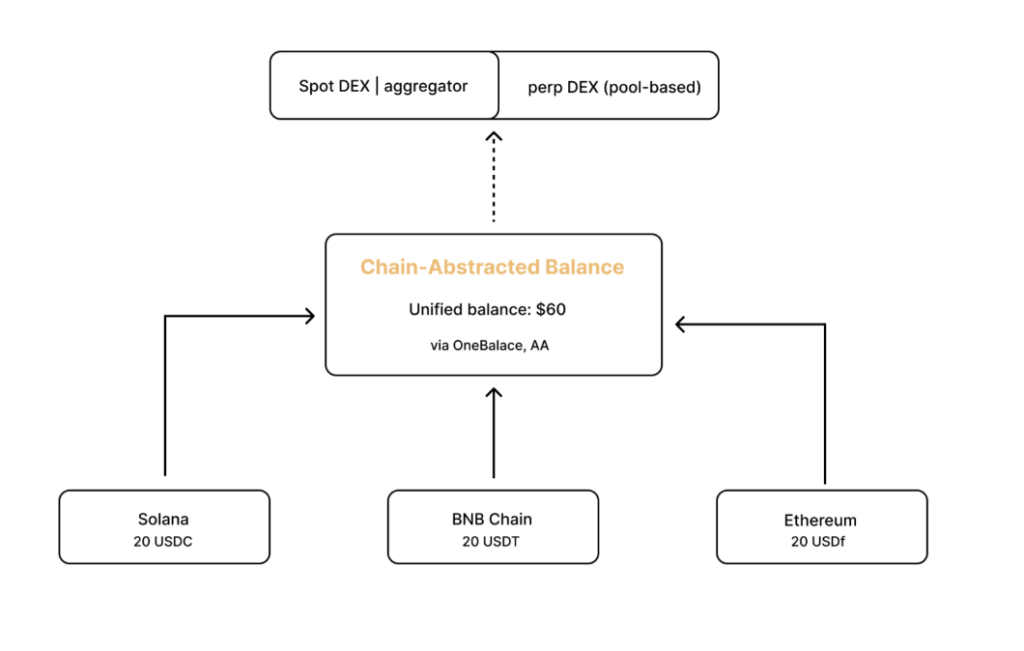

With VOOI Light, this flow is further simplified through the Chain Abstracted Balance (CAB). Users can trade without seeing gas payments, bridges, or network selections.

VOOI Light vs VOOI Pro

The ecosystem consists of two complementary products.

VOOI Pro, formerly the Unified Trading Terminal, targets advanced users who require granular control, advanced order types, and detailed position management.

VOOI Light focuses on simplicity. Through chain abstraction:

-

A single cross-chain balance is used

-

Trades are effectively gasless

-

Network complexity is fully abstracted

This makes VOOI Light suitable for both newcomers and users seeking fast, frictionless execution.

Governance Model

Token holders can vote on:

-

Protocol parameters

-

New DEX integrations

-

Incentive and reward mechanisms

-

Potential token buyback decisions

This structure supports long-term community-driven development.

Roadmap

VOOI’s development is structured into three main phases.

Phase 1 – 2024 Q2

Launch of the Unified Trading Terminal and initial integrations, including Orderly, KiloEx, SynFutures, and Hyperliquid.

Phase 2 – 2025 Q1–Q2

Launch of VOOI Light, implementation of chain abstraction, and release of the AI trading copilot. VOOI Light entered beta in July 2025.

Phase 3 – 2025 Q3–Q4

Introduction of VOOI Ultra, advanced automation, smart order routing, and AI-driven trading agents, with a strong focus on active traders.

Token Utility

The VOOI token plays a central role in the ecosystem.

-

Governance participation

-

Trading fee discounts

-

Incentive and reward programs

-

Yield boost mechanisms

-

Early access to new features

The token is not a direct revenue-sharing asset but is tightly linked to platform activity and incentives.

Token Information

VOOI follows a fixed, non-inflationary token model.

-

Total supply: 1B

-

Max supply: 1B

-

Circulating supply: 244.21M

-

No future minting

-

Emissions released gradually via vesting schedules

This structure ensures long-term supply predictability and governance stability.

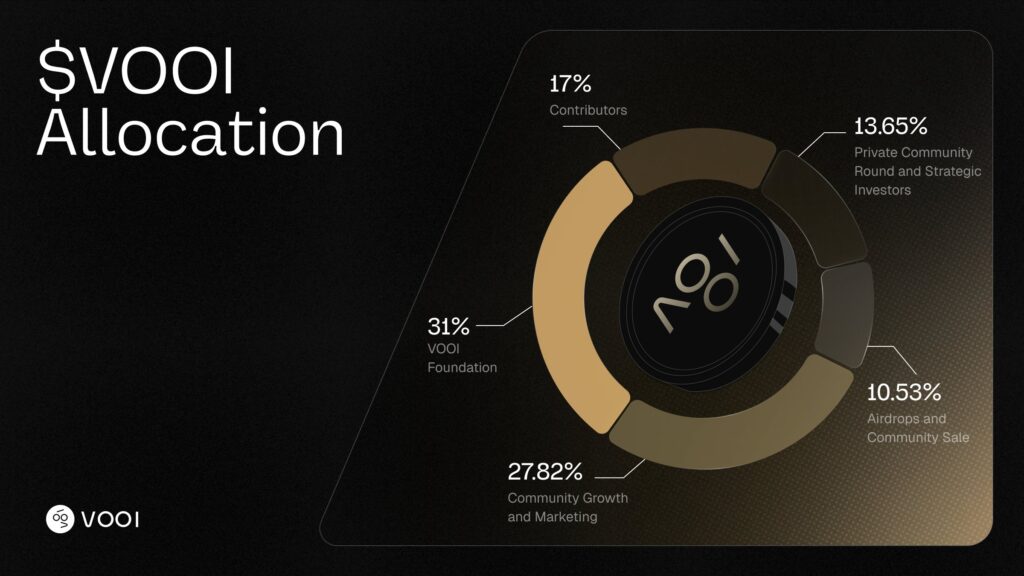

Token Distribution

-

Airdrop and community sale: 10.53%

-

Community growth and marketing: 27.82%

-

VOOI Foundation: 31%

-

Contributors: 17%

-

Private community round and strategic investors: 13.65%

The distribution balances ecosystem growth with sustainable development.

Investors and Partnerships

-

Investors include YZi Labs (founded by former Binance Labs leadership), ConsenSys, and ZK Accelerator

-

Total funding exceeds $1.25 million across ICO and strategic rounds

Key integrations and partners include Orderly Network, Hyperliquid, SynFutures, KiloEx, OneBalance, and Privy.

Ecosystem and Key Features

-

Pro for advanced trading workflows

-

Light for simplified, mobile-friendly trading

-

Telegram Mini App with gamified onboarding and points

-

Multi-asset roadmap covering crypto, equities, forex, and commodities

-

AI Copilot for market insights and strategy assistance

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.