The potential impact of quantum computing on cryptocurrencies has been discussed for years, but the conversation is gaining renewed urgency. This time, the warning comes from a data-driven Bitcoin investment firm. According to Charles Edwards, founder of Capriole Investments, Bitcoin could face an extreme downside scenario if the network is not made resistant to quantum computing within the next few years. Edwards argues that failure to implement quantum-safe upgrades by 2028 could push Bitcoin’s price well below the $50,000 level.

Rather than focusing on immediate technical attacks, this scenario centers on how markets respond to perceived technological vulnerability.

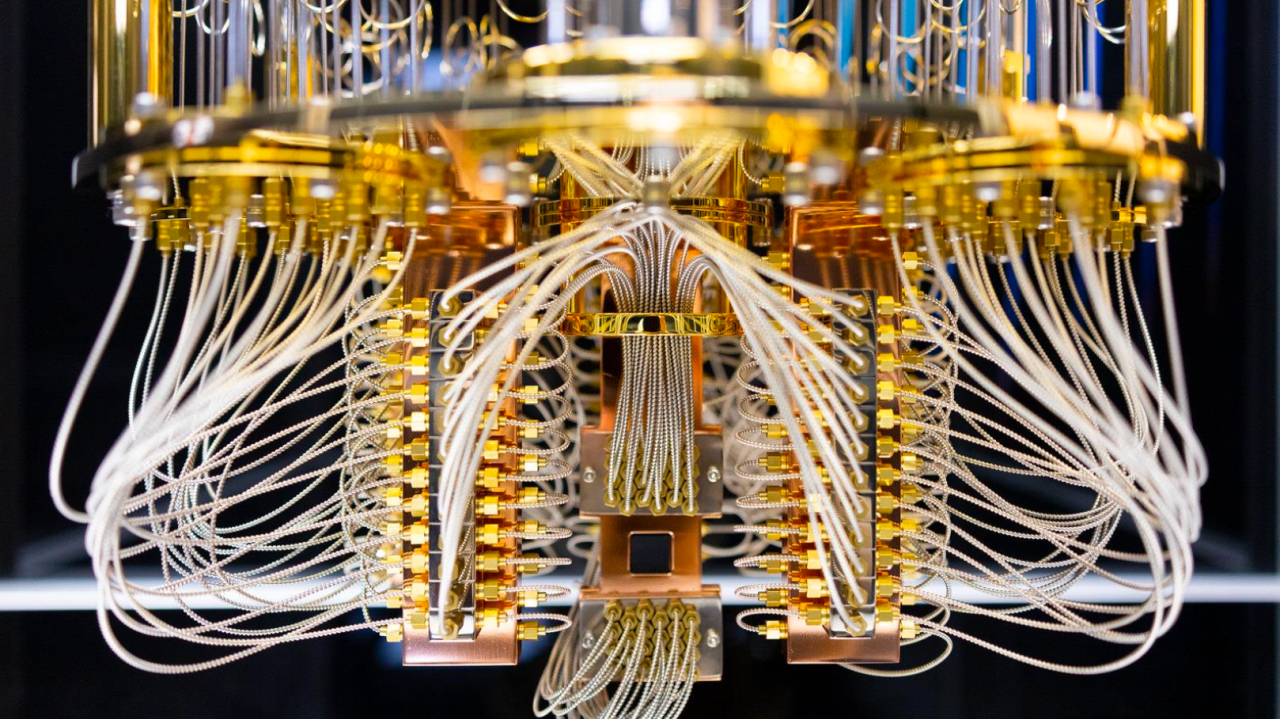

Why Quantum Computing Is Seen as a Real Risk

Quantum computers are theoretically capable of breaking the cryptographic standards currently securing blockchain networks. If such capabilities were realized, private keys could be compromised, wallets could be accessed without authorization, and on-chain assets would face unprecedented risks.

Although quantum machines with this level of power are not yet operational at scale, investment in the technology is accelerating rapidly. Edwards emphasizes that the primary danger lies in market perception. Even without an actual breach, growing concern that Bitcoin is unprepared for quantum threats could undermine confidence and trigger aggressive selling pressure.

A Narrow Window for Action

Edwards believes the timeline is critical. In his view, Bitcoin should adopt quantum-resistant solutions no later than 2026. If the transition is delayed and uncertainty persists into 2028, markets may conclude that the network has fallen behind irreversibly.

Under such conditions, Edwards describes a potential downturn as the most severe bear market in Bitcoin’s history—one that could eclipse previous crises in both scale and duration. This assessment stands in contrast to more optimistic views within the industry.

Divided Opinions Across the Crypto Sector

Not all experts share this level of concern. Some argue that practical quantum threats remain decades away, giving blockchain networks ample time to adapt. Others point out that major financial institutions are already experimenting with post-quantum cryptography, suggesting a gradual and manageable transition.

Within the Bitcoin community itself, opinions remain split. Analyst Willy Woo has suggested that SegWit-based wallets may offer relatively safer long-term storage as an interim measure. Meanwhile, MicroStrategy chairman Michael Saylor has dismissed quantum fears as largely overstated and driven by narrative rather than near-term reality.

Technology, Timing, and Market Psychology

The quantum debate highlights that Bitcoin’s risks are not purely economic. Technological readiness, upgrade timing, and investor perception all play a crucial role in price dynamics. Even if a technical solution eventually emerges, delays or uncertainty could prove costly. The coming years may represent a defining period in determining whether Bitcoin can stay ahead of the next technological curve.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.