Binance has reached over 300 million registered users since its 2017 launch. The platform’s growth is driven by deep liquidity, a variety of stablecoins, robust infrastructure, and regulatory compliance. This success highlights the exchange’s ability to maintain stability even during volatile periods.

Liquidity and Market Structure

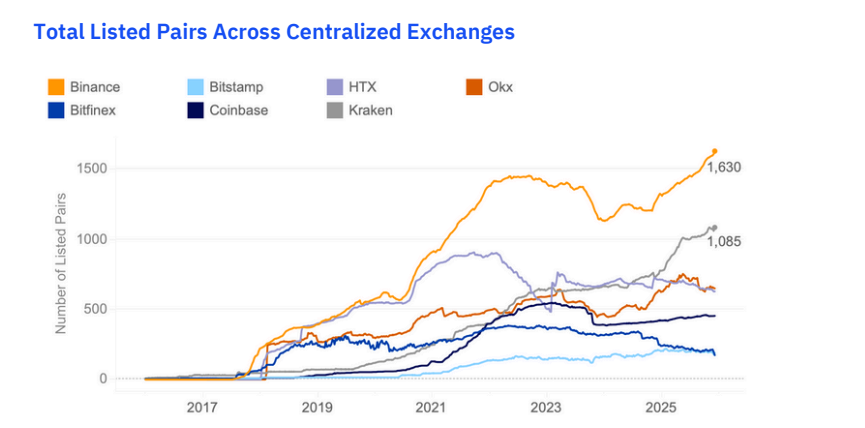

From the start, Binance offered low entry barriers and deep order books for global users. Professional market makers and the expansion of derivative products strengthened liquidity cycles, keeping spreads narrow even in volatile periods. According to Kaiko research, spot and perpetual markets grew simultaneously in 2019-2020, facilitating hedging and reducing execution costs.

Cross-venue spreads, such as Binance’s BTC-USDT versus Coinbase’s BTC-USD, are generally within a basis point under normal conditions. Price gaps now close within seconds. Efficient arbitrage, combined with Binance’s matching engine performance, data distribution, and settlement infrastructure, keeps execution costs low.

BTC accounts for roughly 28.6% of trading volume, ETH 22%, with SOL and other large-cap assets contributing to rotation. Long-tail assets remain active, sustaining tight spreads on certain pairs. Spread stability and predictable depth indicate market maturity.

Infrastructure Resilience

During the 2020-2021 bull run, Binance’s infrastructure faced a significant test. Despite higher volumes and directional moves, spreads on key pairs like BTC-USDT and ETH-USDT remained minimal.

In October 2025, daily spot volume exceeded $60 billion, with intraday swings around 20%. Spreads widened slightly but order books continued to function and replenish. Execution strategies using small, frequent trades remained effective, demonstrating a resilient market structure.

Fast trade matching, robust data distribution, and clear communication allowed market makers to quote confidently. Listing standards and transparent rules encouraged institutional participation.

Stablecoin Diversity

While USDT remains dominant, FDUSD and USDC usage increased during 2024-2025. This diversification reduces issuer-specific risk while maintaining liquidity. Users can execute strategies uninterrupted thanks to faster recovery and stable market depth during sudden market moves.

Trading Activity and Efficiency

As of December 1, 2025, Binance processed 61.9 million trades with $20 billion in spot volume. Coinbase and OKX recorded $3.6 billion and $3 billion, respectively. Smaller average trade sizes reflect a broad retail base and algorithmic strategies. High activity narrowed cross-exchange price gaps, enabling low-cost price discovery for users.

Over a 100-day period from November 2 to December 1, BTC dropped 21.77%, yet daily average spot volume was $19.8 billion, totaling $613.5 billion. Spreads remained tight, and depth recovered quickly, showing strong market making and arbitrage activity.

Binance’s success demonstrates that liquidity, regulatory clarity, stablecoin diversity, and resilient infrastructure together create a reliable trading environment. This stability also facilitates secure entry for institutional investors.

Corporate Licensing and ADGM

In December 2025, Binance obtained an Abu Dhabi Global Market (ADGM) license, active from January 5, 2026. Operating as three licensed entities—exchange, clearinghouse, and broker-dealer—positions Binance to attract institutional flow from MENA and Asia-Pacific regions while strengthening its credibility in Europe. Dual licensing deepens liquidity, tightens spreads, and supports the platform’s growth toward 300 million users.

Binance’s growth shows that combining liquidity, regulatory clarity, stablecoin variety, and robust infrastructure creates a secure trading ecosystem. Continuous market activity, tight spreads, and predictable execution provide a sustainable advantage and reinforce institutional trust.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.