Realio Network (RIO) is a Layer-1 multi-chain Web3 ecosystem designed to facilitate the issuance and management of digitally tokenized real-world assets (RWAs) in a decentralized manner. The platform enables real estate, private equity, and other RWAs to be accessible, investable, and tradable on the blockchain.

Realio also operates as an end-to-end blockchain-based SaaS platform, streamlining the issuance, investment, and lifecycle management of digital securities and cryptoassets. The platform integrates a fully on-chain decentralized P2P exchange with issuance and investment features. Realio is hybrid-compatible with both Cosmos SDK and Ethereum Virtual Machine (EVM), ensuring compliance and seamless asset tokenization.

Founders

-

Derek Boirun (CEO): Experienced in real estate and blockchain, leading the platform’s strategy.

-

Aaron Gooch: Finance and technical infrastructure expert.

-

Eduardo Romeiro: Technology and software development contributor.

-

Marcelo Moyano: Software developer with blockchain experience.

Project Idea

Realio Network bridges traditional finance with digital assets, enabling fast, transparent, and decentralized investment in tokenized physical assets such as real estate, art, and commodities.

Investors & Partnerships

-

Algorand: Core technology partner

-

Valentus Capital Management: Strategic partner for corporate asset tokenization

-

tZERO ATS: RST token listing in the U.S.

-

HTX Global support

-

Diamond Hands AF, LLC (registered funding portal)

The platform integrates with third-party websites and applications to enhance tokenization and P2P trading infrastructure.

How It Works

-

Tokenization: Converts assets securely into digital tokens

-

Staking Mechanism: $RIO, $RST, and $DSTRX secure the network and reward users

-

P2P Exchange: Peer-to-peer trading without intermediaries

-

Permissioned Smart Contracts: Only authorized parties can access private transactions (e.g., real estate)

-

SaaS Model: Cloud-based access reduces costs and simplifies usage

-

Multistaking: Stake tokens across multiple chains for higher returns

-

Consensus: Proof-of-Stake-like mechanism ensures network security and compliance

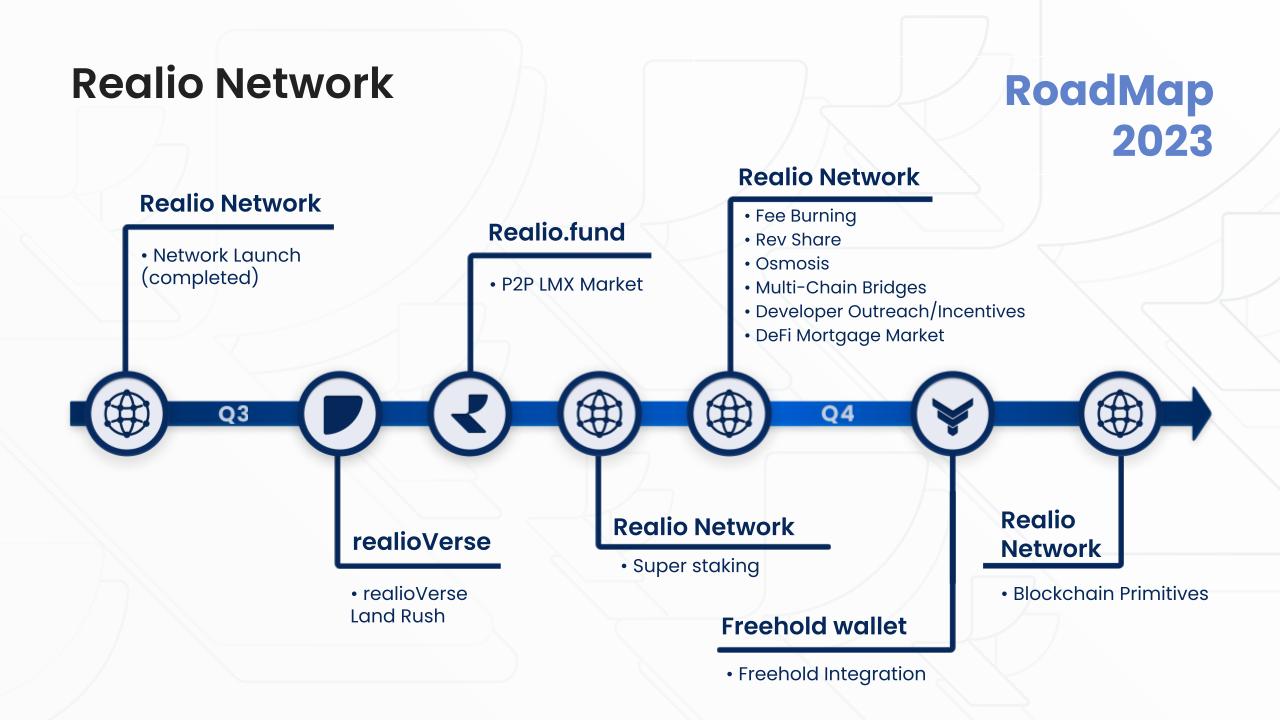

Roadmap

-

August 2020: Multistaking launch

-

March 2025: Block explorer upgrade

-

May 2025: Telegram launch; infrastructure upgrades

-

April 2025: Districts LandRush

-

October 2025: Freehold Web launch; $DSTRX staking integration

-

December 2025: Infrastructure maintenance

-

2026 Plans: Freehold Mobile staking, WalletConnect integration, RWA Tokenization Studio

-

Future Goals: Expansion to EVM-compatible chains and more RWA integration

Token Use Cases

$RIO

-

Pay gas fees and staking rewards

-

Governance voting

-

Multistaking across multiple chains

-

Burn $RIO to become a Market Maker

-

Participate in RWA tokenization and trading

-

Required for events like Districts LandRush

$RST: Security token representing company shares for investment and ownership

$DSTRX: Staking and reward token within the Districts ecosystem

Token Information

-

Token Name: RIO

-

Network: Initially ERC-20 (Ethereum), with multi-chain support planned

-

Total Supply: 150.5M RIO

-

Max Supply: 175M RIO

-

Circulating Supply: 150.5M RIO

RIO Distribution:

-

Block & Market Maker Rewards: 92.9%

-

Initial Airdrop: 7.1%

Ecosystem

-

Realio Network: Layer-1 blockchain

-

Realio Fund: Portal for digital asset investments

-

RealioVerse: Real estate-themed metaverse connected to physical world

-

Freehold Wallet: Multi-chain, non-custodial wallet

-

Tokenization Studio: Tools to tokenize user-owned real-world assets

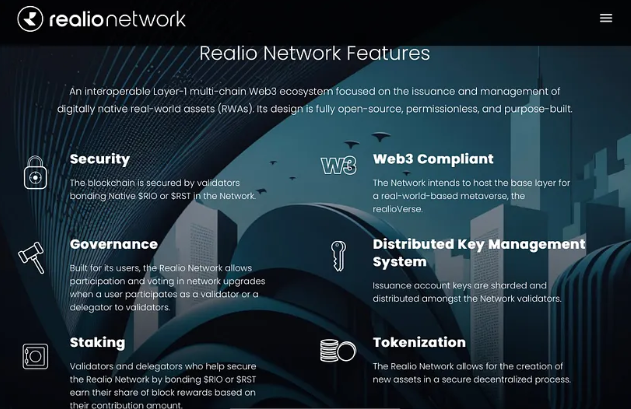

Key Features

-

Security: $RIO and $RST staked by validators protect the network

-

Governance: Users vote as validators or delegators

-

Staking: Earn block rewards based on stake

-

Web3 Compatibility: Foundation for realioVerse metaverse

-

Distributed Key Management: Asset keys sharded and distributed across validators

-

Tokenization: Assets created securely and decentralized

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.