Recent price declines in the crypto market are now noticeably affecting not just retail investors but institutional players as well. On-chain analytics platform Glassnode reported that ongoing net outflows from Bitcoin (BTC) and Ethereum (ETH) ETFs over the past weeks indicate that institutional sentiment has shifted from a bullish outlook to a more cautious, bearish stance.

ETF Outflows Highlight Weak Institutional Participation

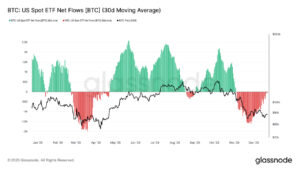

According to Glassnode, negative fund flows in Bitcoin and Ethereum ETFs have persisted for weeks. This trend shows that institutional investors’ appetite for the market has weakened, and they are adopting a more cautious approach to risk. Since ETFs are considered one of the clearest indicators of institutional capital movement, these outflows are closely monitored as a signal of overall market sentiment.

Analysts note that the negative trend in ETFs reflects both lower participation and partial withdrawals by institutions, highlighting ongoing liquidity constraints in the crypto market. Reduced liquidity can decrease trading volumes and make short-term price fluctuations sharper and more volatile.

Market Implications

Glassnode emphasizes that the continued outflows from BTC and ETH ETFs signal a shift to a lower-volume, more cautious market phase. As ETFs reflect institutional perspectives most directly, this trend is an important indicator of general sentiment. Weaker institutional capital inflows reduce market depth and trading volume, while lower liquidity increases the potential for sharper short-term price swings. This suggests that investors are entering a period where risk management takes on heightened importance.

“Institutional Sentiment Has Turned from Bullish to Bearish”

Glassnode notes:

“Ongoing negative flows in Bitcoin and Ethereum ETFs indicate weakening institutional participation and a shift to a lower-volume market phase.”

Analysts point out that the 2025 rally was largely fueled by institutional capital entering via ETFs. The current reversal of these flows indicates that institutional sentiment is moving from bullish to more cautious, bearish territory, suggesting that short-term downward pressure could persist.

Bearish Signal or Temporary Correction?

While the debate continues over whether institutional selling signals the start of a lasting bear market or a temporary correction, Glassnode takes a more balanced view for the long-term. Despite short-term low liquidity, weak risk appetite, and bearish institutional tendencies, large investors have not entirely abandoned their long-term positions.

Other analysts argue that ETF outflows may reflect seasonal dynamics rather than a permanent shift in investor confidence. Pre-holiday risk reduction, reduced liquidity during the festive season, portfolio rebalancing, and seasonal profit-taking are all likely contributing factors to the current trends.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates