BlackRock, the world’s largest asset manager and a key reference point for global markets, has released its expectations regarding the U.S. Federal Reserve’s interest rate trajectory for 2026. According to the firm’s latest assessment, the Fed is unlikely to pursue an aggressive easing cycle, instead favoring a cautious and data-dependent approach as monetary conditions gradually normalize.

Where Does the Current Rate Cycle Stand?

In an analysis led by BlackRock strategists Amanda Lynam and Dominique Bly, it is highlighted that the Federal Reserve has already delivered a cumulative 175 basis points of rate cuts in the current easing cycle. As a result, the policy rate is now approaching levels considered neither stimulative nor restrictive for the broader economy.

The strategists emphasize that unless there is a clear and sustained deterioration in labor market conditions, the Fed lacks a compelling justification to implement sharp additional rate cuts in 2026. This perspective reinforces the likelihood of a “wait-and-see” stance, with policymakers closely monitoring economic data before taking further action.

Market Expectations Remain Restrained

BlackRock’s outlook broadly aligns with prevailing market pricing. According to derivatives-based expectations, investors are currently anticipating only two rate cuts throughout 2026. This cautious pricing reflects a broader consensus that inflation is relatively contained while employment conditions remain resilient.

As long as inflation pressures do not reaccelerate and labor markets maintain stability, market participants appear comfortable with the notion that the Fed will avoid an overly accommodative policy stance.

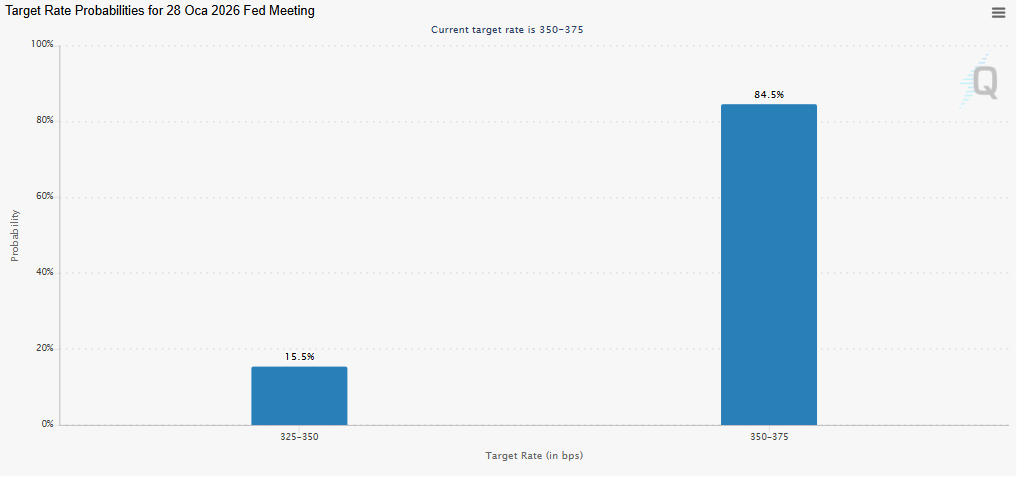

According to FedWatch Tool data, markets are assigning an 84.5% probability to the policy rate remaining in the 350–375 basis point range, while a 15.5% probability is priced in for a potential cut to the 325–350 basis point range. This distribution indicates that expectations for near-term aggressive easing remain limited.

A Different Tone From the Political Front

In contrast, voices close to former President Donald Trump present a more optimistic growth narrative. Some argue that the U.S. economy could sustain growth near the 3% level, creating room for continued monetary easing. This view assumes that strong economic expansion can persist without reigniting inflationary pressures.

The “Non-Inflationary Growth” Argument

Joe Lavorgna, an advisor to U.S. Treasury Secretary Scott Bessent, describes the current environment as one of “non-inflationary growth.” According to Lavorgna, deregulation efforts and growth-oriented policies have encouraged capital investment and strengthened supply-side dynamics. A more robust supply capacity, he argues, can support ongoing economic expansion while simultaneously easing inflation concerns.

What This Means Going Forward

Taken together, BlackRock’s assessment suggests that 2026 may be characterized by limited and measured rate adjustments rather than a broad-based easing cycle. For investors, this reinforces the importance of aligning expectations with a higher-for-longer interest rate environment, where policy flexibility remains constrained by economic fundamentals.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.