Ellipsis Finance is a decentralized exchange (DEX) on BNB Chain (formerly Binance Smart Chain) that enables low-slippage, low-fee stablecoin swaps. It is an authorized fork of Curve Finance on Ethereum.

Overview

Ellipsis is an Automated Market Maker (AMM) designed for highly efficient swaps between pegged assets such as USDT, USDC, BUSD, or BTC derivatives like hBTC and renBTC. By bringing Curve Finance’s StableSwap algorithm to BNB Chain, the platform minimizes price deviations even in large-volume trades.

Team and Founders

The project maintains a decentralized structure, so details on the team are limited. However, it is known to be supported by experienced BNB Chain developers and inspired by Curve Finance.

- Founders: Not publicly disclosed, experienced DeFi and BNB Chain teams

- Advisors/Partners: Strategic partnerships with BNB Chain projects and liquidity providers

Project Idea and Vision

Ellipsis uses the StableSwap algorithm to enable highly efficient swaps between pegged assets. Users can trade, stake assets for yield, or provide liquidity to earn fees. The platform ensures liquidity remains consistently high through EPX incentives.

Investors and Key Partners

Curve Finance is the main supporter, providing technical support and governance guidance. Close ties with Binance ecosystem strengthen Ellipsis as a leading DEX on BNB Chain.

How It Works

-

StableSwap Algorithm: Optimized for closely valued assets rather than classical AMM formula ($x · y = k$).

-

Liquidity Provision: Users deposit tokens into pools to earn LP tokens and fees.

-

Low Slippage: Algorithm ensures near 1:1 price stability for stablecoins.

-

V2 Upgrade: EPS tokens replaced with EPX in 2022, introducing bribe and governance mechanics.

Benefits for Other Projects

Ellipsis allows projects to create deep liquidity pools. Example: the USDD pool achieved $50M liquidity in the first week with EPX and USDD rewards. Projects can lock EPX to redirect emissions, encouraging more stablecoin deposits, easier trading, and a flywheel effect for governance and rewards.

Ellipsis also supports derivative token pools like ANKR’s aBNBb<>BNB or dotdot.finance’s dEPX<>EPX. Partnerships such as with Valas.finance enhance capital efficiency and ecosystem synergy.

Governance

Governance uses veEPX (vote-escrowed EPX):

-

Decide which pools receive more EPX rewards (Gauge votes)

-

Vote on protocol parameters

-

Receive a share of protocol revenue

Roadmap

-

Expand to crypto-to-crypto pools

-

Fully decentralized governance

-

Potential expansion beyond BNB Chain

EPX Token Uses

-

Liquidity Mining: Incentives for LPs

-

Staking & Locking: Obtain veEPX

-

Fee Discounts: Access protocol benefits

-

Voting Power: Influence protocol decisions

Token Information

-

Total Supply: 723.7M EPS

-

Max Supply: 1B EPS

-

Circulating Supply: 723.7M EPS

Distribution

-

Liquidity Providers: Majority, distributed long-term

-

veCRV Holders: Initial airdrop to Curve holders

-

Team & Development: Small allocation

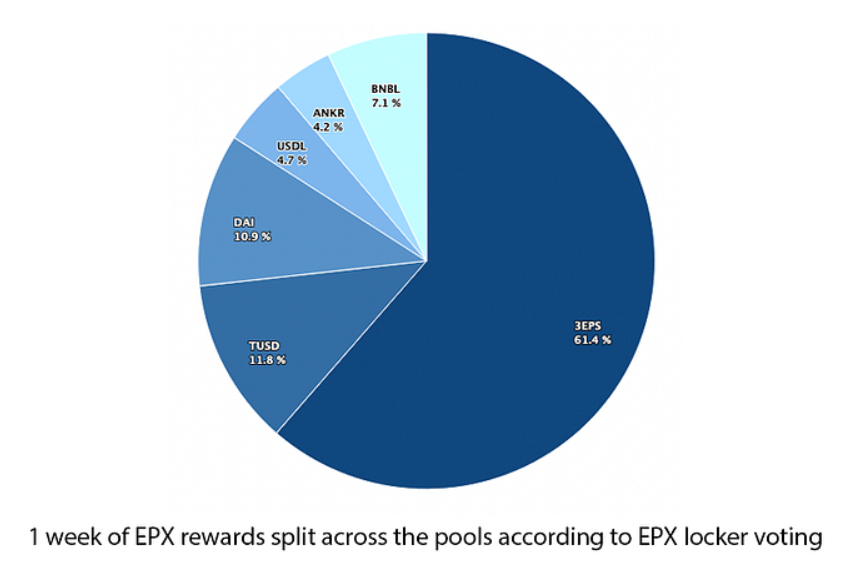

Weekly EPX Rewards Distribution

-

3EPS Pool: 61.4%

-

TUSD Pool: 11.8%

-

DAI Pool: 10.9%

-

BNBL Pool: 7.1%

-

USDL Pool: 4.7%

-

ANKR Pool: 4.2%

Gauge Voting: veEPX holders vote weekly on reward allocation. 55% of total supply is scheduled for LP incentives over 5 years.

Ecosystem and Features

-

Preferred by professional traders for high-volume stablecoin swaps

-

Bribe system allows projects to boost pool rewards

-

Built on Curve codebase, audited and secure

-

High capital efficiency: small liquidity, large trades

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.