Recent sharp volatility and price movements in the cryptocurrency market have become a closely watched topic, especially for Bitcoin investors. On-chain analytics firm CryptoQuant emphasizes that these movements should not be viewed merely as a short-term correction, but rather as part of a deep structural realignment process within the market. The company warns that investors should remain cautious during this period and carefully analyze on-chain data, noting that this phase reflects a broader rebalancing across price and momentum indicators rather than a temporary cooldown.

Bitcoin BCMI Index Is Declining

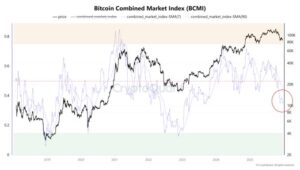

According to an assessment dated December 24, 2025, Bitcoin’s on-chain indicator, the BCMI (Bitcoin Cycle Momentum Indicator), has been steadily declining. While the index has fallen below its equilibrium level, it remains above historical bottom zones. This suggests that the market is not experiencing a brief pullback, but is instead undergoing a deeper structural reset reflected through both price action and on-chain momentum indicators.

CryptoQuant analysts note that in past cycles (2019 and 2023), market bottoms formed when BCMI values dropped into the 0.25–0.35 range. Since current levels remain above this band, a lasting bottom has likely not yet formed. Analysts therefore stress that the current movement should not be viewed as a simple correction, but potentially as a transition toward a bear market. If historical patterns repeat, a strong and sustainable long-term bottom would only emerge once BCMI approaches its previous lows.

Investor Warning: Proceed with Caution

CryptoQuant states that the market is still in a downward transition phase and that it is too early to say the structural reset has been completed. This highlights the need for investors to remain cautious in the face of short-term volatility and to closely monitor on-chain data.

According to experts, Bitcoin’s current outlook presents both short-term risks and long-term opportunities. Clearer direction is expected to emerge once more decisive signals appear in on-chain indicators. Therefore, investors are advised to shape their strategies by analyzing both price movements and on-chain metrics.

Assessment

Bitcoin and the broader crypto market are currently undergoing a structural reset phase. The steady decline in the Bitcoin Cycle Momentum Indicator (BCMI) points to an increased risk of a bear market, while simultaneously signaling potential long-term opportunities for investors. Analysts emphasize that closely monitoring on-chain indicators and adopting cautious, disciplined, and long-term strategies is critical during this period. This approach can help market participants manage risks effectively while positioning themselves to capitalize on future opportunities.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.