While 2025 has been a highly volatile year for cryptocurrency markets, Ethereum (ETH) has recently fallen short of investor expectations. Macroeconomic uncertainty, expectations around interest rate cuts, and geopolitical risks have driven a significant shift in investment preferences. During this period, gold has posted strong gains, while Ethereum and Bitcoin have struggled to hold key technical levels.

Why Has Gold Outperformed Cryptocurrencies?

Throughout 2025, gold has reestablished its role as a safe-haven asset. Rising geopolitical tensions and central banks moving closer to interest rate cuts have pushed investors away from riskier assets and toward gold. This dynamic has supported a steady rise in gold prices. By contrast, cryptocurrencies such as Bitcoin and Ethereum have exhibited higher volatility over the same period. In Ethereum’s case, slowing institutional inflows and a weakening narrative have made it difficult for prices to gain upward momentum. This divergence has been clearly reflected in investor behavior.

Polymarket Data Reveals Investor Sentiment

Data from the popular prediction market Polymarket clearly highlights the shift in investor expectations. A large majority of participants believe that gold will reach $5,000 before Ethereum does. Based on current pricing, the probability of gold hitting $5,000 is estimated at around 71%. Gold is currently trading at approximately $4,480 per ounce, placing it relatively close to the target. In contrast, Ethereum continues to trade below $3,000. For ETH to reach $5,000, it would need to rally by roughly 70% from current levels.

Factors Behind Ethereum’s Loss of Momentum

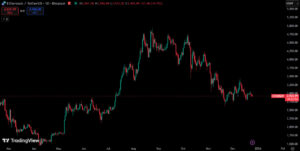

Ethereum experienced a strong rally during the summer of 2025, driven by increased inflows into spot Ethereum ETFs and growing interest in digital asset–based products. During this period, ETH approached the $5,000 level, fueling expectations of a sustained uptrend. However, this momentum proved short-lived. Weakening institutional demand, fading market narratives, and declining overall risk appetite led to a pullback in Ethereum’s price. Since then, buying pressure has noticeably weakened, and ETH has entered a downward trajectory.

The Growing Divergence Between Gold and Ethereum

The gap between gold’s strong performance and Ethereum’s relative weakness continues to widen. While indicators suggest further upside potential for gold, Ethereum appears to be struggling to find a strong short-term catalyst. This environment is prompting investors to adopt more cautious portfolio allocations.

“In the current macroeconomic environment, investors are favoring safe-haven assets over volatile ones. Gold’s performance is the clearest reflection of this trend.”

Assessment

Despite strong expectations heading into 2025, Ethereum (ETH) has significantly underperformed gold. Polymarket data and price performance indicate that investors currently view gold as the more attractive short-term asset. For Ethereum to reenter a strong upward trend, both institutional interest and the market narrative will need to regain momentum. Otherwise, the divergence between gold and cryptocurrencies may persist for some time.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.