Critical signals that concern altcoin investors are becoming increasingly clear in the crypto market. As Bitcoin dominance regains strength, the Altcoin Season Index has dropped sharply, highlighting a market-wide risk-off trend. Many altcoins have lost key support levels, and weakening trading volumes reinforce this bearish outlook. Technical indicators and current market data suggest that the altcoin season could remain under pressure, and caution is advised in the short term.

Altcoin Season Index Hits Yearly Lows

The Altcoin Season Index, which measures altcoins’ performance against Bitcoin (BTC), fell to 15 this week, marking its lowest point of the year. This sharp decline signals reduced risk appetite across the market, with most altcoins under selling pressure. Rising Bitcoin dominance is driving capital away from altcoins, keeping many projects in the red.

According to CoinMarketCap data, over the past 90 days, only a few cryptocurrencies recorded positive performance. Pippin Token stood out with a gain exceeding 2,300%, while privacy-focused projects like Zcash, Dash, Monero, and Merlin Chain also posted relatively strong gains compared to the broader market.

On the other hand, major losses were observed for projects such as DoubleZero, Story, MYX Finance, Immutable, and Pudgy Penguins, each losing over 60%, reflecting the clear risk-off sentiment in the altcoin market.

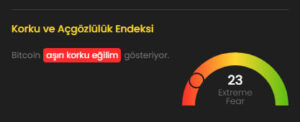

Fear Index and Reduced Leverage Amplify Pressure

The weak altcoin trend is further highlighted by the Crypto Fear & Greed Index, which dropped to 23, entering the “fear” zone. Open positions are also declining, indicating that investors continue to reduce leveraged trades. Since October 10, more than 1.6 million investors faced liquidations totaling around $20 billion. This has significantly reduced demand for altcoins, which are generally seen as riskier than Bitcoin. Analysts note:

“When Bitcoin declines, altcoins historically fall harder. The current situation suggests this cycle could repeat.”

Double Top Pattern Creates Risk for Altcoin Season

Three-day charts show that the total market cap of all coins excluding Bitcoin and Ethereum fell from $1.18 trillion in October to around $825 billion. This valuation, combined with a double top formation at $1.16 trillion and a neckline around $658 billion, increases the risk of a deeper drop.

Additionally, the total altcoin market cap has fallen below the 38.2% Fibonacci retracement level, as well as below the 50-day and 200-day exponential moving averages. The Relative Strength Index (RSI) and MACD indicators have trended downward in recent months, reinforcing that bears remain in control of the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.