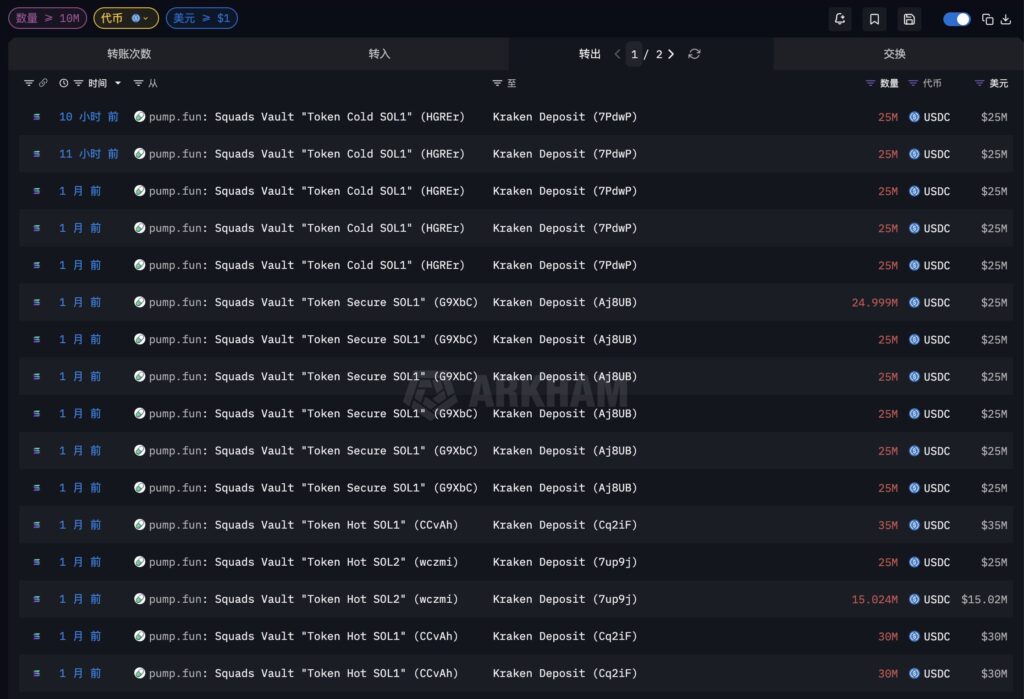

Stablecoin movements have returned to the spotlight as the year draws to a close. Altcoin project Pump.fun transferred another 50 million USDC from its ICO proceeds to the Kraken exchange. On-chain data shows that the total amount sent to Kraken over the past six weeks has reached 605 million USDC. During the same period, $PUMP has fallen roughly 55% below its ICO price, leaving investors at a numerical loss.

The transfer originated from wallets directly linked to ICO revenues, making the timing particularly notable as year-end liquidity dynamics come into focus.

Accumulated Outflows From ICO Funds

Since November 15, Pump.fun has routed a total of 605 million USDC from ICO sales to Kraken. On-chain records indicate that this flow was not a one-off transaction, but rather a gradual and structured distribution.

In recent days, the team stated that no funds were withdrawn, explaining that ICO-generated USDC was distributed internally to be reinvested into company operations. However, subsequent on-chain activity painted a more complex technical picture.

Kraken Inflow Followed by Circle Transfer

Early this morning, 75 million USDC entered Kraken. Shortly afterward, 69.26 million USDC was transferred from Kraken to Circle, the issuer of USDC.

Such transactions are commonly interpreted by the market as USDC redemption or cash conversion preparation. While this does not directly indicate a token sale, the concentration of large stablecoin flows between an exchange and the issuer has drawn attention.

Pump.fun Cuts Supply with $131M PUMP Token Buyback

$PUMP Trades Below ICO Levels

Amid these fund movements, $PUMP’s price performance has resurfaced as a key discussion point. The project sold tokens to institutional investors in June at $0.004 per token. Current market data shows the price hovering around $0.0018.

This places $PUMP at approximately 55% below its ICO valuation. The price pressure coinciding with continued transfers of ICO funds to exchanges has weighed on short-term market expectations.

Why It Matters

Routing ICO funds to exchanges and then directly to the stablecoin issuer extends beyond routine treasury management. These flows directly affect investor sentiment, token supply perception, and timing risk. When such transfers occur while the token trades below its ICO price, market sensitivity tends to increase.

Going forward, new movements along the Kraken–Circle route will be closely monitored as key signals to determine whether Pump.fun’s strategy remains operational-focused or balance-sheet driven.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.