Spot ETFs based on XRP have reached $1 billion in investment volume despite recently starting trading. This indicates strong investor interest in the market. However, investors are somewhat disappointed that XRP’s price has not shown the expected increase, observing that price movements may occur gradually over time.

Rapid Rise in XRP ETFs

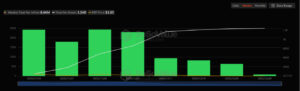

Launched in November, XRP ETFs attracted over $1 billion in net investment in a short time, according to SoSoValue data. Notably, there hasn’t been a single day of net outflow since the launch, demonstrating consistent and stable investor interest.

This strong performance far surpasses Solana ETFs, which only gathered $387 million during the same period. Meanwhile, Bitcoin ETFs saw $3.6 billion in net outflows, and Ethereum ETFs experienced $1.2 billion in outflows. This shows that capital flowing into XRP ETFs has displayed remarkable stability compared to the broader market.

Why Isn’t XRP Price Rising?

Despite this strong demand for ETFs, XRP’s price has struggled to recover after the roughly $1 trillion market loss in October. Jonathan Yark, a quantitative trader at Acheron Trading, notes that price dynamics may take time:

“We expect price behavior to resemble what we’ve seen in Bitcoin and Ethereum, but on a smaller scale. XRP has unique use cases such as payments and treasury flows. We are in a phase of real adoption in crypto ETFs, which naturally brings consolidation periods after rapid inflows.”

Institutional Investors and Steady Capital Inflows

The sustained capital inflow into XRP ETFs parallels growing institutional interest in the market. Vanguard attracted attention by launching spot crypto ETF trades in December, making it easier for traditional investors to access this asset class. Over the past two years, Wall Street giants such as BlackRock, Fidelity, and Franklin Templeton have also rolled out crypto ETF products. This development indicates that the market is evolving toward a more sustainable, long-term structure rather than short-term excitement.

Yark’s assessment of the XRP market:

“Flows will remain sensitive to short-term settlement and trading dynamics, but the overall trend is clearly positive.”