The latest meeting minutes from the US Federal Reserve (Fed) reveal a clear lack of consensus within the central bank regarding the future direction of monetary policy. While a majority of policymakers remain supportive of further rate cuts, several members favor maintaining current interest rate levels. This internal split creates an uncertain backdrop as markets move closer to 2026, affecting both traditional financial assets and the crypto market.

A Period of Fine-Tuning in Monetary Policy

Some Fed officials emphasized that decisions around interest rate cuts require careful calibration. According to the discussion, additional easing could be appropriate if inflation continues to decline in line with expectations. However, other members argued that following the most recent rate reduction in December, holding rates steady for a period would be a more prudent approach.

There was broader agreement that transitioning toward a more neutral policy stance could help prevent unnecessary strain in the labor market. Rather than aggressive easing, the Fed appears focused on balancing inflation control with economic stability.

The Fed Policy Path Heading Into 2026

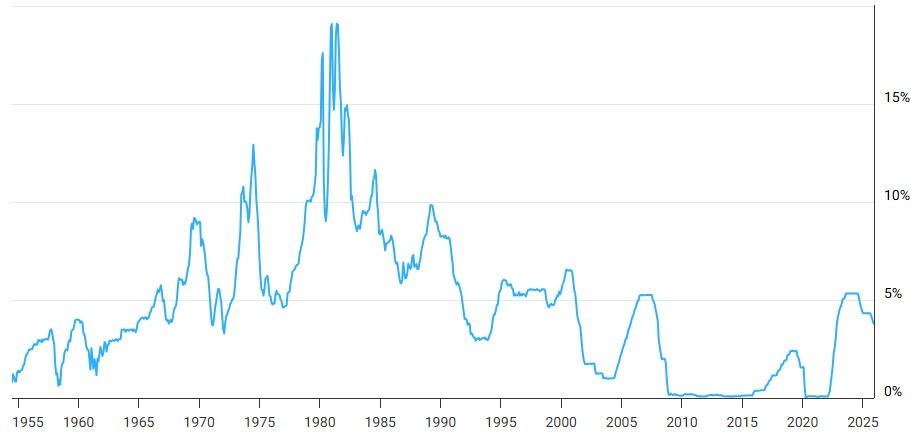

Throughout 2025, the Federal Reserve implemented three rate cuts, bringing the benchmark interest rate down to a range of 3.5% to 3.75%. Despite this, current projections indicate that only one additional rate cut may take place in 2026. If realized, this would keep interest rates near their highest levels seen since the global financial crisis.

The December 2025 dot plot highlighted the extent of division among policymakers. An equal number of officials projected zero, one, or two rate cuts, underscoring the uncertainty surrounding the policy outlook. Median forecasts suggest rates could settle around 3.4% by the end of 2026, reinforcing expectations of limited easing.

Possible Scenarios for 2026

Market participants expect the Fed to maintain a cautious tone in the early months of 2026. The likelihood of a rate cut at the January meeting is considered low, while expectations increase for potential action in March. Some analysts believe two cuts remain possible, particularly if labor market conditions soften further.

In a more optimistic scenario, declining inflation combined with rising unemployment could prompt the Fed to adopt a more accommodative stance. Such a shift would likely inject additional liquidity into markets, benefiting risk-oriented assets. Conversely, a resurgence in inflation could force policymakers to pause rate cuts altogether, potentially triggering sharp corrections across both equity and crypto markets.

What This Means for Bitcoin and Crypto

Lower interest rates typically encourage investors to move toward higher-risk assets as returns on bonds and cash instruments decline. As a result, the Fed’s decisions in 2026 will play a crucial role in shaping demand for Bitcoin and other digital assets. Although expectations for aggressive easing have moderated, changes in economic data or leadership at the Fed could still alter the policy trajectory, creating new opportunities for crypto markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.