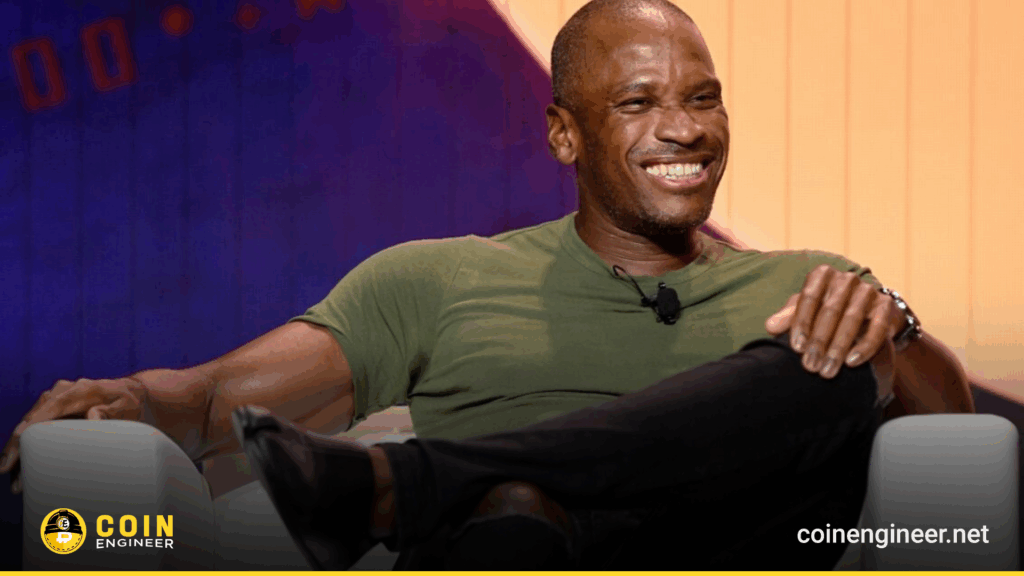

Arthur Hayes, the crypto market’s attention turns again as he shifts from Ethereum to DeFi. The BitMEX co-founder sold 1,871 ETH worth $5.53 million, reallocating the funds directly into DeFi tokens. The timing is notable, with ETH still struggling below $3,000, highlighting Hayes’ confidence in decentralized finance.

On-chain data shows Hayes not only sold ETH but also withdrew $2.52 million from exchanges, moving it into DeFi assets. This is not a sudden trade but a deliberate two-week repositioning. His move increases ETH selling pressure while signaling a strategic tilt toward undervalued DeFi opportunities.

DeFi Portfolio Highlights

PENDLE dominates Hayes’ DeFi holdings, making up nearly 49% of the allocation at $1.75 million. LDO and ENA holdings are valued around $1.3 million and $1.24 million, respectively, while ETHFI is a smaller but strategic component at $343k. This allocation shows a concentrated confidence in certain DeFi projects rather than a broad diversification.

Liquidity Over Price Drops

Despite recent declines in PENDLE, LDO, and ETHFI, Hayes focuses on macro liquidity trends rather than short-term price movements. He expects fiat liquidity improvements to disproportionately benefit DeFi tokens over large-cap layer-one assets like Ethereum, challenging traditional market assumptions.

ETH Pressure Mounts

Hayes’ repeated ETH sales, including previous moves to Binance, reinforce the ongoing selling pressure. While Ethereum remains foundational, high-profile exits like Hayes’ increase negative sentiment and highlight a growing preference for DeFi tokens.

Arthur Hayes’ DeFi bet signals a shift in market focus. ETH remains under pressure, while DeFi tokens could see underappreciated gains as liquidity flows in. The outcome remains uncertain, but this strategic reallocation offers a strong market signal.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.