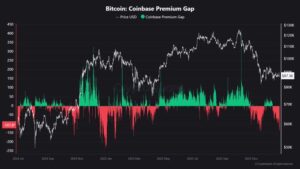

Coinbase Premium, a key indicator for measuring U.S.-based institutional demand for Bitcoin and cryptocurrencies, has recently turned notably negative. The gap between Bitcoin prices on Coinbase and major global exchanges has dropped to – $122, signaling a weakening risk appetite among U.S. investors.

Gap Narrows to -$12

Recent data shows Coinbase Premium at – $122, meaning Bitcoin on Coinbase is about $122 cheaper than on other major exchanges. Considering that last week this gap was around $50, this rapid expansion in the negative premium is significant. Experts note that such a sharp negative premium is usually observed during periods of heightened selling pressure in the U.S. market. It is especially known that Coinbase Premium quickly turns negative when institutional investors adopt a cautious stance.

Maartuun, a well-known analyst at on-chain data platform CryptoQuant, highlighted the severity of this drop:

“Coinbase Premium gap reached -$122. One of the lowest levels in the past 18 months. Such extreme discounts have only been seen 5 times this year.”

This suggests that the current situation reflects a deeper cautious stance rather than a routine market move.

What is Coinbase Premium and What Does It Indicate?

Coinbase Premium measures the difference between Bitcoin prices on the U.S.-based Coinbase exchange and major global exchanges like Binance. It is widely used to analyze institutional investor behavior.

- A positive premium indicates strong buying demand from the U.S.

- A negative premium signals increasing selling pressure or weakening demand.

Since Coinbase is heavily used by U.S. institutional investors, this metric is particularly important.

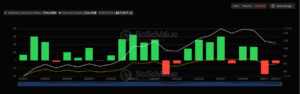

Bitcoin Spot ETF Outflows Align

The negative trend in Coinbase Premium coincides with outflows from Bitcoin spot ETFs. U.S.-listed Bitcoin spot ETFs have recorded net outflows in all of the last 30 trading days, totaling approximately $744.49 million. Given that spot ETFs are primarily favored by institutional investors, this indicates that large U.S. investors are currently adopting a risk-reducing strategy.

Assessment

The drop of Coinbase Premium to rare levels like – $122 signals a clear weakening in U.S.-based institutional demand. While not a definitive sell signal on its own, combined with Bitcoin spot ETF outflows, it suggests that major investors are taking a cautious stance at present. In the coming days, the movement of Coinbase Premium and ETF flows will continue to provide important signals for Bitcoin’s short-term direction.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.