Ethereum is seeing a new milestone in institutional adoption. Tom Lee-led Bitmine Immersion Technologies has locked billions of dollars worth of ETH through staking. On-chain data shows the company staked 119,000 ETH in a single transaction, bringing its total staked holdings to 460,000 ETH. At current prices, this amount exceeds $1 billion.

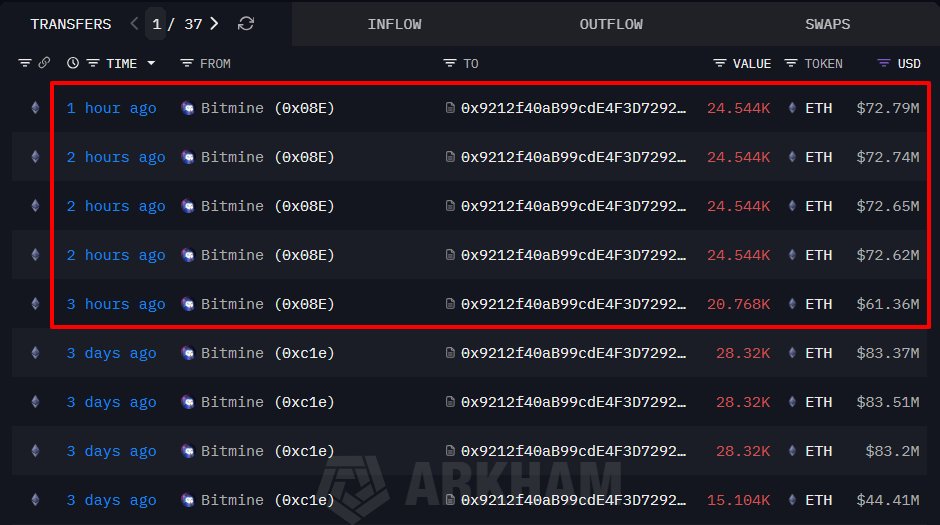

Bitmine preferred a gradual staking approach rather than a single large transaction. Recently, large ETH transfers to Bitmine-linked wallets were observed, some facilitated by institutional brokerage firms like FalconX. This move stands out as one of the largest corporate actions in Ethereum’s validator ecosystem and highlights the company’s long-term strategic commitment.

Institutional Investors Focus on Ethereum

According to Artemis data, Ethereum leads in net capital inflows among blockchains. Networks like Solana, Hyperliquid, and Sonic occasionally attract interest, but most alternative ecosystems are seeing net outflows. High liquidity, predictable staking returns, and robust infrastructure continue to make Ethereum a preferred choice for institutional investors.

Companies like Bitmine locking billions in ETH for the long term indicate that institutional accumulation remains strong, reinforcing Ethereum as a secure and predictable yield layer.

Staking and ETFs Create a Reinforcing Loop

Institutional interest in Ethereum goes beyond holding ETH reserves. BlackRock’s staking-backed Ethereum ETFs have introduced ETH to traditional finance as both a price exposure and yield-bearing investment vehicle.

This creates a reinforcing loop: more ETH is locked in staking, circulating supply decreases, and yields remain attractive. Institutional confidence strengthens, supporting long-term network security and staking growth.

Staking Queue Signals Market Sentiment

On-chain data shows Ethereum’s staking entrance queue has exceeded exit queue for the first time in six months. The entry queue holds roughly 745,619 ETH with a 13-day wait. Exits have steadily declined while new entrants surged.

Monad DeFi lead Abdul noted that the last time this happened in June, Ether’s price doubled shortly after. During Kiln’s organized validator exits in September, about 70% of unstaked ETH was absorbed by Bitmine, giving it control of roughly 3.4% of total supply.

The Ethereum Pectra upgrade made staking easier and allowed larger ETH amounts to be staked at once. Analysts also point out that rising DeFi borrowing costs and unwinding of positions may have influenced staking behavior.

Ultimately, Ethereum is moving beyond being just a smart contract platform, positioning itself as the settlement and yield layer of the crypto economy. Liquidity, security, and robust infrastructure continue to concentrate capital, and Bitmine’s long-term staking reinforces that institutional accumulation remains strong.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.