Bitcoin (BTC) closed 2025 with a loss, prompting investors to adopt a more cautious stance. Although strong rallies were seen at times throughout the year, global economic uncertainties, rising risk perception, and market volatility prevented these gains from becoming sustainable. As a result, Bitcoin ended a year in the red for the first time since 2022. This situation has shifted investors’ attention toward 2026. While it is debated whether the recent decline is temporary or part of a longer-term trend, regulatory developments, institutional interest, and potential changes in global monetary policies are expected to play a decisive role in shaping Bitcoin’s direction in 2026.

Why Did Bitcoin Close 2025 with a Loss?

Despite showing strong upward moves during the year, Bitcoin failed to maintain its momentum due to global macroeconomic pressures and declining risk appetite. Especially after October, waves of selling made a price recovery more difficult. According to recent data, Bitcoin ended the year down by more than 6%, trading around the $87,000 level.

In the early months of the year, crypto-friendly statements by U.S. President Donald Trump had triggered a strong rally in the market. During this period, Bitcoin surpassed $126,000, reaching a new all-time high. However, new tariffs announced in April and rising global trade tensions led to sharp sell-offs in both equities and the crypto market.

A Wave of Liquidations and Rising Volatility

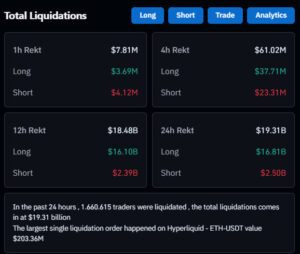

In October, new trade threats against China and statements regarding tariffs significantly increased risk perception in global markets. The cryptocurrency market was also sharply affected by these developments. Positions opened with high leverage were quickly liquidated amid rising volatility.

In a short period, liquidations in leveraged crypto trading exceeded $19 billion. This figure went down as one of the largest liquidation waves in the history of the cryptocurrency market. The intense liquidations created additional selling pressure on Bitcoin, pushing prices even lower and clearly revealing the fragility of the markets.

Is Bitcoin Now a Riskier Asset?

According to analysts, 2025 was a year in which Bitcoin increasingly behaved like a “risk asset.” The growing correlation with U.S. equities has strengthened this view.

XS.com senior market analyst Linh Tran commented on the issue as follows:

“The increasing interest of institutional investors in the crypto market has strengthened Bitcoin’s ties with traditional financial markets. In 2026, monetary policies and valuation pressures on technology stocks could make this relationship even more pronounced.”

In the past, Bitcoin was seen as an alternative investment that moved independently of stocks. However, rising institutional participation has increasingly weakened this separation.

Promising Scenarios for 2026

Although 2025 was challenging, expectations for 2026 are more optimistic. Crypto brokerage and research firm K33 points to strong catalysts for the coming year. According to the firm, the weak performance in 2025 was largely driven by temporary leverage imbalances.

K33 analysts argue that Bitcoin could outperform both equity indices and gold in 2026. They also note that current prices still appear undervalued relative to fundamental indicators. It is emphasized that the Trump administration’s support for crypto has not yet been fully priced in, and that accelerating integration between traditional finance and crypto could create a new area of growth for Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.