ADI (ADI) is a Layer-2 blockchain network designed for corporate and public sector use, secured by Ethereum, and fully regulation-compliant. ADI Chain offers transparent settlement, smart contract execution, and secure digital asset infrastructure, targeting governments, financial institutions, and large enterprises with practical on-chain solutions.

The network’s security is supported by OpenZeppelin standards, while the architecture is designed with regulation-focused, long-term enterprise adoption in mind.

ADI Chain Architecture

Built on zkSync’s Atlas and Airbender technologies, ADI Chain is a modular, high-performance, EVM-compatible zkRollup.

-

Transactions are executed off-chain

-

Verified using zero-knowledge (ZK) proofs

-

Final settlement occurs on Ethereum L1

This design ensures high throughput, low costs, and Ethereum-grade security.

Vision and Mission

ADI Foundation aims to bring 1 billion people in developing countries on-chain by 2030.

The project addresses structural challenges:

-

Unbanked populations

-

Lack of digital identity

-

Transparency gaps in public services

-

Inefficiencies in cross-border payments

Regulation speed and local adoption will determine how effectively this scale is realized.

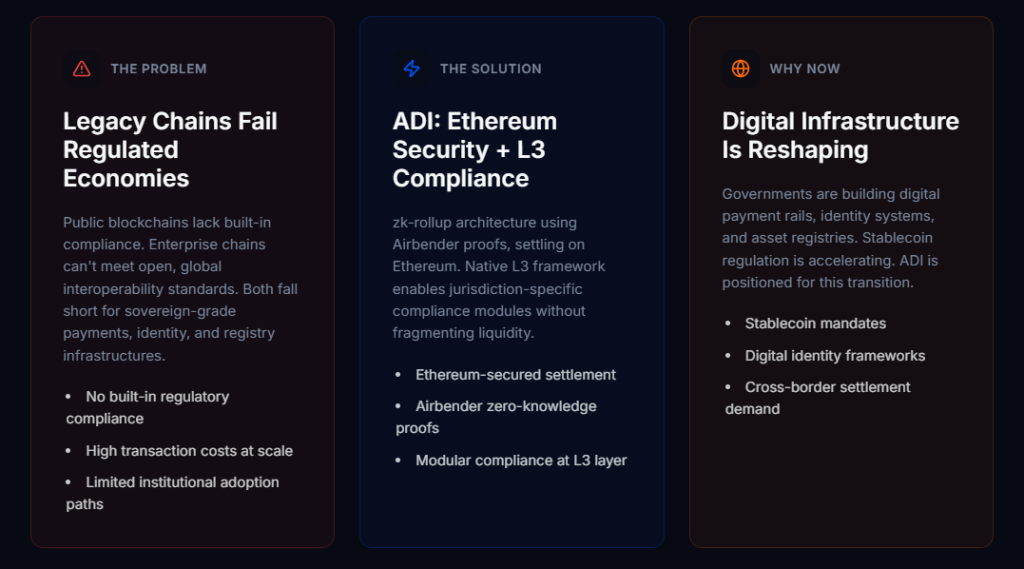

Core Concept

ADI Chain integrates innovation and regulation into the same framework, making blockchain practically usable for governments and enterprises. Unlike conventional chains, compliance is not an add-on but a core network design principle.

Focus areas include:

-

Stablecoins and real-world asset tokenization

-

Payments, digital identity, public records

-

Healthcare, logistics

The long-term goal is a network of Ethereum-linked L3 chains for enterprises and governments, enabling cross-border value transfer.

How ADI Chain Works

ADI Chain uses a zkRollup architecture:

-

Transactions processed on L2

-

Batches created for efficiency

-

Cryptographic proofs generated per batch

-

Proofs submitted to Ethereum

-

State finalized after Ethereum verification

Benefits:

-

Invalid transactions never enter the chain

-

Security inherited from Ethereum

-

Transaction costs reduced by 90–95%

Layer-3 (L3) Compliance and Flexibility

Key differentiator: built-in regulation-compliant L3 chains.

Enterprises and governments can deploy custom L3s aligned with:

-

Their jurisdiction

-

Industry

-

Policies and regulations

Features:

-

Inherits L2 security

-

Interoperable with other L3s and mainnet

-

Configurable for FATF & ADGM Travel Rule compliance

ADI Token ($ADI)

$ADI is the utility token at the heart of ADI Chain, powering network operations and economic incentives. Unlike standard L2 tokens, $ADI functions as:

-

Gas Fee – Primary gas for all L2 & L3 transactions

-

Medium of Exchange – Facilitates settlement among users and enterprises

-

Staking & Yield – Can be staked in treasury-backed pools; no inflationary mint

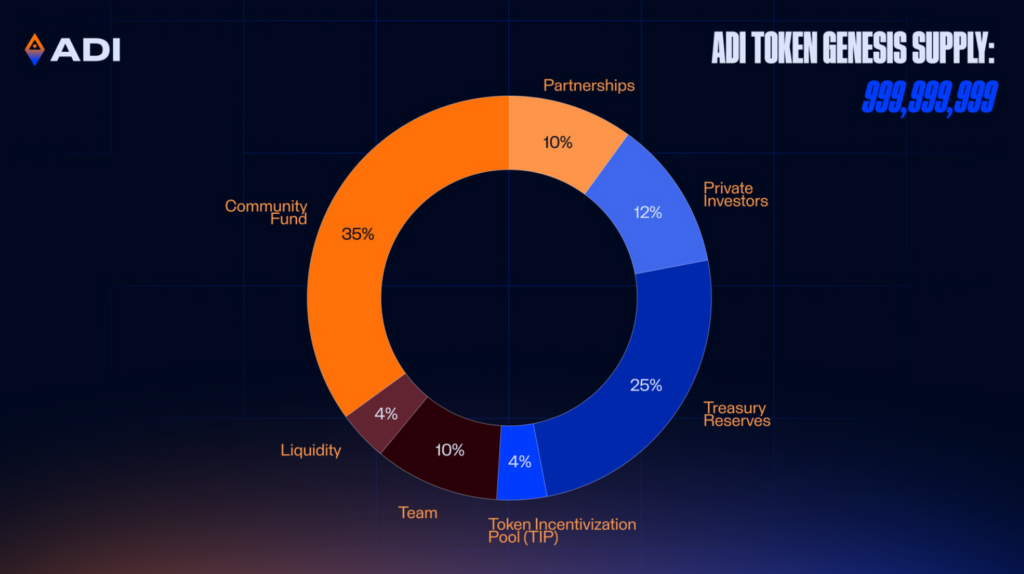

Token Details

-

Total Supply: 999.99M ADI

-

Max Supply: 999.99M ADI

-

Circulating Supply: 51.14M ADI

-

Gas Model: Custom Gas Token (zkStack)Distribution

-

Community Fund: 35%

-

Treasury Reserves: 25%

-

Private Investors: 12%

-

Partnerships: 10%

-

Team: 10%

-

Token Incentivization Pool: 4%

-

Liquidity: 4%

Unlock schedules are long-term with a 12-month cliff for team & investor tokens.

Governance

-

Token-based governance not active at launch

-

Governance framework defined, will activate after smart contract audits and ADGM registration

Team & Founders

-

Andrey Lazorenko – CEO

-

Mohammad Rajab – CMO

-

Herman Stohniiev – CTO

-

Anna Datsenko – COO

Experienced in blockchain infrastructure, enterprise software, and regulatory compliance.

Investors & Partnerships

-

Focused on Middle East enterprise collaborations

-

Planned dirham-backed regulated stablecoin

-

Partners: IHC, First Abu Dhabi Bank, ADQ

-

All stablecoin transactions use $ADI as gas

Key Features

-

Full Ethereum & EVM compatibility

-

L1-L2-L3 secure bridging

-

Hyperledger FireFly integration

-

REST API & middleware support for enterprises

-

Dedicated L3s for digital identity, healthcare, logistics, public records

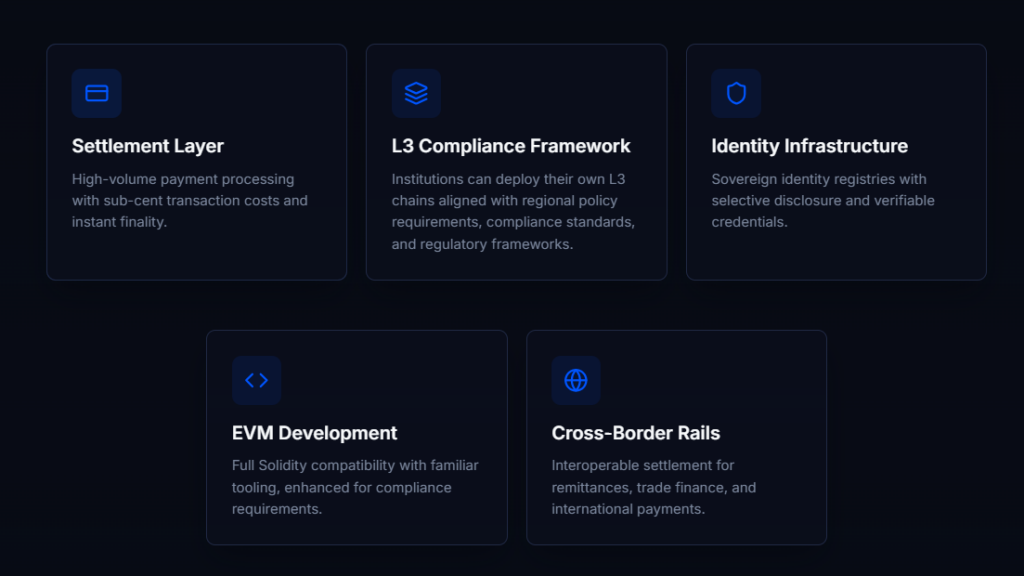

Ecosystem

-

Payment Layer: Sub-second, low-cost, high-volume settlements

-

L3 Compliance: Regulation & enterprise-specific L3 chains

-

Identity Infrastructure: Selective disclosure, verifiable digital identity

-

EVM Development: Solidity-compatible, compliance-focused smart contracts

-

Cross-Border Rails: Interoperable remittance & international payments

Roadmap

-

Past | Foundation: Core architecture built, testnet & block explorer live, developer documentation & zkSync Atlas integration completed

-

Present | Enablement: Mainnet live, $ADI launched, L3 modules active, pilot partnerships ongoing

-

Future | Deployment: Gas abstraction, first enterprise L3 chains, cross-chain bridges, global expansion in emerging markets

Overall Assessment

ADI Chain positions itself as a rare, “public yet adaptable” blockchain, merging Web3 and compliance without friction.

Success depends on:

-

Actual adoption by governments & enterprises

-

L3 chains going live

-

Stablecoin & public projects implementation

The true test will be whether the regulatory-first approach remains flexible and how fast L3s are deployed in practice.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.