Crypto markets are bracing for significant volatility today due to upcoming U.S. Supreme Court decisions and unemployment data releases. With the total crypto market capitalization hovering around $3.11 trillion, these critical developments could trigger heightened short-term volatility and sharp price fluctuations. Investors are closely watching for sudden moves across major cryptocurrencies such as Bitcoin and Ethereum, as well as the broader altcoin market. Analysts emphasize that news coming from the U.S. will have a direct impact on market sentiment, and that traders and portfolio managers should adjust their positions accordingly.

Supreme Court Ruling on Trump Tariffs

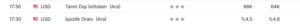

At 18:00 today, the U.S. Supreme Court is expected to announce whether the 10%–50% tariffs imposed by President Trump last April on certain goods are legally valid. Trump had labeled these tariffs as “Liberation Day” measures.

Experts and prediction markets currently estimate a 76% probability that the Court will rule the tariffs unlawful. If such a decision is made, the U.S. government may be required to refund a portion of the approximately $600 billion previously collected. This outcome could rapidly shift market sentiment, as tariffs are currently viewed as growth-supportive. A ruling against them could prompt increased caution among investors and lead to selling pressure in both equities and crypto assets.

U.S. Unemployment Data Could Move Markets

The second major catalyst is the release of U.S. unemployment data at 08:30 ET. Markets expect the unemployment rate to rise slightly from 4.5% to 4.6% compared to the previous month. This data will provide key insights into the health of the U.S. labor market and will directly influence investor sentiment and market expectations.

A higher unemployment rate could strengthen recession concerns and encourage a more risk-averse stance among investors. Conversely, a lower unemployment rate would signal economic strength and could reduce expectations for interest rate cuts. While the probability of a rate cut in January is currently high, strong labor data could eliminate these expectations entirely and trigger short-term volatility in the crypto market.

Bitcoin and Ethereum Options Expiry

In addition, the expiration of Bitcoin and Ethereum options may further amplify short-term price movements. According to Deribit data, more than $2.2 billion in options will expire today at 08:00 (UTC). Bitcoin accounts for approximately $1.89 billion of this total, with a maximum pain level near $90,000. BTC is currently trading around $90,975.

For Ethereum, roughly $396 million in options will expire, with a maximum pain level of $3,100. ETH is currently trading close to this level, around $3,117. As a result, the next 24 hours are expected to be critical for crypto investors. The heightened risk of volatility marks a period that both short-term traders and long-term portfolio managers should monitor closely.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.