Unitas Protocol is Unipay’s on-chain “dollar + yield” stack. It combines the USDu yield-bearing stablecoin with a delta-neutral JLP (Jupiter Liquidity Pool) arbitrage strategy. Operating on Solana and Binance Smart Chain, it allows users to access a stable and yield-generating dollar alternative without relying on traditional banks.

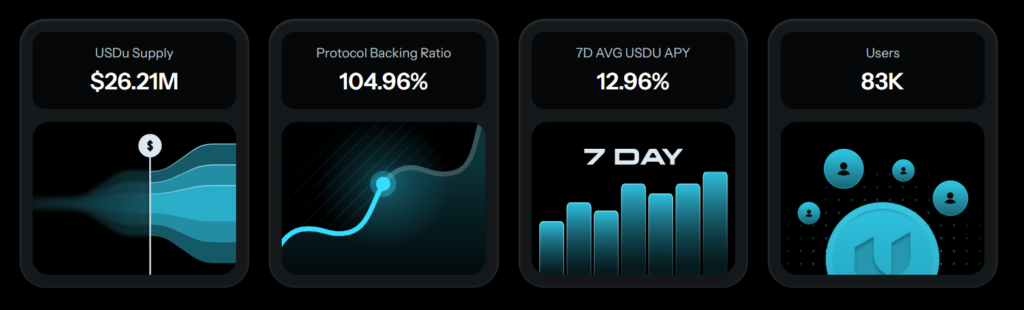

USDu is fully over-collateralized (104.92%) and hedged using a JLP long + perp short strategy to minimize price risk. TVL is around $25–26M, USDu supply ~26.21M$, and the protocol has 83K+ users. sUSDu offers a 7-day average APY of 12.96%. The Ethereum-focused foundation has pivoted; the Solana-based Labs version now emphasizes yield and stability.

Who is Behind Unitas?

The pivoted Unitas Labs enables a more agile development process.

-

Sun Huang: CTO & co-founder

-

Wayne Huang: Board Director & co-founder, also CEO of XREX

-

Jerry Li & Ethan Yang: Founding members

The team actively communicates via Discord and X, with Immunefi bounty programs, AccountableData, and HTDGTL proof of solvency ensuring transparency. Legacy concepts from the foundation are now reshaped under Labs.

Investors and Partnerships

With the Binance Wallet Booster campaign live today, all eyes are on the 30M UP rewards. Other notable partnerships include:

-

Jupiter Perps: Core of the delta-neutral strategy

-

Stablewatch: sUSDu listed with transparent TVL & APY tracking

-

Kamino / RateX: Additional yield via money market deployments

-

Orca: USDu/USDC swap and staking

-

AccountableData / HTDGTL: PoS / Proof of Reserves

-

Superteam Poland / Sanctum: Solana ecosystem references

-

LayerZero: Cross-chain USDu planning

-

XREX: Emerging market payments

-

Early-stage investors: Amber Group, Blockchain Builders Fund, Bixin Capital

The Concept

Unitas leverages local currencies as a “value translator.”

How it Works: Users deposit USDT; the protocol locks it and mints units pegged to local currencies (e.g., USD91).

Collateral: Always exogenously over-reserved, meaning each minted unit has more than $1 backing in USD.

Mechanics:

Unitas executes market-neutral arbitrage via JLP long + perp short. Protocol fees are zero (Solana gas only). Revenue comes 75% from JLP fee capture.

-

Revenue distribution: 80% to sUSDu holders, 10% to insurance fund, 10% treasury

-

sUSDu staking: Minted by staking USDu, auto-yield, 7-day cooldown

-

Risk management: Hourly re-hedge, circuit breaker, OES custody

-

Current APR: 7-day average 12.96% (yield independent of market direction, driven by trader activity)

-

User flow: USDu mint → sUSDu stake → 7-day cooldown → collateral redeem

The JLP pool, composed of SOL, ETH, BTC, and USDC, captures trader activity revenue through swap, trade execution, and liquidation fees. Perp shorts neutralize market risk, preserving USDu value while generating yield.

Token: UP

UP is a governance and utility token. Stakers earn rewards and protocol revenue shares.

-

Total Supply: 1B UP

-

Booster Campaign: 30M UP (~3%)

-

TGE & detailed distribution: Announced soon via Binance Wallet

-

Points / Rewards Program: Season 1 ongoing for holding, staking, and liquidity contributions

UP Token Use Cases

-

Governance: Voting on protocol decisions

-

Staking & Rewards: Earn sUP and long-term incentives

-

Protocol Fee Sharing: Revenue share when governance is active

Future Plans

-

JLP-backed USDu v1 (Solana) – Live (Q3 2025)

-

Cross-chain USDu (LayerZero) – Design (Q4 2025)

-

Unipay Card – Prototype (Q1 2026)

-

Permissionless Collateral Adapters – Research (2026)

Ecosystem & Products

-

Core Products:

-

USDu – DeFi stablecoin

-

sUSDu – Staking yield

-

JLP Pool – Jupiter perp liquidity provider

-

-

Coming Soon:

-

Unitas Card

-

Cross-chain support

-

USDu Delta-Neutral Mechanics & JLP Revenue

USDu invests in spot assets via JLP long positions while simultaneously opening perp short positions to neutralize price risk. Revenue from JLP fees and funding rates is distributed 75% to USDu and sUSDu holders. JLP’s basket of BTC, ETH, SOL, and USDC captures trader activity, ensuring the stablecoin maintains $1 value while generating sustainable yield.

Unitas (UP) Features

-

Solana-based yield-bearing stablecoin

-

USDu over-collateralized (~105%), delta-neutral hedged

-

sUSDu staking for auto-yield (~13% APY, historical 8–15%)

-

Revenue: JLP fees + funding rates

-

Distribution: 80% sUSDu holders, 10% insurance fund, 10% treasury

-

Extras: RateX/Kamino boosts, Orca swaps, Stablewatch tracking

-

Binance Booster: 30M UP rewards (~3% total supply), Alpha Points required, TGE & tasks phased via Binance

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.