Story Protocol (IP) has returned to the spotlight after recording a rapid price increase of roughly 30% in a short period. The sudden rally has attracted significant attention across the crypto market, prompting investors to question whether this move is driven by sustainable fundamentals or short-term market dynamics. While the price action may initially signal strong demand, a closer look at both technical factors and on-chain data suggests a more nuanced picture.

What Triggered the Rally in Story Protocol (IP)?

The primary catalyst behind IP’s recent surge was a network upgrade implemented on the protocol. Historically, such upgrades tend to fuel optimism around a project’s future roadmap, often leading to speculative buying in the short term. However, this price movement was not solely driven by fundamentals or development progress.

Derivatives market data played a key role. Funding rates had been hovering in negative territory, indicating that a large portion of traders were positioned for downside. When price unexpectedly moved higher, these short positions were forced to close, creating a short squeeze. This dynamic significantly amplified the upside momentum and accelerated the rally.

On-Chain Activity Tells a Different Story

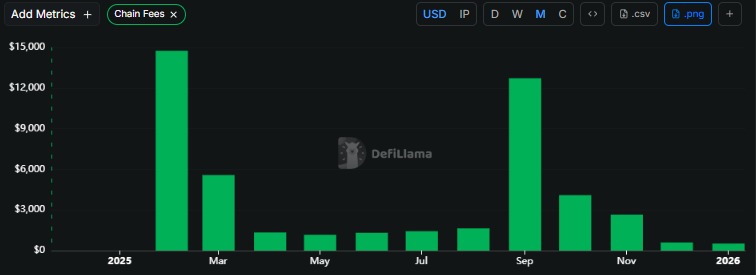

Despite the strong price performance, Story Protocol’s on-chain economic activity remains relatively muted. Recent fee generation figures highlight the gap between valuation and actual network usage:

-

January (to date): $520 in fees

-

December: $600

-

November: $2.6K

-

October: $4K

-

September: $12.7K

When compared against a market capitalization of approximately $1.37 billion and a fully diluted valuation near $4 billion, these figures underscore a notable mismatch. The data suggests that current valuations are being driven more by expectations than by present-day adoption or revenue generation.

Momentum vs. Fundamentals

The latest rally in IP appears to be largely momentum-driven, supported by technical catalysts and derivatives market mechanics rather than organic demand on the network itself. While such conditions can sustain price action in the short term, they often prove fragile without a corresponding increase in real usage.

For medium- to long-term investors, the key variable will be whether Story Protocol can translate its vision into tangible adoption. Without a meaningful rise in on-chain activity, the current valuation may remain difficult to justify.

What Is Story Protocol (IP)?

Story Protocol positions itself as a programmable intellectual property (IP) network built on blockchain technology. Its core objective is to tokenize IP rights, transforming them into digital assets that can be licensed, shared, and commercialized in a decentralized and transparent manner.

Having secured $140 million in funding, the project has generated significant interest within the Web3 ecosystem. Over the long run, Story Protocol aims to build a more automated and fair IP economy for creators, developers, and brands.

This content is not investment advice

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.